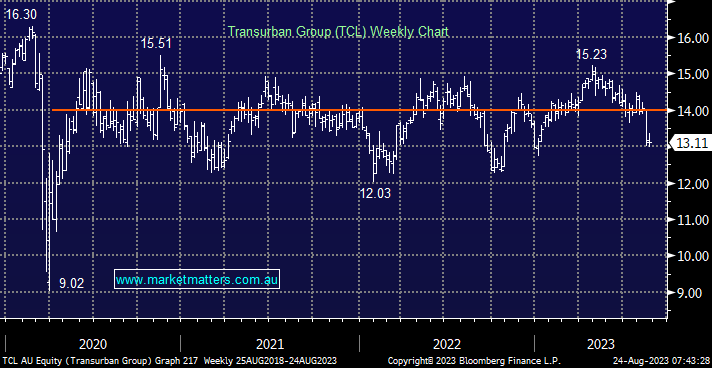

Toll road operator TCL is a stock we touch on often but it sits in many investors portfolios for its defensive nature i.e. revenue will remain solid while we all keep driving. The company’s FY23 results and outlook for FY24 were mildly disappointing compared with some analyst expectations and the stock now finds itself trading at new 6-month lows – that certainly wasn’t the rhetoric on the 6 pm news the night of their results! Operationally, Group proportional traffic was up 3.3% on the previous corresponding period (pcp) in 4Q23 and 20% in FY23 while revenue of $3,450m was up 25% on pcp but was marginally below expectations. Nothing too bad in the result but as we said this is a well-owned stock which makes it easy to slip on a “slight miss” to earnings &/or guidance.

- We think Transurban remains a relatively low-risk option for investors versus other industries and it’s starting to trade at interesting levels – it’s estimated to yield 4.46% over the next 12 months.