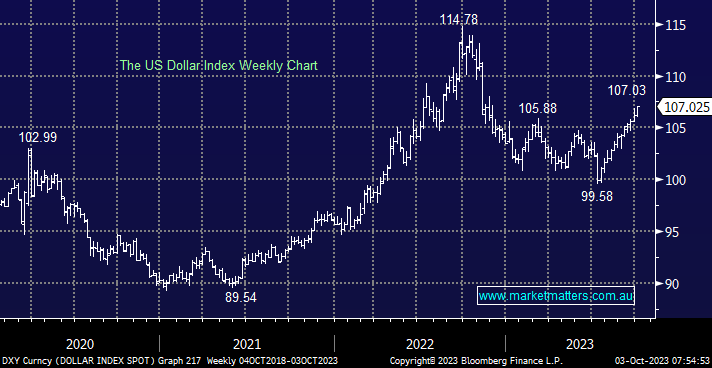

The $US edged ever closer to its 2023 high last night, following further hawkish rhetoric from Jerome Powell, which sent US bond yields higher. In our opinion, until bonds reverse, fighting this recovery by the greenback is likely to be a frustrating pastime.

- We remain net bearish towards the $US medium term, but the 7% bounce is showing no signs of reversing.

The USD-Yen has rallied ~17% from its January low as the BOJ sticks to its ultra-accommodative interest rate policy while the Fed maintains its hawkish rhetoric – a double whammy on the currency cross. While we still believe the $US is stretched on the upside longer term over the coming weeks/months, it could easily squeeze higher, i.e. another trend that should be respected.

- We are looking for failure by the Yen, but it could easily test the 155 area first.