The US Fed raises interest rates again – our thoughts & plans

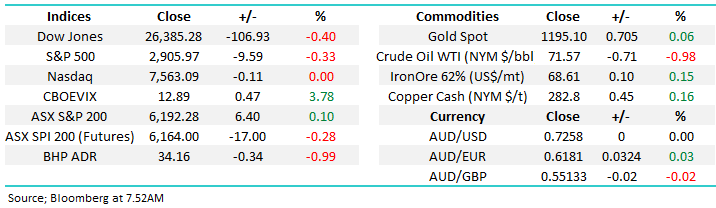

The ASX200 closed marginally higher yesterday after attempting to breakout to fresh 3-week highs in the morning, the gains were again in the energy / resources sector while anything royal commission facing came under pressure as the market eagerly awaits the interim report.

Markets felt almost on hold ahead of this morning’s US Fed announcement on interest rates. Following the widely expected hike the following “clues” were released by the Fed to what the future may hold:

- The Fed raised rates for the 3rd time this year with a 4th looking extremely likely in December – the most aggressive period of hikes in over a decade.

- The “dot plot” showed a wide range of views for their path in 2019 with considerable support for between 2 & 4 additional hikes i.e. interest rates are going higher, the question is by how much & how fast, the latter being the more relevant point for markets

- The Fed sees tepid inflation but may continue to raise rates past the perceived neutral level i.e. they want to normalise rates post the GFC.

- The Fed introduced its first estimates for 2021 believing we will see their economy slowing but not slipping into recession – clearly their objective.

- The Fed dismissed any impact from the current trade disputes and Chairman Powell stated the Fed didn’t care about politics strongly suggesting any “tweets” by President Trump would be falling on deaf ears.

- He also said “financial vulnerabilities are moderate” but did acknowledge some asset prices are in the upper reaches of historical ranges i.e. stocks are a bit expensive.

Overnight US stocks slipped on the news finally closing down -0.33% with the fall led by the energy / resource stocks plus the interest rate sensitive plays. The SPI futures are pointing to the ASX200 opening down around 20-points not helped this morning by BHP which closed down over 1% in the US.

· MM remains mildly negative the ASX200 in the short-term with an initial target sub 6000.

In today’s report we are going to cover 5 MM views around interest rates following the Feds latest hike with the emphasis on how we intend to invest moving forward.

ASX200 Chart

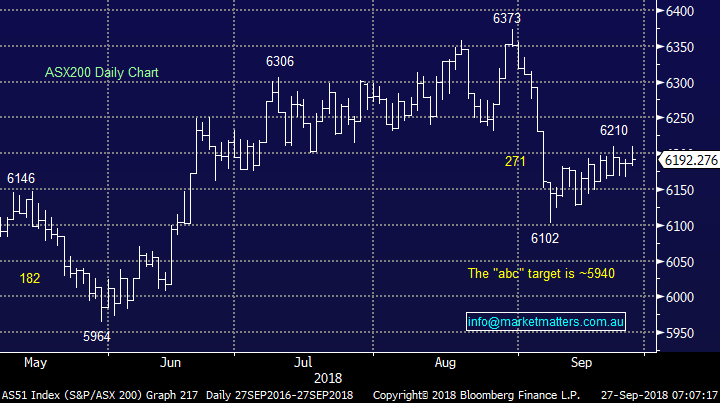

1 Don’t fight the Fed

The Fed has been steadily increasing interest rates since late 2015 as their economy enjoys an excellent recovery from the GFC. Important to notice over this time:

- The US share market has rallied strongly - a strong economy overrides rising rates for a while at least.

- The interest rate sensitive stocks have struggled e.g. over the last year the S&P500 is up +16.8% but Utilities are down -3.44% and Real Estate is up just +0.74% while the consumer discretionary sector is up +30.8%.

US Fed Funds Rate Chart

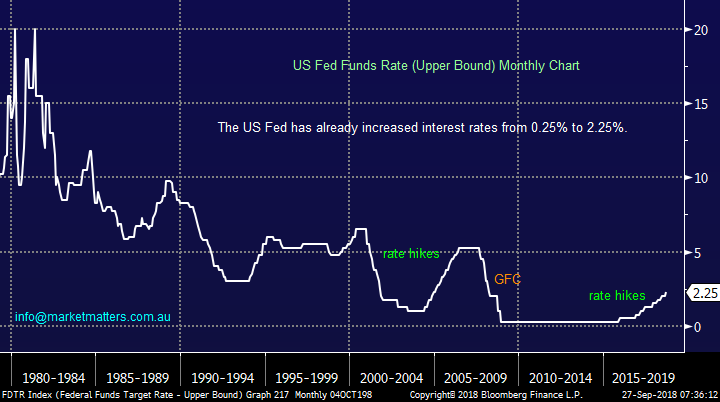

Locally the RBA official cash rate has remained at its historically lowest ever level of 1.5% since mid-2016 with the next meaningful move likely to be up – banks are already raising rates due to their ~30% exposure to overseas bond markets which has reduced the need for the RBA to act.

Hence when signs do emerge that local interest rates are going to follow the US higher our investing thematic will follow the below thoughts:

- Do not buy any initial weakness in real estate stocks – utilities have already started falling. This underperformance should last a few years.

- Look at / buy consumer discretionary stocks i.e. stocks that benefit from Australians feeling richer and hence spending – this feels far away at present.

NB We are already following this view to a certain degree in our stock selection but it will intensify.

RBA Cash Rate Chart

2 The $US needs a rest

Following the Fed hike the currency markets were fairly quiet with the $A actually trading back above 73.15c at one stage.

Our long term bearish view on the $A against the $US remains intact but it feels like too many people are now on board the train and a bounce / period of consolidation following the 11c drop since January is our “gut feel” short term.

· We remain bearish the $A ultimately targeting the mid 60c region against the $US.

Hence in the short term we can see weakness generally in local stocks with $US earnings but moving forward into 2019 the tailwind should return – we believe this is another crowded trade and one of the reasons stocks like CSL Ltd have corrected aggressively over recent weeks.

· MM is keen to increase our exposure to $US earners into reasonable weakness – stock specific calls here obviously important

Australian Dollar ($A) Chart

The interest rate differential between the $US and Australian 10-year bond yields has moved to levels not seen in ~30-years i.e. US bonds are paying a higher yield hence investors are receiving more interest on monies being held in $US as opposed to $A. The wider this differential becomes the more bearish the $A MM will become.

US v Australian 10-year bond yields. Chart

3 Emerging markets are interesting here

Emerging markets may interpret the current market moves in two very different ways i.e. they fall in sympathy with US stocks or they rally with a drifting $US i.e. of course assuming we are correct with our views on both the $US and US stocks.

Our plan remains unchanged:

- If emerging markets (IEM) rally above 61 we will bring stops up to 60 on our position

- If emerging markets (IEM) make fresh lows below 56 we will add to our long position.

NB; We currently have a 3% weighting to the IEM in the Growth Portfolio.

Emerging markets ETF (IEM) Chart

4 Energy / Oil sector

Our macro-economic view of rising inflation / interest rates remains intact which means we need to retain a bullish bias towards resources and the oil sector – both of which look set to fall today.

MM currently has no exposure to oil which has been frustrating as we saw stocks MM likes soar over the last few days. However, a few things have caught our eye in the last 24 hours:

- Oil Search (OSH) has broken out and looks destined for ~$10, or around 10% higher.

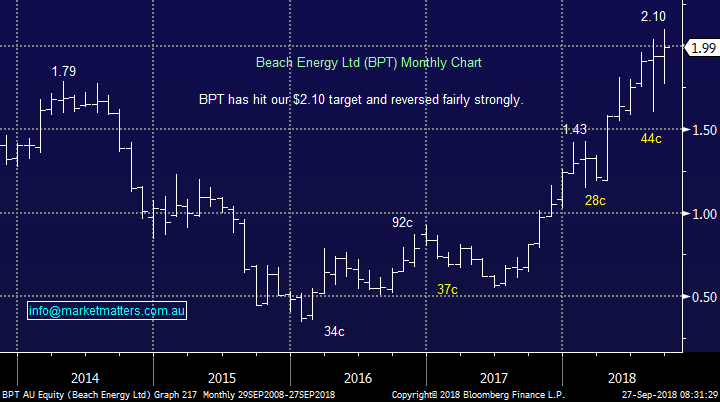

- Beach Petroleum (BPT) reached our recent $2.10 target only to correct over 5% and generate technical sell signals.

- Beach this morning announced increased production over the next five years, Santos made the same announcement yesterday i.e. producers are becoming bullish which is typical when prices have rallied!

Our interpretation at this stage is we now have no interest in BPT but may accumulate OSH into weakness, note I say accumulate and not buy a major position in one go. Ultimately, we feel the easy money has been made in this current rally in share prices.

Oil Search (OSH) Chart

Beach Energy (BPT) Chart

5 US stocks look “heavy”.

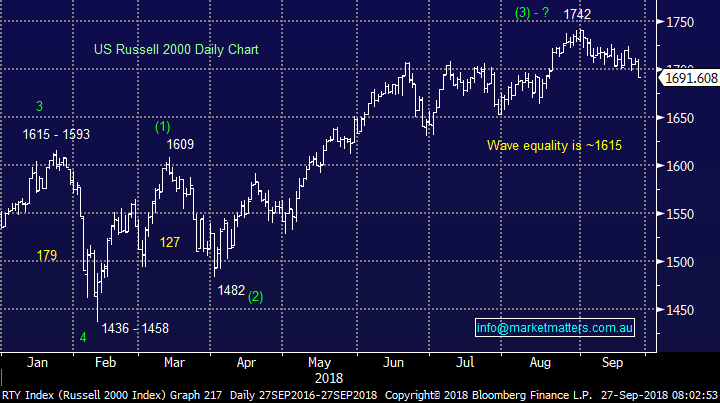

We have been watching Russell 2000 index closely over recent weeks and this morning it cracked under 1700 generating a technical sell signal now targeting a fall of ~4%.

At this stage, we believe any meaningful weakness in markets will be bought , simply given the high level of cash and cautiousness residing by fund managers. For that reason, we’ll likely step up to the plate and buy the correction if it plays out from here, particularly in stocks that may get hit from a short term decline in the $US. e.g. Macquarie Group (MQG)

Russell 2000 Chart

Conclusion

Overall no major change at MM headquarters this morning!

- We are bullish interest rates and inflation and intend to invest accordingly

- We will likely ‘tweak’ our portfolios accordingly *watch for alerts*

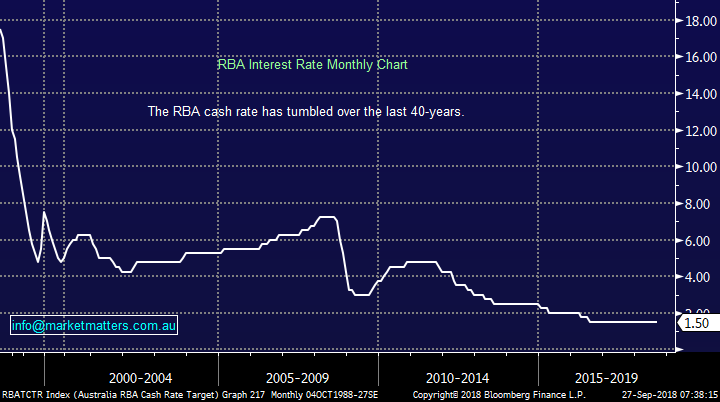

Overnight Market Matters Wrap

· The US equity majors closed in negative territory as investors digested the comments following the expected Fed rate hike, taking it up 0.25% to 2.25%.

· Expectations remain little changed for further US rate hikes of around 1.00% to more normal levels by the end of 2019, as forecast by the Fed “dot plot” of the median rate expectations of the Fed Governors. The Fed also raised its US economic growth targets from 2.8% to 3.1% for this year and from 2.4% to 2.5% in 2019. The Fed Governor however said he did not expect inflation to surprise to the upside.

· The bond market rallied with the ten year benchmark back to 3.06% from 3.1% after the recent selloff from 2.8% driven by rising inflationary fears. The bond rally dragged the banking sector in particular lower, with such names as Citigroup, JP Morgan and Bank of America falling over 1%.

· The December SPI Futures is indicating the ASX 200 to open 18 points, testing the 6175 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.