Checking out the “chaff” for value (ALL, OSH, GEM, ECX, AMP, AHG, SYR)

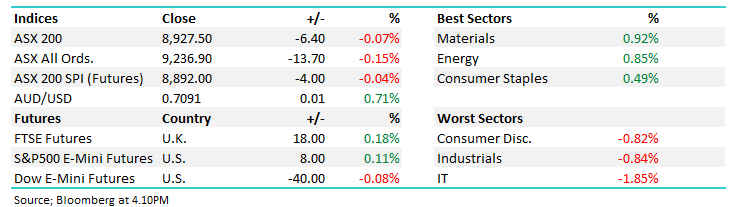

The ASX200 was again very quiet yesterday trading in a tight 25-points range and finally closing basically unchanged, volumes remained subdued with the 2% rally in the oil sector the main standout on an otherwise dull day. The Chinese Moon Festival has probably contributed to the regions slumber, FYI: The Mid-Autumn Moon Festival is a harvest festival celebrated notably by the Chinese and Vietnamese people, this year September 24th was the focal point.

Trump performed at the UN overnight to a mixed reaction although one quote shone through…."America is governed by Americans" and rejects "the ideology of globalism."

Perhaps tonight’s decision by the Fed on interest rates and more importantly their rhetoric for the future path of hikes (via the dot plot) will finally inject some life back into the lacklustre markets – either direction would be refreshing.

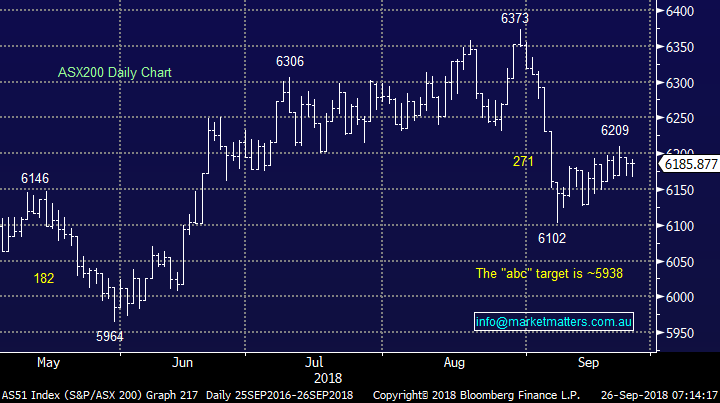

· MM remains mildly negative the ASX200 in the short-term with an initial target sub 6000.

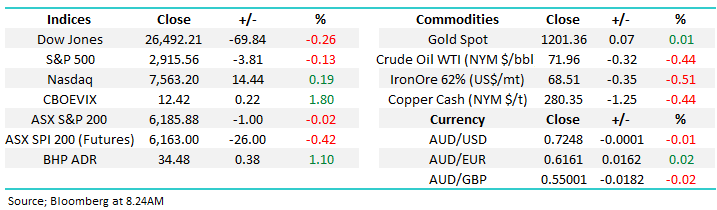

Overnight US stocks were quiet ahead of the Fed with the S&P500 closing down just -0.1%. The SPI futures are pointing to a mildly higher open by the ASX200 with BHP set to add a positive tone closing up ~1% in the US following the US energy sectors +0.5% rally.

in today’s report we are going to look at the 5 worst performing stocks in the ASX200 over the last year to see if we can see any bargains are emerging.

ASX200 Chart

Yesterday MM finally pressed the buy button in Aristocrat (ALL) and purchased 5% for the Growth Portfolio at $28. There have been a few murmurs in the market that ALL was considering a capital raise. While only a small portion of market murmurs usually become reality, if this proves correct, perhaps ALL are looking at another major acquisition. Back in November 2017 ALL bought gaming company Big Fish for $990m, and the stock subsequently doubled.

These guys have an excellent track record of acquisitions and we believe an almost 16% correction is a buying opportunity. We may even add to the position if we see another prudent purchase that requires additional capital.

· We are bullish ALL initially targeting the $35 area.

Aristocrat (ALL) Chart

The Energy Sector had another cracking session yesterday finally closing up just under 2%, Oil Search (OSH) one of our preferred picks broke out of its recent trading range. This morning we’ve seen Santos (STO) release a presentation to the market with a very catchy headline – looking to almost double their current oil production by 2025.

I’ve also just left our usual morning meeting with analysts, and the consensus was firmly ‘bullish Oil’. Interestingly enough this bullish tone was firmly in play with the resource stocks just before last month’s big sell off. i.e. when everyone is bullish, who is left to buy! While being cynical can often mean we miss out on ‘obvious trades’, we can’t help but think extreme bullishness by both the market and companies themselves is a sign that the Oil trade is near a peak. Perhaps we need to see a round of begrudging upgrades from analysts due to the strength in the Oil price for a top to come into play.

At MM, we do think the inflation trade has legs, and Oil fits that theme, however we need to ask ourselves whether or not stocks are worth chasing at current levels. From an investment standpoint, we prefer to buy weakness rather than chase strength at this stage.

· The active trader could buy OSH with stops under $8.70, which offers good risk / reward.

Oil Search (OSH) Chart

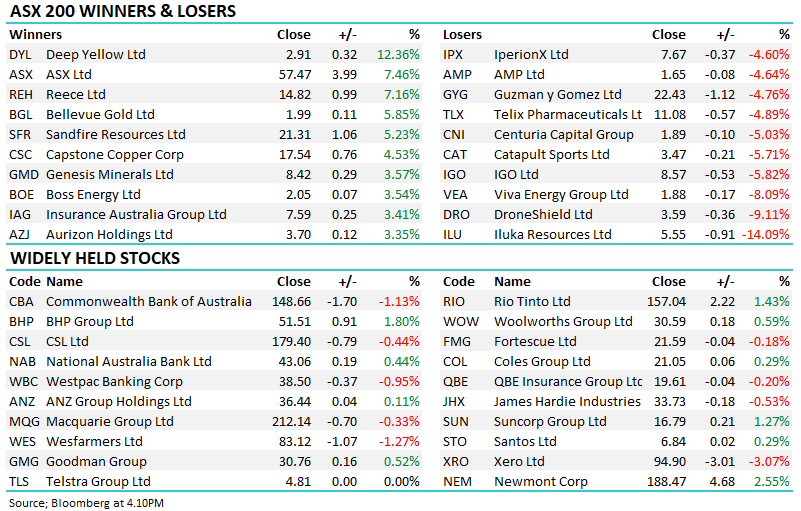

To make today's group of major market underperformers, the company’s share price needs to be down over 30% over the last year, clearly not great when the ASX200 put in a solid performance rallying +8.8%.

Even the recently battered aged care stocks like Estia Hhealth (EHE) failed to make the cut, ‘only’ managing to decline -24%.

It should be noted that 2 of the 5 are in the “Top 10” most shorted stocks on the ASX200 and all of them still have reasonable positions “betting against them” i.e. buying stocks that are heavily shorted by professional traders is a dangerous game from a statistical perspective.

NB Nufarm (NUF) might well make the grade after its capital raising – however as suggested yesterday, we will look at NUF post raise / post results for any opportunity in the beaten up agricultural play.

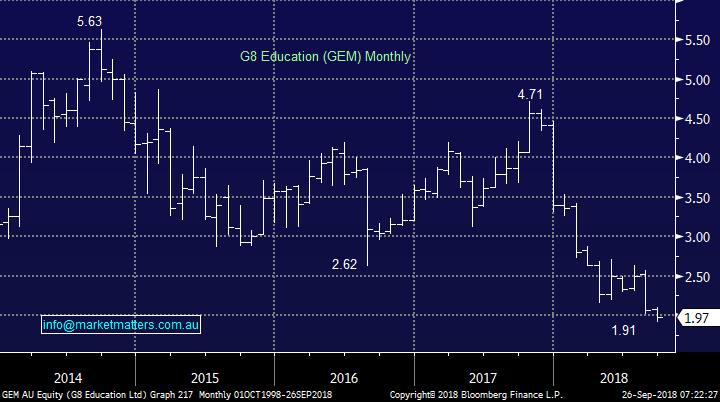

1 G8 Education (GEM) $1.97

GEM is the worst performing stock in the ASX200 falling -52.5% over the last 12-months and it's currently the 10th most shorted stock on the ASX with -16.9% of the stock short sold.

The child care business is struggling on 3 critical points:

- The oversupply of childcare centres – supply and demand seemed to turn on a dime.

- GEM is experiencing falling occupancy rates, due in part to point 1.

- The Brisbane based companies expansion via acquisition which was in part funded by debt is not ideal as interest rates start increasing globally.

There has been talk that the company may be a target for cashed up private equity players and this makes sense with the company trading on a conservative valuation of 11x expected 2019 earnings.

· We believe buying GEM is a punt on a private equity play and hence very risky, not for us BUT we would not be short either at current levels.

G8 Education (GEM) Chart

2 Eclipx Group (ECX) $2.45

Financial services company ECX is the second worst performer over the last year falling -38.9% . The stock was smacked back in August after updating the market on its forward guidance i.e. a big downgrade. The 4.65% short position certainly enjoyed that day.

The company currently manages / finances over 100,000 vehicles with over $2bn in assets under management and it should also be noted that ECX recently rejected a takeover play by SG Fleet valuing the business just over $2.50, no real premium to today’s price.

Rivals McMillan Shakespeare (MMS) have shown that the fleet management sector remains solid and its shares are up ~70% over the last 2-years. Technically we prefer ECX to MMS at current prices plus the simple valuation comparison is noticeable, i.e. ECX is trading on an EST. P/E of 9.9x 2018 earning compared to MMS on 14.4x Est. 2019 earnings – a switch for the brave!

· We are neutral ECX but aggressive players could be buyers with stops under $2.20.

NB at current levels and following interest from SG Fleet we are comfortable holding our position in the MM Income Portfolio.

Eclipx Group (ECX) Chart

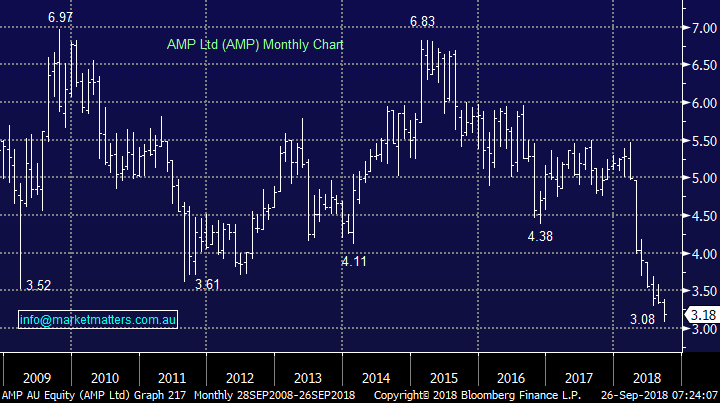

3 AMP Ltd (AMP) $3.18

AMP has been in the press on regular and painful way throughout 2018 with the stock now down -38.8% over the last year. The stocks 4.65% short position is enjoying the move although the downside momentum is slowing around the psychological $3 area.

The stock simply does not feel cheap enough to MM considering the headwinds for the business which we’ve discussed a few times recently e.g. loss of / payouts to advisors along with new academic requirements are likely to lead to a large volume of retirements in the next few years.

· MM is negative AMP expecting a move below $3.00.

AMP Ltd (AMP) Chart

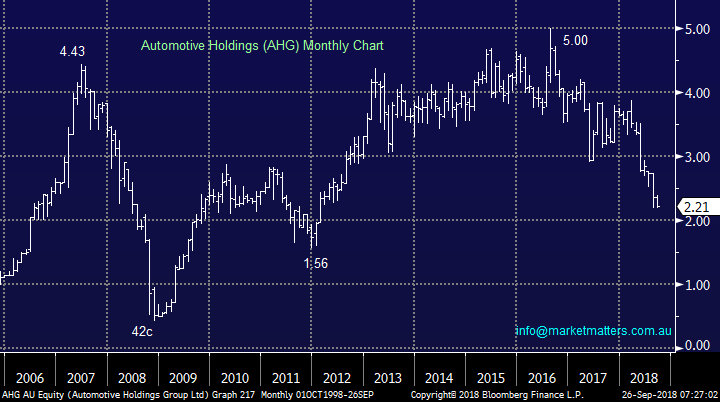

4 Automotive Holdings (AHG) $2.21

AHG has fallen -34.6% over the last year in a relatively slow and steady manner, except one aggressive move in May following a trading update. The holding company for a large group of automotive dealers in Australia and NZ currently is carrying a 4% short position, not too significant.

This is another Australian business facing regulatory issues, this time around finance and insurance. It’s extremely hard to see any growth in the next few years for AHG and its 7.38% fully franked yield feels like a classic trap, at least short-term.

· MM is negative AHG, expecting a move below $2.00

Automotive Holdings (AHG) Chart

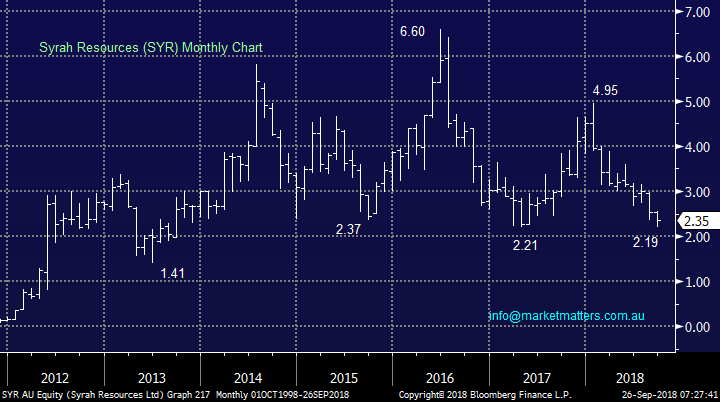

5 Syrah Resources (SYR) $2.35

SYR is down -30.7% over the last year vindicating the traders who have made it the second most shorted stock on the ASX with -16.9% of its stock short sold – only JB HI-FI has more negative bets against it.

However the graphite miner has seen its short interest decline marginally from around 20% as it sits alongside lithium stocks Orocobre (ORE) and Galaxy Resources (GXY) in a group that professionals are betting against – interestingly, it seems that many are better against the rapid evolution of the electric vehicle.

SYR struggled to sell its product at forecasted prices, never a good sign.

The volatility of this stock with its main project in Mozambique is huge. This is a trading stock in our opinion, and we would only be buying panic lows which feels way under $2 to us at this stage.

· MM is neutral SYR, at best

Syrah Resources (SYR) Chart

Conclusion

This morning we looked at the 5 worst performing stocks over the last year and unfortunately found nothing of great interest to MM at this stage.

· We felt that ECX was the best of the bad bunch plus GEM for aggressive players looking for takeover targets.

Overseas Indices

Nothing new here as US markets were very quiet ahead of the Fed. We are watching price action carefully especially now the Dow has made the fresh all-time highs that we have been looking for since ~February.

US Dow Jones Chart

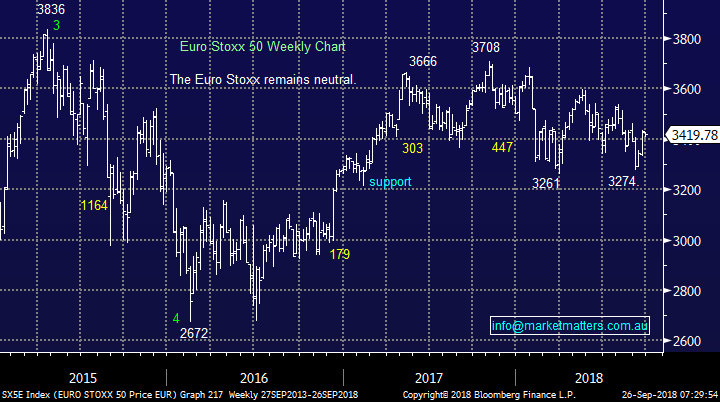

European indices like the US were quiet last night ahead of the Fed tonight.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· The US repeated its performance from the previous day, with both the Dow and broader S&P 500 ending their session marginally lower, whilst the tech. heavy Nasdaq 100 closed in positive territory.

· European markets were firmer on the back of a stronger energy and materials sector as oil prices held yesterday’s gains.

· US President Trump’s speech to the UN overnight once again reiterated his firm stance on global trade saying the US “will no longer tolerate abuse” on trade. It was also reported, that the US is prepared to move ahead on a trade deal with Mexico without Canada, where talks are at an impasse. President Trump also called on OPEC to increase supply, to offset sanctions on Iranian exports which are due to take effect in early November. He also talked of further sanctions on Iran.

· The major material sector is expected to outperform the broader market today as it has been so far this week. BHP in the US closed up 1.10% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to test the 6200 resistance level this morning, up 9 points from the previous close.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.