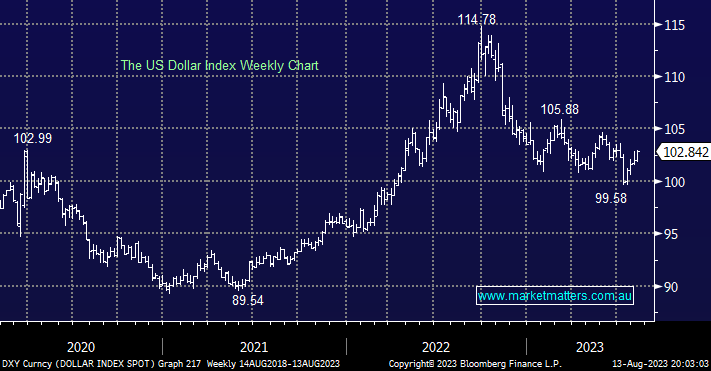

The $US ended on its highs on Friday after another solid US Jobs Report pointed to higher interest rates will remain for longer than many hoped, this is weighing on the likes of gold which is now over $US150/oz below its May high i.e. with short term US bonds yielding almost 5% gold needs to advance close to $US100/oz from current levels to simply match the returns from the safety of fixed interest.

- No change, in line with our view on US bonds we’re looking for another 10% on the downside by the $US but we caution a short-term bounce towards 105 would not surprise.

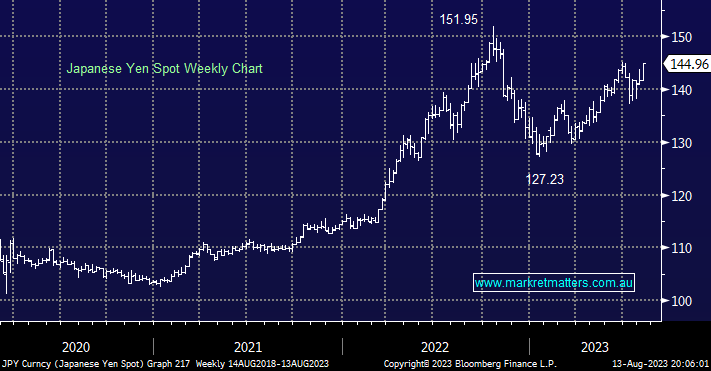

The $US is now testing levels against the Yen not seen since November 2022 in line with firm bond yields, a direct correlation which we believe will ultimately see the $US fall against a broad basket of currencies but we caution in line with the current position of bonds we can see the Greenback higher in the short term.

- We believe the USDJPY will find a top above 145 but it could easily squeeze up towards 150 if US yields do push toward fresh 2023 highs.