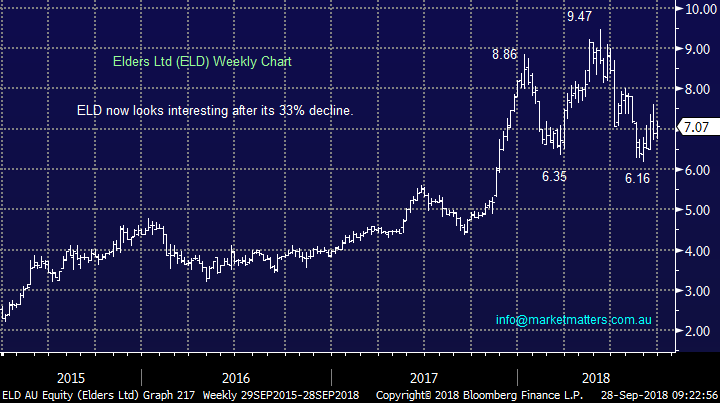

6 stocks we are considering buying / selling at today’s levels (SUN, JG, ASX, A2M, ELD, RIO)

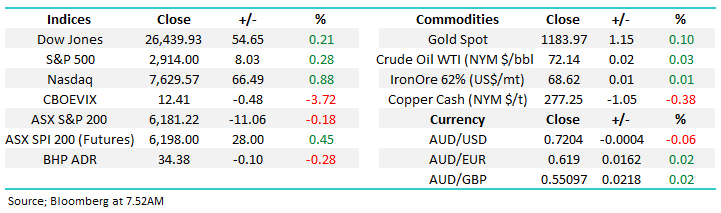

The ASX200 has now traded in a tight ~100-point range for 3 weeks as the various sectors go through periods of enthusiasm and pessimism almost every few days i.e. the markets simply unsure what’s next. Arguably the only consistent theme has been the oil sector looking strong.

Today’s release of the Hayne banking royal commission’s interim report could easily be the catalyst for a move out of the current slumber. The market is certainly very wary with the sector down ~2% over the last 5 days implying to us that there’s a clear possibility that if its “not too bad” the banks could enjoy a strong relief rally i.e. “sell the rumour, buy the fact”.

· We remain mildly negative the ASX200 targeting sub 6000.

Overseas markets were mixed with the exception of the tech-based NASDAQ which rallied +0.8% and the $US which rallied strongly sending the $A back to 72c after breaking above 73c just 24-hours earlier. Our SPI futures are suggesting a strong open up around 20-points, perhaps they have an opinion on the banking report.

Today’s report is going to look at 6 ASX200 stocks we are considering carefully at today’s levels. Importantly 3 we hold and 3 we don’t as potential switches are not out of the question.

ASX200 Chart

One point of interest that we didn’t mention in yesterday’s report around the Feds rate hike was the decision by Fed Chair Jerome Powell to now give a press conference with every Fed policy meeting rather than once a ¼ implying to us that he might hike and / or prepare the market for faster hikes moving forward if inflation gathers momentum in the US. It feels to us that he’s concerned about the balancing act over the next 12-months.

With the gap between Australian and US interest rates the largest ever and likely to widen further we continue to believe in the below 3 points:

1. We remain medium-term bearish the $A.

2. We remain net keen on $US earners but concede this is a fairly crowded trade.

3. We remain very negative on interest rate sensitive stocks.

Obviously, our portfolios will be constructed / tweaked with these opinions in mind.

· At MM we believe the surprises are on the side that the Fed hikes interest rates faster than many market players think in 2019.

Australian Dollar Chart

1 Suncorp (SUN) $14.34

We have held an overweight position in SUN for a while with an initial target of $16 which was achieved and we trimmed our largest holding back but the pullback towards $14 has been aggressive as the insurers have fallen under the royal commission spotlight.

We are now facing some interesting “mixed emotions” on the stocks.

a. Fundamentally we like SUN, with a combination of cost out and growth in general insurance + their last set of results were far superior to IAG

b. Technically however, the chart / price action has turned bearish targeting $11.

Importantly we rarely take a position if the both the fundamentals and technical picture fail to align don’t align and although SUN has recently paid a 41c fully franked dividend its correction remains harsh.

· We reduced our holding at $15.67 on the 9th August and at this stage we are considering trimming our holding back further around $15 but we may lower this level. Currently we have a solid 8% weighting.

Suncorp (SUN) Chart

2 Janus Henderson Group (JHG) $37.49

From a stock we hold that’s been looking after us to one that’s not, wealth manager Janus Henderson (JHG).

The sector has largely had a tough time recently with over the last 12-months stocks like AMP and the Pendal Group falling far harder than JHG but conversely Magellan (MFG) has rallied strongly.

a. Fundamentally the stock screens exceptionally cheap on 9.2x forward earnings relative to a global peer group that trades on 18x

b. Technically it’s a buy if its makes and reject a marginal new low around $36.

We don’t like averaging losing positions but if its planned beforehand and deep value exists we will press the button.

· MM is strongly considering averaging JHG if it falls to ~$36. We currently have a 5% weighting.

Janus Henderson Group (JHG) Chart

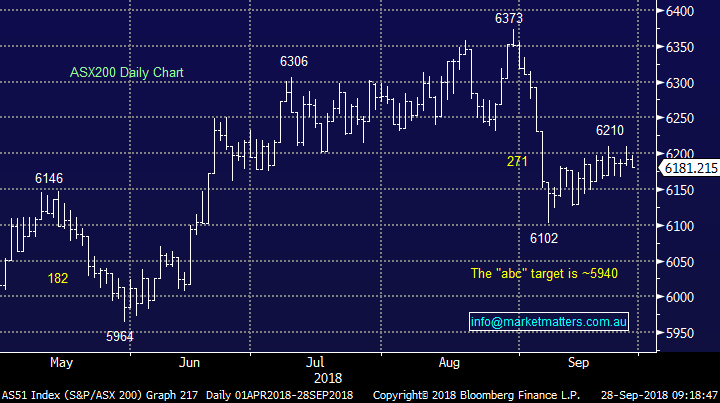

3 ASX Limited (ASX) $63.53

The ASX is one of the popular stocks that has come under some pressure since last month falling over 9% in just a few weeks. Corporate activity / new listings and trading volumes are all down.

a. Fundamentally we like this steady performer in a rich valuation market environment.

b. Technically another leg down should complete the pullback - we are keen buyers around the $61 area.

Overall, we like ASX into further weakness but not at today’s levels from a risk / reward basis.

· MM is likely to buy ASX around the $61 area if / when it trades there.

ASX Limited (ASX) Chart

4 A2 Milk (A2M) $10.55

We still own half of our position in A2M which is concerning us after the CEO sold a big lump of stocks to fund a tax liability plus earlier in the month the CFO sold some stock. Over the years, I’ve read of reasons for senior management selling stock however in most cases the reasons become irrelevant, and the stock more often than not will decline. We have given the stock a few days to digest the news and it doesn’t feel right.

A2 is a momentum stock and the momentum has lost steam in recent weeks on concerns around the maturity of the Chinese infant formula market. we can see the potential for A2M to be further rerated lower and its Est P/E based on Est. 2019 earnings of 32x feels a touch risky.

We took profit on the first half of our position back in June at $11.40 and are considering taking a very small loss on the balance of our holding – simple logic is we would not be buyers after the directors selling!

· MM is considering cutting its A2M holding.

A2 Milk (A2M) Chart

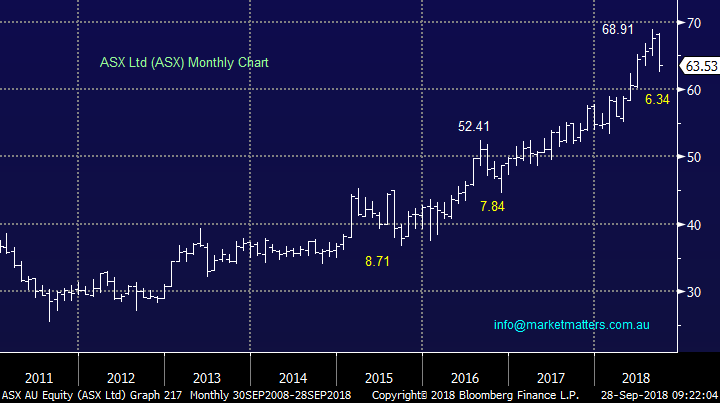

5 Elders (ELD) $7.07

We have discussed a few times buying into the drought-stricken farming sector obviously with mixed emotions as we all feel for the heart of Australia doing it extremely tough.

Nufarm (NUF) has recently announced a $300m capital raising to cut debt illustrating how tough things have been in the sector.

However, Elders (ELD) is a stock in the sector we have liked for a while following its ~30% correction.

a. Fundamentally it’s a tough one because it’s all about the drought – on 12x is there enough margin for error there?

b. Technically we are bullish targeting ~$8 in the first instance.

This is clearly a play with risks around the weather but the sector / stock has clearly priced in a degree of weakness.

· MM is considering ELD below $7 but it will be a small play due to the nature of the situation.

Elders (ELD) Chart

6 Rio Tinto (RIO) $79.23

No change from previous comments but we wanted to reiterate our thoughts as the stock follows our short-term path.

We believe the resources may well correct short term and if they do we have a number on our radar including Western Areas (WSA) under $2.20 and RIO around 2% lower.

· MM will consider adding to our RIO between $77.50 and $78.

RIO Tinto (RIO) Chart

Conclusion

Summarizing the 6 stocks we covered today:

1. Suncorp (SUN) – reduce into strength.

2. Janus (JHG) – average around $36.

3. ASX Ltd – buy around $61.

4. A2 Milk (A2M) – likely sell.

5. Elders (ELD) – aggressive buy under $7.

6. Add to RIO around $77.50, plus look at other resources into weakness.

Overseas Indices

Last night US stocks were again firmer apart from the Russell 2000 which has generated short-term sell signals for us.

While we are wary stocks at present no sell signals on major indices.

US Dow Jones Chart

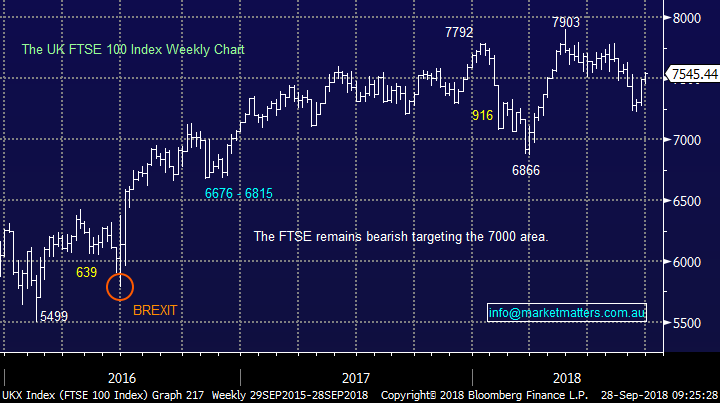

European indices were also stronger overnight, The UK FTSE continues to feel relatively heavy as expected with our medium-term target of ~7000 now 6% away.

UK FTSE Chart

Overnight Market Matters Wrap

· Local futures are pointing to a strong open this morning as US equities rallied overnight. The Dow and S&P 500 closed up ~0.25%, while the FANG stocks led the NASDAQ higher, +0.6%.

Business equipment orders at US factories declined and exports of food, autos and industrial supplies fell which hit the August merchandise trade deficit in signs the trade war is starting to impact the US economy

· Copper, aluminium and nickel all fell 1.5-2%, while Brent Crude oil rose to $US81.68/bbl. Iron ore closed lower and gold is trading down 1%.

· The December SPI Futures is indicating the ASX 200 to open up 28 points, testing the 6210 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.