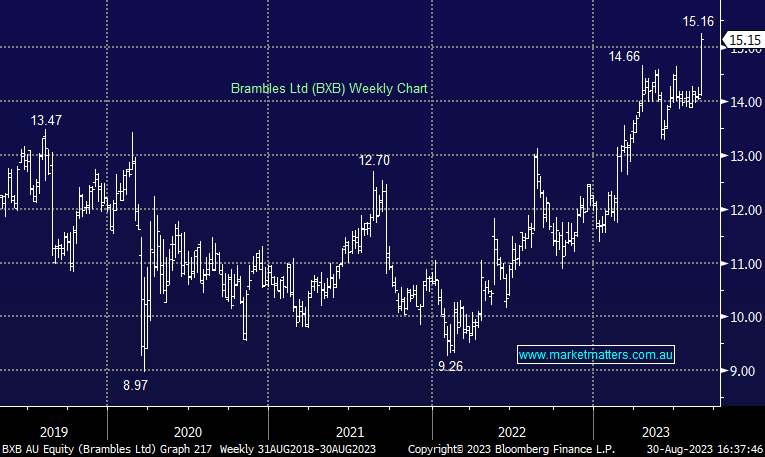

BXB +7.07%: The global supply chain business delivered a good result today, at the high end of their FY23 guidance range, benefitting from falling input costs (mainly lumber), solid pricing and a good mix of earnings drivers, while they talked to positive momentum and ongoing improvements operationally i.e. there was plenty to like in today’s update.

FY23 sales grew 14% YoY (constant currency) to $6.08b thanks largely to higher prices which drove a 19% uplift in underlying profit to $1.07bn. For FY24, they expect sales revenue growth between 6-8% and underlying profit growth of between 9-12%.

- On 18.5x FY24 BXB is not cheap however if they deliver what they said, the outlook is solid and the valuation seems justified in MM’s view.