A month ago CWY held an investor day where it outlined the group’s aim to drive, better operational outcomes, incremental cultural change and capital-aware performance. The ongoing investment opportunity remains strong, and it’s apparent that management is applying due discipline to this pipeline, as in the case of Energy from Waste. However It was not surprising to hear that capital costs had increased ~15-20% (a market trend), but a deterioration in the competitive environment in the VIC landfill market does seem to hold a potential delay in a final investment decision if the conditions persist.

The group reiterated FY23 guidance including EBITDA of ~$670m which was first issued in February and affirmed in May, we assume this will become fact when they report on the 24th of August. Encouragingly CWY also noted that progress to recoup margins remained strong with better labour markets helping to alleviate a key cost pressure for the business. We continue to like the longer-term outlook for CWY as profitability recovers, especially in light of the ongoing growth opportunities in the industry and companies competitive position.

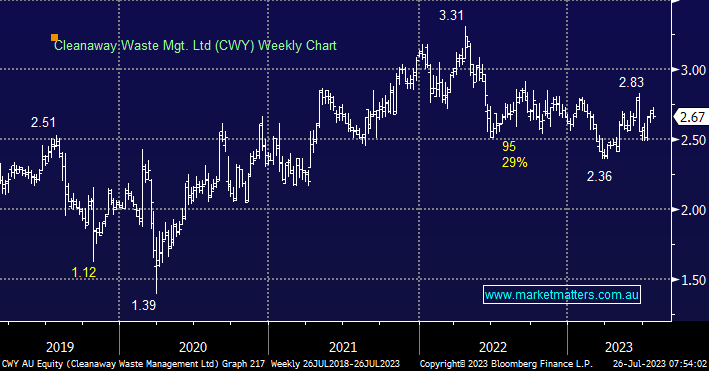

However, within a few days of the investor day, the stock endured a tough week falling over -10% on big volume as a large seller (s) appeared to trim/exit their holdings, it’s hard to know if this was EOFY price action or a lack of faith in the stock following the investor day – our position is basically at breakeven 6-weeks into its journey. With FY23 well-guided the market will be focusing on its FY24-FY26 targets next month plus of course their ability to control costs.

- We still like our CWY position but to consider increasing our exposure from 4% we will need to see deeper value e.g. around 10% lower.