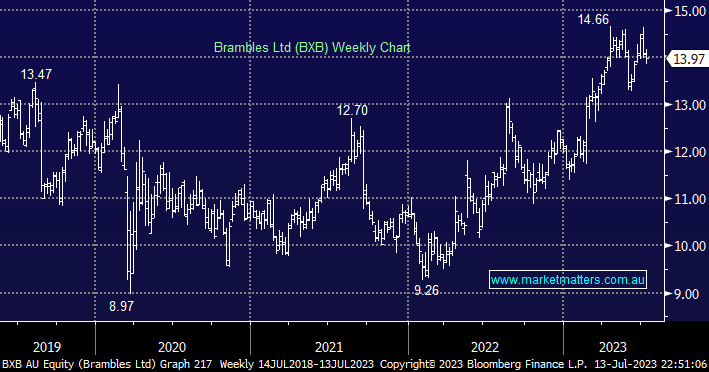

Global leader in the pallet rental market BXB has been an excellent performer over the last 12 months advancing over +50% helped by an FY23 guidance upgrade in the 2Q, and as supply chains pick up and pallet availability improves, BXB is in a good position, but on 20.3x Est FY’23 earnings it’s hard to get too excited, especially as the $US struggles. Also, we are cautious ahead of the company’s August results believing it’s possible that earnings guidance for FY24 could start the year on a conservative note which the share price is unlikely to embrace i.e. under-promise and over-deliver.

- We like BXB under $13.50, only 3-4% lower.