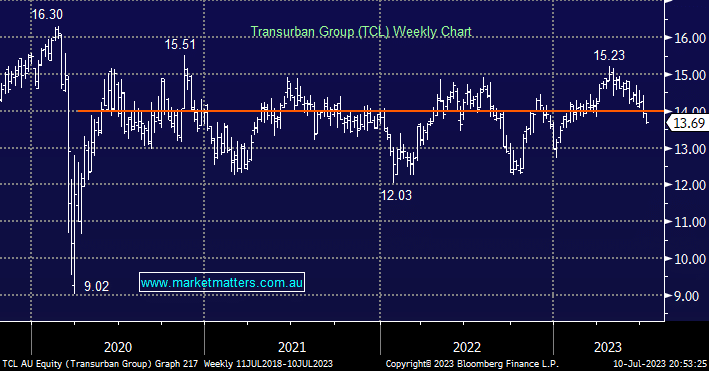

TCL has been performing well on the corporate level but it’s the stocks return compared to the risk-free opportunities elsewhere that are weighing on the shares i.e. TCL is forecast to yield 4.27% over the next 12 months, but the Australian 10-years are yielding +4.29% which in our opinion doesn’t portray a compelling reason to buy TCL around $13.70. Transurban is a relatively low-risk option for investors versus other industrials given its defensive demand, growth from recovery and new assets, CPI-linked toll escalations, and slow-moving cost of debt due to hedging but just because it’s defensive doesn’t warrant overpaying in our opinion.

- We took profit on our TCL position in our Active Income Portfolio back in April for the reasons mentioned around $1 higher.

- At this stage we would want to receive a yield premium of over 1% from TCL when compared to that being paid by 10-year bonds.

- This is a business we like but all stocks have a fair value and in our opinion its defensive nature has it trading at an attractive valuation.