Can we find any value amongst the recent blow ups? (LOV, CYB, APT, XRO, SGP, EHL, AMP, IRE, BWX, KGN, CTD)

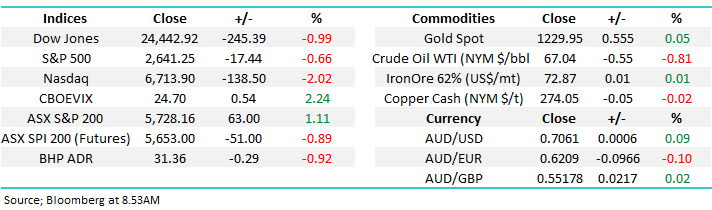

The ASX200 rallied strongly yesterday led by the “big 4” banks who all gained over 1% and CSL which bounced an impressive +3.7%, plus to help both the index and sentiment the heavyweight miners all had solid days e.g. BHP +1.4% and RIO +0.7%. Overall it felt like a day where the sellers were absent as opposed to the buying was rampant with 26% of the ASX200 stocks still closing in the red.

The 63-point / +1.1% gain by the local index was especially impressive as the US S&P futures were unchanged at 4pm AEST, after giving back early gains, and Asia was mixed with China actually falling -2.2%. Our preferred scenario is the market now climbs a wall of worry over next few weeks towards the 5900 area which by definition implies a period of relative calm – a large call at the moment!

MM remains mildly bullish the ASX200 short-term targeting the 5900 area.

Overnight US stocks reversed early gains in a savage fashion following the comment from “sources” that the US plans more China tariffs if the Trump-Xi meeting fails – they plan to meet at the November 30-Dec 1st G20 summit. This would clearly be awful news for stocks but we again find a degree of solace in the markets reaction overnight:

1 – The US S&P500 only closed down -0.66%, 38-points above its low but 65-points below its high - the market was trying to rally strongly before the negative trade news crossed traders screens.

2 – The Russell 2000 (US small cap index) which has been leading US / global indices of late only closed down -0.4%, again outperforming.

3 – The Fear Index (VIX) only closed up +2.2%, well below the highs of the last few weeks.

4 – The ASX200 is set to open down around 1% giving back yesterday’s gains, we feel it may improve over the day.

We have to make sure that we are not currently looking at markets through rose tinted glasses but on balance we are comfortable with our short-term view although we may have to wait until the end of November for some meaningful positive economic news – Trump has obviously decided to go into the US mid-terms as a “strong leader” as opposed to a resolver of issues.

ASX200 Chart

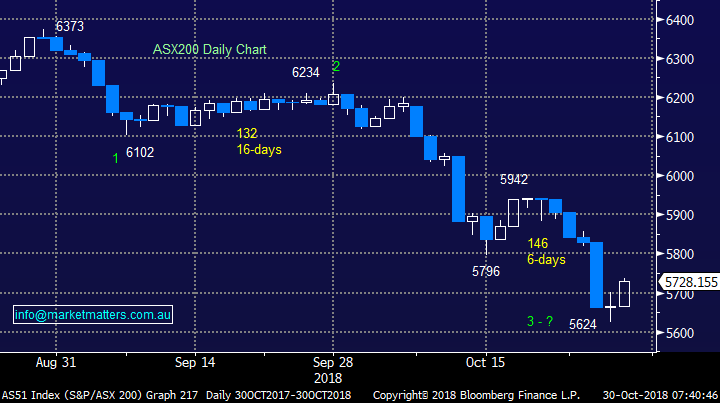

As you all know we look at charts for technical risk / reward signals and one of our “strong hunches” was confirmed from a technical perspective yesterday when Macquarie (MQG) closed back above $112.50.

We are bullish MQG short-term targeting test towards the $118 area, over 4% higher.

This set up by MQG adds confidence to our opinion that the ASX200 can test 5900, or 3% higher, although this morning will be yet another test.

Macquarie Bank (MQG) Chart

Today’s report is going to look at some of the local stocks who have been hammered by recent news flow and / or simple aggressive sector selling in an already nervous market, yesterday alone we saw 3 “blow-ups”:

1 – Kogan (KGN) $3.11: fell -33% following a business update with much of the disappointment put at the feet of “the now apparent avoidance of GST by a number of foreign websites selling into Australia.”

We continue to have zero interest in KGN and ponder the 2 directors aggressively selling down their holdings, including Ruslan Kogan, when the stock was double the price only a few weeks ago; it’s a brave (at best) investor who buys a director’s shares!

2 – BWX Ltd (BWX) $2.80: fell -16.2% following another trading update, in this case putting the blame at the feet of the failed management buyout (MBO). The skin and hair care products business are sticking to its profit guidance but that will need a 70% skew to the second half of the year – the markets clearly not convinced.

I see no reason to jump into BWX at this stage.

3 – Corporate Travel (CTD) $27.64: went into a trading halt as it responds to a scathing research report by investment firm VGI Partners. The 176-page report names 20 ‘red flags’ that VGI have used to justify their heavy short position - CTD has fallen -18.4% since it’s early September highs.

The report lists reasons such as low interest income, growth through acquisitions, ‘non-existent’ offices, suspect accounting practices with a long-serving auditor and high management turnover (except for the CEO & CFO) in its reasons for the negative view, as well as noting the significant number of management share disposals over the past few years. Potentially this is a case of “throw it against the wall and see what sticks” with VGI already short the stock, however a small review of offices shows numbers may be overstated, particularly in northern Europe.

I see no reason catch this falling knife when the stock reopens this week – trading around $20 would not surprise us.

Now moving onto 5 other stocks who have endured a time they would rather forget over recent weeks / months:

Lovisa Holdings (LOV) $8.08

Fast fashion jewellery chain corrected over 35% since June driven by concerns around valuation following a trading update showing store sales growth below expectations. The stocks now trading on an estimated P/E of 21.6x for 2019, not excessive but we are wary of the Australian retail sector.

MM is not planning on purchasing LOV but if we were looking to gain some exposure to the beaten up sector, LOV around $8 looks interesting

Lovisa Holdings (LOV) Chart

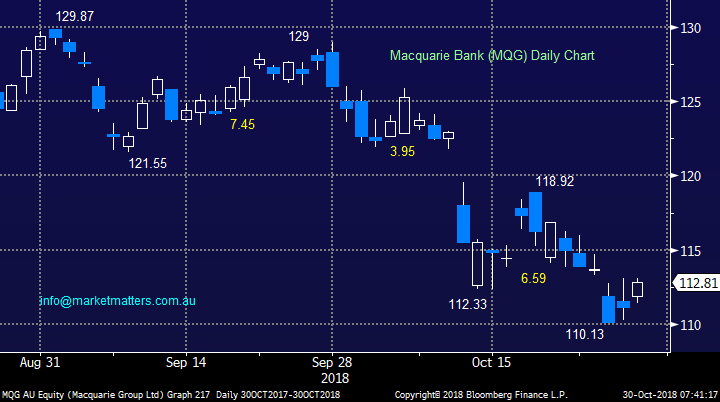

CYBG Plc (CYB) $4.70

The UK bank CYB has corrected -28.6% since August, significantly underperforming the local sector as a messy BREXIT appears to be just one factor weighing on the stock.

The owner of Clydesdale and Yorkshire banks in the UK has been struggling since warning that mortgage competition in the UK is increasing although management is optimistically sticking with its net interest margin target – if they achieve this moving forward the sell off is overdone in our opinion.

Technically the bank has solid support around $4.50 while it also trades at a steep discount to its book value.

MM is unlikely to purchase CYB in the short-term but it is on our radar.

CYBG Plc (CYB) Chart

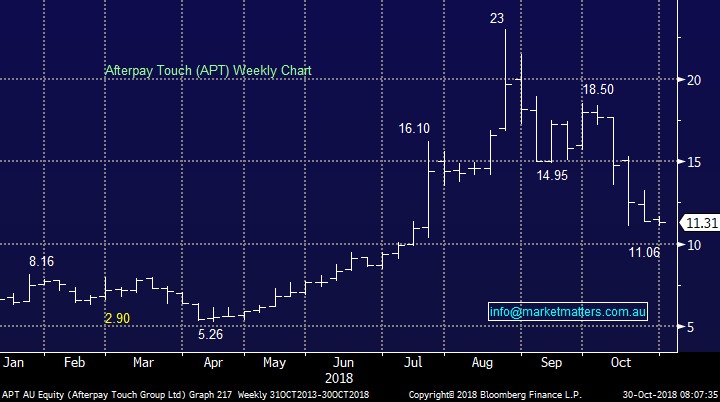

Afterpay Touch (APT) $11.31

APT has corrected over 50% since late August as crazy valuations came down to earth with an inevitable thud. The bulls on APT sighted massive growth in users that would translate into earnings at some point. Additionally they now have the potential for a ‘senate enquiry’ into the sector.

MM sees no reason to buy APT here (just yet) although the easy $$ being short the stock has gone in our opinion

Afterpay Touch (APT) Chart

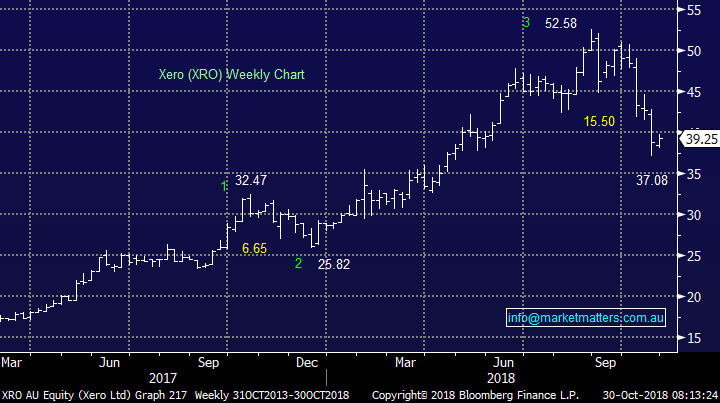

Xero Ltd (XRO) $39.25

Cloud accounting and business provider XRO has corrected almost -30% since the end of August but this is a quality business with sustainable growth and ‘real earnings’ . The question is obviously what price to pay for this growth, a tumbling NASDAQ is certainly not helping sentiment around the stock – XRO has corrected 30% and the NASDAQ 14.7% over recent weeks.

We like XRO as a business and could consider “nibbling away” in a small manner, the further under $40 the better.

Xero Ltd (XRO) Chart

Stockland Corp (SGP) $3.64

Australian property group Stockland has corrected over -13% this month following its quarterly update which confirmed residential trading conditions are moderating – no surprises there!

The companies $350m buyback remains in place which is clearly supportive of the stock but it’s hard to see investors chase the stock until we get a feel for the bottom of Australian housing.

SGP is not for us at present.

Stockland Corp. (SGP) Chart

Finally a brief comment on 4 other stocks who’ve had a tough time recently:

Emeco Holdings (EHL) 26c – Engineering business EHL has corrected over 26% in the last 2 weeks, technically we are bearish looking for another 10% downside.

AMP Ltd (AMP) $2.36 – corrected over 30% in the last week, a stock we covered a number of times in recent weeks / months, MM still has no interest until further notice.

Iress (IRE) $10.76 – The equity data provider for Australia and New Zealand has fallen over -25% from its August high and over 20% since we took profit close to $14. We remain bearish with a technical target ~10% lower.

Conclusion

Today we looked at 12 stocks who have been significant market underperformers over recent times.

There isn’t a stock on that list that is jumping out at us as a great countertrend buying opportunity at present

We are bullish short-term but still very cautious moving into 2019-2020.

Overseas Indices

No change, we believe US stocks are looking for a low, at least in the short-term.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

Overnight Market Matters Wrap

· The US couldn’t hold any early gains overnight, following a report that said the US is contemplating new tariffs on China in December if the US doesn’t get its way in trade talks between presidents Trump and Xi.

· On the earnings front, almost half of all S&P 500 companies have reported and are on track for one of the best performances in the past eight years. Some are worried that earnings have peaked and that the economy will slow.

· All metals on the LME were weaker, while gold fell. Iron ore was flat and some of our lower grade iron ore miners could be breathing a sigh of relief after analysts predict that the discount they receive will shrink in the near term.

· The December SPI Futures is indicating the ASX 200 to open 55 points lower, towards the 5675 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.