Petrol’s soaring will oil stocks follow? (WHC, WPL, ORG, CTX, STO, OSH)

The ASX200 was sold off yesterday despite strong performances from heavyweights BHP, RIO and CSL which helped the market avoid falling back towards its September lows. The real estate sector fell another -1.3% and we take this opportunity to reiterate our lack of interest in sectors vulnerable to rising interest rates.

The resources sector has bounced strongly over the last 48-hours, frustratingly from only a few % above our buy areas in a couple of stocks – although we did pick up RIO a little earlier at $72.67 in the Growth Portfolio. We are now watching both the sector and emerging markets for further clarity that the worst is behind us.

The situation remains a complicated one and Trump is being the aggressor at this stage, however worth keeping in mind that despite the US being Chinese biggest export market, China is America’s largest creditor. The ‘Trump card’ for China is clearly around their ongoing support in US debt markets. If they were to step back, then we could see a sharp rise in US bond yields which would support the US currency and be a major headwind for markets.

· We remain mildly negative the ASX200 targeting sub 6000.

Traders put this to one side overnight as overseas markets were strong led by the Dow which rallied almost 1%, finally making fresh all-time highs. The SPI futures are calling the ASX200 to open up over 20-points regaining yesterday’s losses. Donald Trump clearly liked the overnight move…

TRADE IDEA; Before we get into today’s note, one stock catching our eye is Seven Group Holdings (SVW) trading at $22.50. This is a situational trade based on the deal playing out in the hybrids – the SVWPA. These are being redeemed with holders offered all stock in SVW or half cash and half stock in the SVW. In the interest of keeping a long story short there was an arbitrage opportunity available by buying SVWPA and shorting SVW. A complicated strategy mainly played by institutions, however if SVW was being short sold as part of the arbitrage it suggests that there would have been artificial selling pressure applied on the sell side of the stock in the last few weeks. This could have provided an artificial cap on the stock over that time. The arbitrage opportunity has now gone which suggests the stock should go higher from here in the short term.

Seven Group Holdings (SVW) Chart

Today’s report is going to take a look at the energy sector as petrol prices on the east coast of Australia rise to fresh 4-year highs adding to the burden of high household debt levels.

ASX200 Chart

When we stand back and look at the strong bounce in some of our major resources stocks its coincided with a 2c bounce in the $A – it’s a common correlation between our resources and the $A.

We continue to believe the $A is ultimately headed back under 70c but a continuation to the current bounce would not surprise hence the questions we ponder into the weekend:

1. Should we take profit on our long $US ETF?

2. Should we add to our resources holdings even though they have already bounced strongly?

Australian Dollar Chart

The Energy Sector.

As we mentioned earlier prices are soaring at the petrol pumps while crude oil is hovering 5-6% below this year’s high ~$US75/barrel reached in July. At today’s exchange rate of almost 73c the crude price in $A is also ~5% below its 2018 high but the price at the pumps is not as reactive as the futures prices day to day – occasionally they can feel they are but only as an excuse to hike prices!

They good news is if the $A remains firm petrol should fall, at least a few percent.

Crude Oil Chart

Below we have briefly updated our opinion on 6 of the main players in the energy sector.

Today’s thoughts are 75% technical analysis and 25% macro view for a couple of simple reasons:

1. A technical view can always be applied and at times provide attractive risk / reward.

2. Our macro view is inflation / interest rates will rise moving forward, historically a solid back drop for crude oil & the energy sector.

3. Forecasting the actual movements of crude oil on any time-frame is fraught with risks like any commodities hence we always apply technicals within this sector.

1 Whitehaven Coal (WHC) $5.36

We have had Whitehaven Coal (WHC) tagged for a few weeks with a short-term bullish sticker.

· We are bullish WHC targeting a break of $6, good buying into a pullback.

NB We will move to a negative / neutral stance above $6.

Whitehaven Coal (WHC) Chart

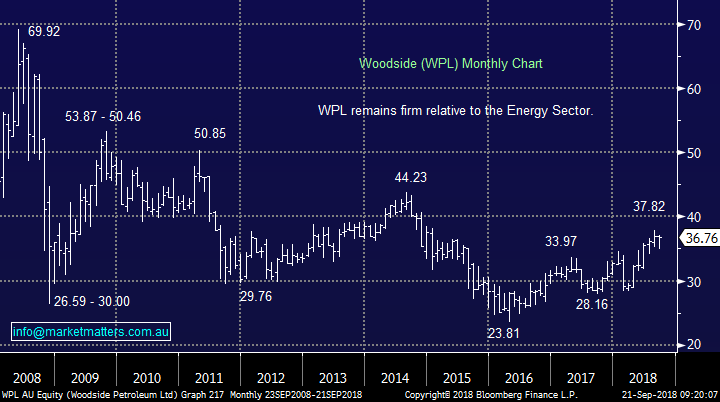

2 Woodside Petroleum (WPL) $36.76

We are neutral / positive WPL at this stage but no clear risk / reward opportunities are presenting themselves.

We are neutral / positive WPL at present.

Woodside Petroleum (WPL) Chart

3 Origin Energy (ORG) $7.93

This stock has been one of the best technical calls of 2018, we turned bearish mid-year when the stock was hovering around $10 calling a 20% correction – the correction to-date has reached 26%.

As we say “when you seeing a stock / market like a water melon go with it”.

· MM is looking to buy ORG around $7.25 initially targeting 15-20% upside.

Origin Energy (ORG) Chart

4 Caltex (CTX) $29.24

CTX is a purchaser, refiner and distributor of petroleum in Australia hence the business has no issues with falling oil prices unlike the other producers covered today.

Over the last 12-months CTX is down -8.9% while the energy sector is up +31.4%. Our negative technical view on CTX adds weight to our macro opinion that oil prices, inflation and the energy stocks look bullish moving forward.

We remain bearish CTX on a medium-term basis targeting ~$26, or 10% lower.

· No change, MM remains bearish with a target ~10% lower.

Caltex (CTX) Chart

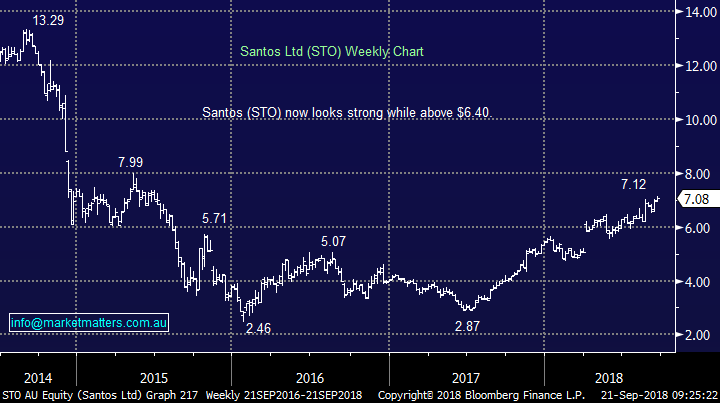

5 Santos (STO) $7.08

Santos continues to grind higher since its mid-2017 lows but it remains a messy picture and the stock has still failed to regain half of the losses following its plunge in 2014.

· MM is neutral STO

Santos (STO) Chart

6 Oil Search (OSH) $8.67

We remain mildly bullish OSH ultimately targeting above $10 but its been a long slow grind over the last few years and the stocks been trading in the same $5.50 - $9.90 trading range since 2010 with no standout impulsive moves in either direction.

· MM is mildly bullish targeting $10 moving forward, or 15% higher.

Oil Search (OSH) Chart

Conclusion

Firstly, summarizing the 6 stocks we covered today:

1. WHC – short term bullish targeting $6, or 12% higher.

2. WPL – Neutral to mildly bullish.

3. ORG – excellent risk reward buying around $7.25.

4. CTX – bearish targeting ~10% lower.

5. STO – neutral.

6. OSH – mildly bullish targeting $10, or 15% higher.

When we write our reports, we are constantly looking for nuggets of information to help formulate our trading plan moving forward, one presented itself this morning!

“Our negative technical view on CTX adds weight to our macro opinion that oil prices, inflation and the energy stocks look bullish moving forward”

MM is likely to add energy exposure to its Growth Portfolio moving forward.

Overseas Indices

Last night US stocks were firmer as investors brushed off concerns around a US-China trade war.

The Dow has finally made the fresh all-time highs we have targeted on the below chart for months, although on a number of occasions we felt it would be just the likes of the S&P500 / NASDAQ that would make the milestone.

If we had no position here we would be looking for triggers to sell US indices but we already hold the BBUS, negative facing ETF, so we must no be vigilant that this is not going to become an aggressive breakout to the upside.

US Dow Jones Chart

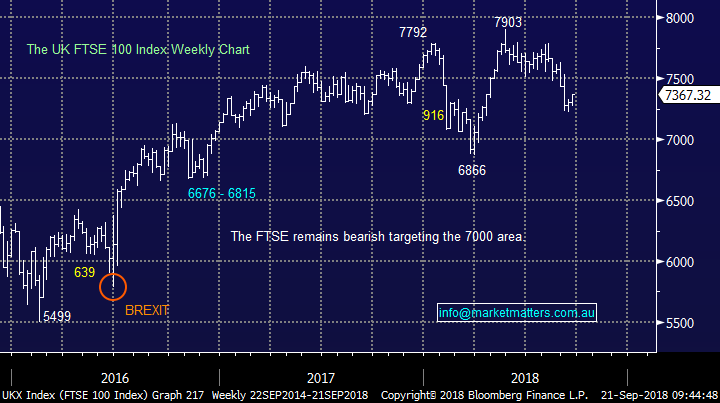

European indices were also stronger overnight, The UK FTSE continues to feel heavy as expected with our medium-term target of ~7000 now only 5% away.

UK FTSE Chart

Overnight Market Matters Wrap

· The US and European equities rallied overnight, with the Euro Stoxx 50 ending its session~1% higher as did the NASDAQ and Dow. The broader S&P 500 however was more subdued, but still managed to rise 0.78%.

· The S&P 500 and the Dow both closed at record highs as the US-China trade tensions dissipated as China announced that they would reduce average tariff rates on most of its trading partners next month.

· The $US fell against most major counterparts with a rate hike being factored in for next week and traders are starting to shift their focus to potential rate hikes elsewhere. Copper fell but aluminium and nickel rallied circa 1%. Oil fell as US President Trump tweeted that OPEC must get prices down now.

· The major miners are set to rally yet again, with BHP ending its US session up and equivalent of 1.03% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 27 points higher, testing the 6200 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.