The high valuation stocks are firmly in the crosshairs! (ALL, XRO, TWE, CSL, COH, APT)

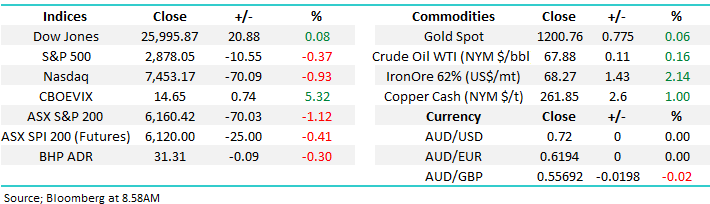

The ASX200 experienced another traumatic day falling over 1% for the 2nd consecutive time this week to increase the sharp declines from last Thursdays high to 213-points / 3.3%. Yesterday’s selling was noticeable in the high valuation / growth stocks which have generally been the market leaders since 2016/7 e.g. Cochlear (COH) -6.1%, Xero (XRO) -5.7% & Wise Tech (WTC) -5.2% - investors appear to be grabbing profits where they still can.

MM’s preference for the old fashioned “blue chip” stocks at this stage of the stock market cycle was on the money yesterday with our Growth Portfolio performing ok in the face of yesterdays strong selling with Commonwealth Bank (CBA), Janus Henderson (JHG), RIO Tinto (RIO) and Telstra (TLS) all managing to close up on the day. However clearly “one day does not make a summer” and we will watch this trend closely moving forward.

· We are negative the ASX200 targeting the 5800 region, another ~6% lower.

Overseas markets were again weaker with the US S&P500 slipping -0.37% but yet again half of the day’s losses were regained into the days close. The SPI futures are calling the ASX200 down another 30-points / 0.5% early today, it will be interesting to see if we see some classic Friday “book squaring” which in this case should be supportive of stocks following their awful week.

Today’s report will focus on 6 of the high valuation / growth stocks that have caught our eye over the last few days with some different conclusions.

To be more specific it was the top performing stocks who were sold yesterday which by definition largely incorporates the growth sector.

· Remember a few days selling of these pervious high performers does not unwind a few years of almost herd like flocking to the similar style stocks.

ASX200 Chart

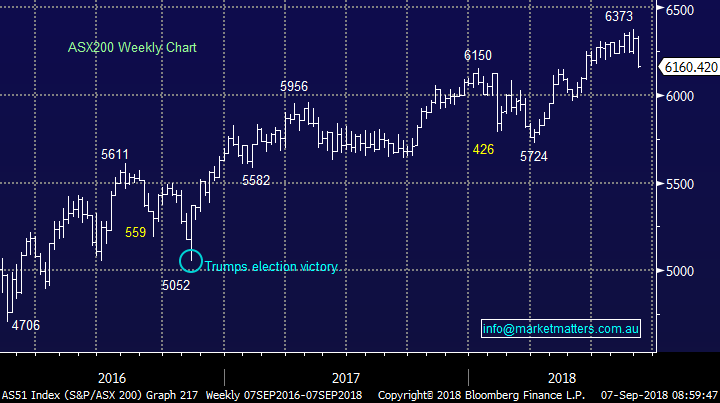

Volatility is on the increase in a few assets, not just stocks and metals, as the Fear gauge (VIX) understandably has ticked higher:

· So far this week the Fear Gauge (VIX) has rallied 14%.

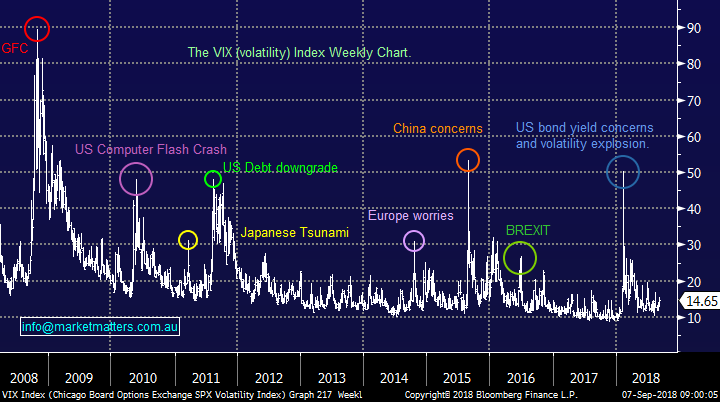

· Bitcoin has tumbled over 12% in just the last 2-days.

Volatility Index / Fear Gauge (VIX) Chart

Bitcoin in $US Chart

Six high growth / valuation stocks catching our eye

At MM in our flagship Growth Portfolio we are sitting on 18% cash, 3% exposure to the $US and 10% in negative facing ETF’s of which 5% is leveraged 2-2.75x, in other words we are keen to identify buying opportunities into potential decent market weakness.

With the exception of a 3% allocation into A2 Milk (A2M) we are happily absent from the high-flying growth stocks but if they are flogged too hard a couple will become interesting to MM.

1 Aristocrat Leisure (ALL) $30.22

Yesterday ALL tumbled -67c / 2.2%, not as bad as many of the stocks we are looking at today but again making our list of covered stocks because we remain keen at lower levels.

ALL is trading on an Est P/E for 2018 of 25.1x while yielding 1.3% fully franked.

· MM remains a buyer around $29.25, or another ~3% lower.

Aristocrat Leisure (ALL) Chart

2 XRO Ltd (XRO) $45.97

Yesterday XRO fell -5.7% taking its decline from recent highs to -6.6%. Technically we are targeting the $43 area for XRO, another ~6% lower.

XRO is trading on a huge valuation based on expected 2019 earnings.

· MM may consider XRO as an aggressive play around $43.

XRO Ltd (XRO) Chart

3 Treasury Wines (TWE) $18.21

TWE has fallen close to 8% over the last 2-days but from a technical perspective it will not become interesting to us until closer to $15, another 17% lower – remember never say never in this market, its all about preparation if something out of the box does eventuate.

For example, the concerns around a glut of wine in China could again resurface, this is one stock we will only consider into panic.

TWE is trading on an Est P/E for 2019 of 28.9x while yielding 1.76% fully franked.

· MM is neutral TWE with interest around $15, or a significant 17% lower.

Treasury Wines (TWE) Chart

4 Cochlear (COH) $204.19

One of the market darlings COH fell over 6% yesterday taking its recent correction to almost 8%. Technically COH will look interesting between $185 and $190, another 7-8% lower.

COH is trading on an Est P/E for 2019 of 42.9x while yielding 1.37% fully franked.

· MM likes COH between $185 and $190.

Cochlear (COH) Chart

5 CSL Ltd (CSL) $217.16

CSL may have slipped -4.5% yesterday but remains up over 60% for the year making it one of the best performing stocks on the bourse. Technically this quality stock is very hard to read and closer to the $200 mark looks a better risk / reward entry area.

CSL is trading on an Est P/E for 2019 of 35.9x while yielding 0.87% unfranked.

· MM is interested in CSL around $200-205, or ~6% lower.

CSL Ltd (CSL) Chart

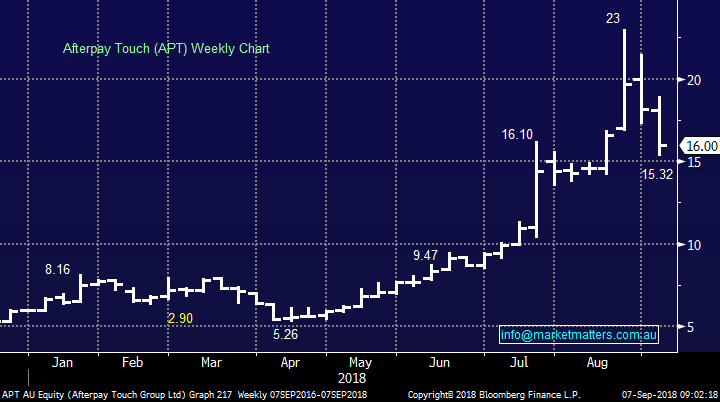

6 Afterpay Touch Group (APT) $16.00

APT has been smacked over 30% since its blow off top in August. Technically the $14-15 area should offer good support for APT but we find its valuation very scary at this stage of the cycle.

APT is trading on a huge P/E of 160x based on expected 2019 earnings, however as with many of these growth stocks, the market is simply looking past earnings (for now), and concentrating on growth rates either in terms of users, or revenue or merchants in the case of APT.

· APT may be considered as a trading buy under $15 but it’s unlikely to be for us.

Afterpay Touch Group (APT) Chart

Conclusion (s)

MM feels our forecasted unwind in the top performing predominantly high valuation / growth stocks is well and truly underway with our views on the 6 stocks covered today below:

1. We like ALL around 3% lower.

2. We like XRO, COH and CSL around 6-8% lower.

3. We only like TWE around $15, or 17% lower.

4. APT may interest the aggressive trader below $15 as a trade but its unlikely to be for us.

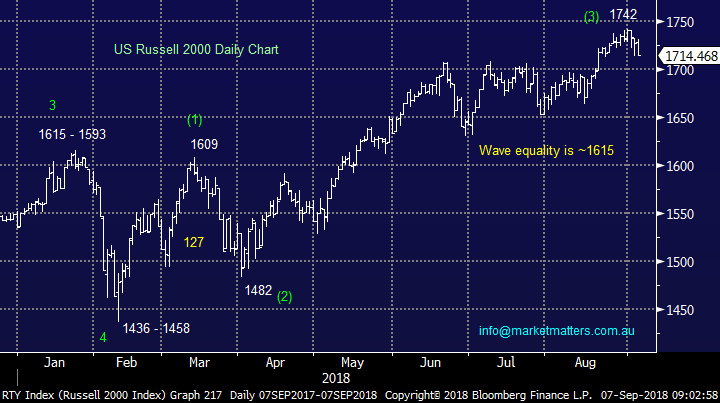

Overseas Indices

Last nights relatively small decline by US stocks again felt like they were receiving a safety bid, tonight’s US unemployment data will be a test from a more domestic economic standpoint.

· MM is targeting a drop of ~6% by the US Russell 2000 – small cap index.

US Russell 2000 Chart

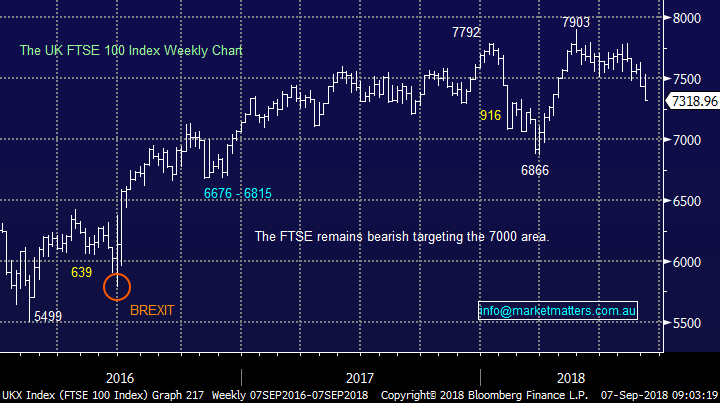

European indices were again weaker overnight, The UK FTSE continues to fall as expected with our target of ~7000 now only 4% away.

UK FTSE Chart

Overnight Market Matters Wrap

· The global equities took another hit, with European stocks weaker across the board and the S&P 500 and NASDAQ fell 0.4% and 0.9% respectively. The Dow eked out a small gain, +0.1%.

· US technology stocks were under pressure again for the second night in a row as Facebook and Twitter face the threat of tighter regulation. Semi-conductor stocks also dragged the NASDAQ lower after a tech conference heard some diverse views around chip pricing.

· US President Trump is expected to impose tariffs on $US200B of Chinese goods in the next day and expect to see the Chinese retaliate with tariffs of their own.

· Copper was better on a mixed night for base metals on the LME. Oil is weaker despite a draw on US inventories, while iron ore seems to have a mind of its own, rallying 2.4%.

· The September SPI Futures is indicating the ASX 200 to open 32 points lower towards the 6130 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.