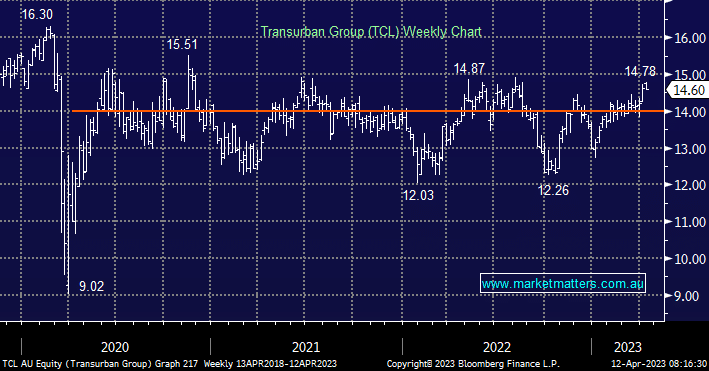

Yesterday, we took profits in toll road operator Transurban (TCL) at $14.68 having bought the stock back in April 2020 at $11.82. This has been a 3-year hold for a return of ~33% inclusive of dividends. While we like the company and believe that critical infrastructure has a place in portfolios, particularly those with a more defensive/income focus, valuation & opportunities elsewhere prompted the sale. In terms of valuation, like other infrastructure companies, we value fairly simplistically based on its yield above Australian 10-year bonds, which over the last 10 years has averaged 2%. Right now 10-year Treasuries sit at 3.22% while the consensus yield forecast for TCL over the coming 12 months sits at 3.90%, a spread of ~0.70%, a historically low margin. While earnings and thus dividends will grow over time, on FY24 forecasts the spread only jumps to ~1% then 1.32% by FY25. With ~90% of its revenues and earnings in Australia, (with the balance in North America), traffic flows here are very important, and while it’s recovered to pre-COVID levels overall, there is a greater number of heavy vehicles versus passenger vehicles making up the volumes implying that the work-from-home trend has further to play out, and ultimately we think the recovery in volumes post-COVID has now largely been achieved.

scroll

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM has now moved to a neutral stance on TCL, having sold the position from the Income Portfolio

Add To Hit List

Related Q&A

Is TCL a utility or an industrial ?

Our opinion on TCL and MQG at their current prices?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.