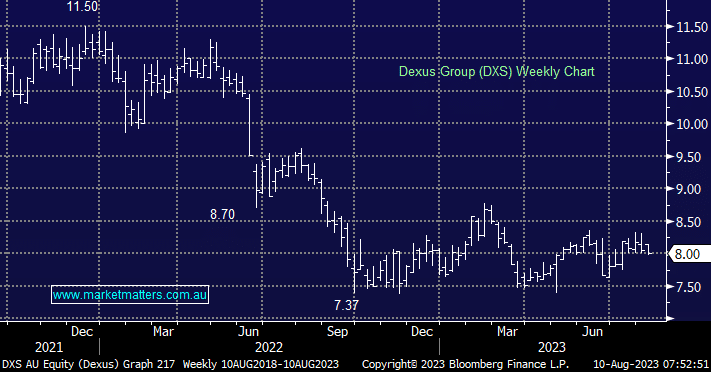

Australia’s largest office landlord Dexus (DXS) trades at a large discount to the value of its underlying assets. Many are clearly questioning whether or not the stock is cheap enough considering the uncertainties that lie ahead for the office market. We believe the answer is yes, and we are holders of the stock in our Active Income Portfolio, having purchased around $8 ahead of the last distribution. The stocks currently trading on an attractive Price/Book Valuation of 0.67x (most recent quarter) – Dexus (DXS) Financials on MM site.

- We like the risk/reward toward DXS into current weakness as underlying valuations leave plenty of buffer to further valuation write-downs.