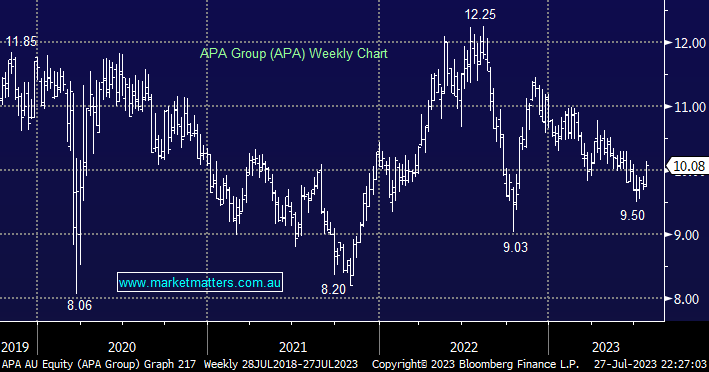

Two stocks jump out at us in this particular market area, Transurban (TCL) and APA Group (APA) with our current preference towards the latter from a risk/reward perspective. APA is often seen as a bond-like stock i.e. if rates have peaked, bond prices will rise which is positive for APA – we’re bullish and long in our Active Income portfolio, the question being considered today is whether it has a place in our Flagship Growth Portfolio – for the income motivated investor its forecast to pay a 27c dividend in December.

If we are correct and the Australian 10 years are headed back toward 3.25% we are likely to see APA back in the $11 – $12 region which combined with its yield provides a solid, if relatively defensive opportunity.