Last week we compared 2 tech-based ETFs and we arrived at the conclusion with regard to the NASDAQ – “we are comfortable fading the current rally towards our long-term target area.”

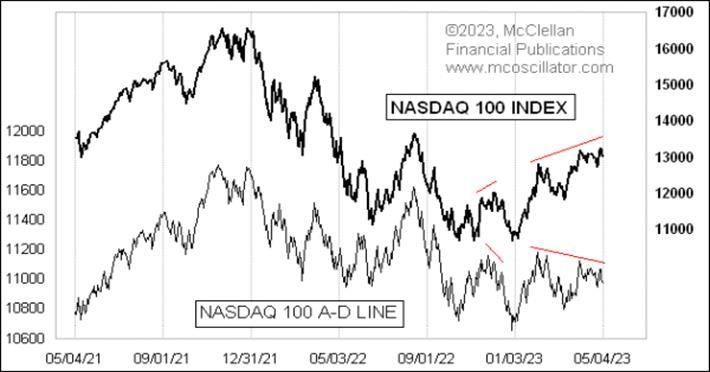

This morning we looked at the NASDAQ (NDX) and its Advance-Decline (A-D) Line which is useful because it helps us identify the health of the market’s underlying liquidity which affects all stocks. The picture today is unusual, we are seeing a rare divergence between the NDX A-D Line and the NDX itself. This almost never happens, which makes it all the more eye-catching, simply there is an unusual disagreement right now between the mega-cap stocks like Apple and Microsoft and the broad-based index. Our conclusion is the same as last week: