The Dow Crashes 831-points, panic or buy? (IEM, WBC, JHG, CIM, RIO)

A fitting quote across the ticker of my Bloomberg Terminal this morning…."Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks altogether." – Peter Lynch

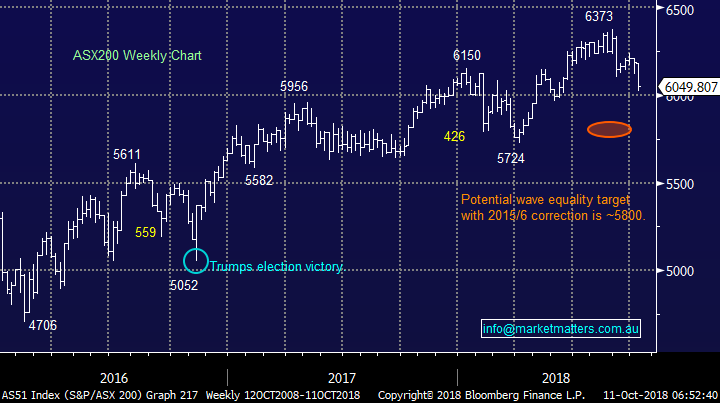

The ASX200 ended basically unchanged yesterday, an improvement on the previous 2-days pummelling by the sellers, but most certainly not particularly exciting for the bulls. The momentum clearly remained down and when I started this report last night it still felt inevitable that the psychological 6000 area would at least be temporarily breached, well that clearly was an understatement!

On Wednesday we saw a perfect consolidation style day and with the exception of the Navitas (NVT) bid there was little of interest “under the hood” although it was nice to see strong bounces by both CSL and Cochlear – MM’s purchases on Tuesday. Stocks are taking in turns almost daily to flirt with MM’s ideal buy zones with Janus Henderson (JHG), Iluka (ILU) and CIMIC Group (CIM) all closing within striking distance at 4pm yesterday – a number will certainly be there this morning.

MM will turn neutral / positive the ASX200 when it opens around 5950 this morning – down around 100-points.

Overnight stocks were smashed with the Dow fluctuating 50-points a minute into the close at 7am as panic clearly gripped equities this morning, rising bond yields and US – China trade concerns received the blame despite there being nothing new in these 2 macro-economic issues.

The ASX200 is set to open down over 100-points this morning following US stocks lower with BHP trading down -2.7% in the US implying the resources will be among the causalities early on.

Today’s report has changed tack full circle following the over 3% plunge by US equities. Last night we started writing about potential future targets for Australian Super & BGH however how MM intends to invest this morning has become the priority.

We’ve been bearish the ASX200 targeting around 5950 to buy local stocks so we certainly don’t want to be a deer in the headlights today when the drop unfolds.

ASX200 Chart

Our investment plan into this morning’s panic

Yesterday MM increased its cash position in the Growth Portfolio to 15% by realising small profits in both our BetaShares Bear ASX200 ETF (BEAR) and US Dollar ETF’s. While we could see these positions going marginally further we wanted to concentrate on the further opportunities within the Australian market which have arrived this morning, a touch faster than expected.

The first place to start this morning’s report is with overseas indices i.e. do we think there’s more to come or is this the ideal buying we’ve been targeting over recent weeks / months opportunity.

Overseas Indices

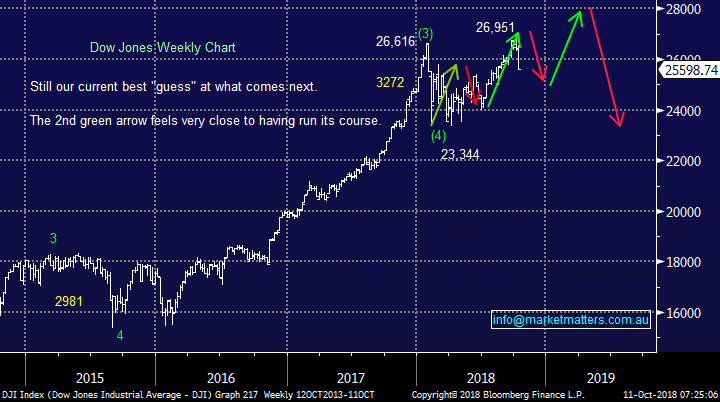

When we look at US indices 2 things catch our eye:

1 The Dow has unfolded as we have been forecasting in our Chart Pack, assuming of course it doesn’t follow through to the downside.

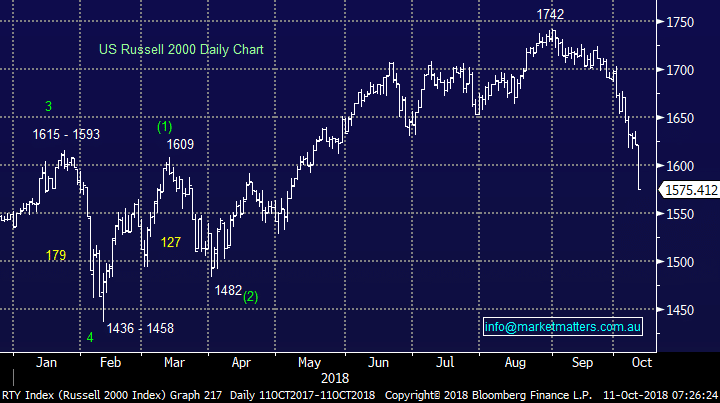

2 The Russell 2000 has now generated a sell signal eventually targeting another ~5% downside.

When we looked at APPLE yesterday we were keen buyers into weakness and its reached our initial buy zone this morning whereas the likes of Amazon has exceeded it. We are bullish APPLE around $US215 targeting ~15% upside, plus we would average if weakness persists to around $US200.

Considering both our medium term view on US stocks and the sell trigger in the Russell 2000 MM will not be cutting our BetaShares long US strong Bear position i.e. a geared bearish exposure to US stocks. This 5% holding equates to a 10% – 13.75% short position on the S&P 500.

Dow Jones Chart

Russell 2000 Chart

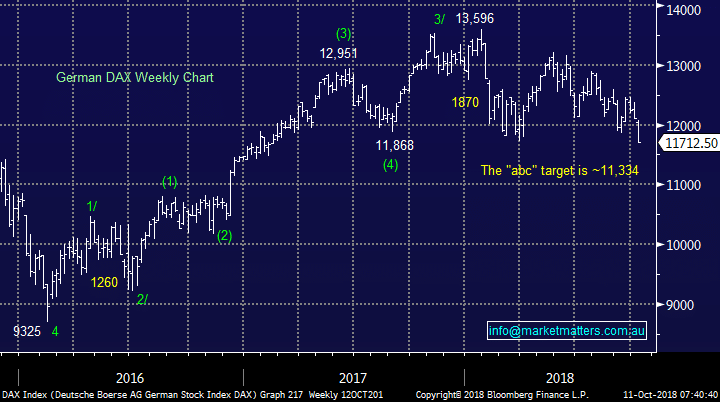

European stocks are unfolding as expected, we’ve been targeting the German DAX in 11,350 region and its likely to test close to this region this evening.

On a risk / reward basis we believe it’s time to buy European markets around 2-3% lower NOT panic sell.

German DAX Chart

Moving onto Australian stocks / positions and one quote from our report yesterday jumps out at us loud and clear:

“NB In my years of investing in the local market I’ve noticed the ASX200 very often reaches a meaningful low the day after the US has a particularly bad day, not really occurred to-date.”– MM on Wednesday.

When we’ve been planning to buy panic don’t be scarred to stand up when it occurs, if we are wrong and it follows through the pain will be a lot lower than if we had followed the lemmings into a strong market back in August – we are set to open 7% below those levels today.

So the question is how do we spend our 15% cash today, stocks will be going “cheap”!

1 Emerging markets (IEM)

We have a small 3% position in the iShares emerging markets ETF (IEM) where we’ve been looking to average the existing position into fresh 2018 lows, i.e. today when we look at emerging markets in the US last night.

MM is looking to add 2% to our IEM emerging markets position into fresh 2018 lows.

Emerging Markets (EEM) Chart

2 Westpac (WBC) $26.98

Again as previously planned we are looking to add to our WBC position close to $26.50, less than 2% below yesterdays close – at this level WBC will be yielding over 7% fully franked.

MM is looking to add 3% to our WBC position around $26.50.

Westpac (WBC) Chart

3 Janus Henderson (JHG) $35.25

Again another stock we’ve been looking to average into panic weakness and the set up of European indices adds confidence to us to push the “buy button” – sometimes easier said than done with our worst performing position.

MM is looking to add 2% to our JHG position below $35.

This will become a position that we will be watching very carefully, it needs to show signs of leaving the naughty corner or we will cut it!

Janus Henderson (JHG) Chart

4 CIMIC Group (CIM) $48.57

We’ve been trying to buy CIM below $48 for many weeks and todays move by overseas indices looks likely to create the opportunity. We definitely like the engineering and infrastructure space moving into 2019.

MM is looking to by CIM below $48 adding 3% of the MM Growth Portfolio.

CIMIC Group (CIMC) Chart

5 RIO Tinto (RIO) $79.17

Again another stock we’ve been looking to increase our exposure into weakness, in this case it’s a position showing a profit already.

MM is looking to add 2% to our RIO position around $77.50.

RIO Tinto (RIO) Chart

Conclusion

We have been looking to move towards a smaller more committed style portfolio of 10-15 positions with holdings generally around 5 to 10%, but when moves occur like we are currently experiencing we believe a slightly wider spread with a few 3% holdings still has merit.

We expect to be busy today buying the below for the MM Growth Portfolio:

1 – Emerging markets ETF (IEM) around 56.50.

2 – Westpac (WBC) around $26.50.

3 – Janus Henderson (JHG) below $35.

4 – CIMIC Group (CIM) below $48.

5 – RIO Tinto (RIO) around $77.50.

NB This leaves just 3% in cash and a 5% holding in the geared bearish US stocks ETF – which equates to a 10-13.75% short exposure on the S&P 500

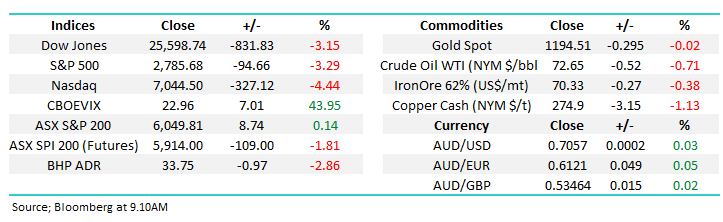

Market Matters Overnight Summary

Global equity markets plummeted, and volatility spiked overnight as investors refocused on risks of rising interest rates and global trade wars, leading to weaker global growth, causing one of the biggest sell offs on Wall Street of the year, led by the tech sector which tumbled 4.8%, its worst overnight fall in 7 years.

The Dow lost 831pts (3.15%), the Nasdaq 315 pts (-4.1%) and the S&P 500 95 pts (-3.3%) as selling accelerated into the close of trading and markets closed on their lows. Earlier, key European markets, Germany and France closed over 2% lower and the UK -1.2%. The local market looks set to lose around 2%. The volatility measure (VIX) sold off more than 40% to around 23 from 16. There appeared to be no specific trigger point for the selloff, with 10 year bonds trading better at around 3.2% vs this week’s 7 year high of 3.26%.

Little was spared in the wipe-out, but tech shares were particularly hard hit, with Netflix (-8.4%), Amazon (-6.2%), Microsoft (-5.5%), Apple (-4.6%), and Facebook (-4.1%) leading the pack. Facebook has tumbled from nearly US$220/share to a year low of US$151/share, just in the last quarter. Commodities were also weaker across the board led by oil and copper. Gold was slightly firmer as was the iron ore price. Both BHP and RIO were around 3% lower in US trading. The A$ was eased slightly to US70.7c.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.