Casting our Eyes over the Small End of Town – Part 2 (WBC, APPL, ELD, ECX, RSG, GWA, API)

Firstly good luck on the Cup today – it should be an interesting race in the wet. Like the market, I’m always keen for a value play and while I’ve only backed two winners since ‘Beyond 2000’ was on Channel Seven, today I’ll be on No 24 Rostropovich which is paying around $30. Macquarie put out a quant report on the race annually, and this year they’re skewing their picks towards lower risk, shorter priced runners in 2018 – although worth noting, it’s been a few lean years for the MQG quant team in the cup.

Source; Macquarie Quant

Also, we shouldn’t forget at 2.30pm the RBA makes its monthly decision on interest rates but I’m more confident here with my view that unchanged until further notice is the stance than any thoughts I have towards Flemington.

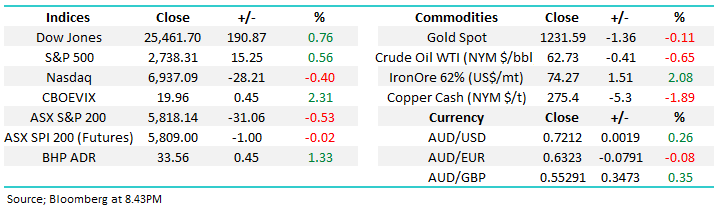

The ASX200 drifted lower from yesterday lunchtime as investors felt a touch nervous ahead of the US mid-term elections – this Wednesday AEST. The index closed down -0.5% with banks actually strengthening throughout the day whereas the growth / high valuation stocks lost support after Friday’s decent bounce plus the resources, with the exception of iron ore, had a disappointing day erasing early gains – basically the market unwound the intra-day trends of the last few days.

Our outlook for the local market has not waivered recently - we are still looking for stocks to continue to climb a wall of worry into next week with an ideal initial target of ~5925, potentially in a very similar manner to the 132-point / 16-day rally through September.

MM remains mildly bullish the ASX200 short-term ideally now targeting the 5925 area – just over 1.5% higher.

Overnight US stocks were up nicely with the Dow up just nearly 200-points although the tech based NASDAQ was down -0.4% led again by Apple – the selling in our growth stocks yesterday was clearly on the money. Interestingly, Apple is often described as a high valuation ‘growth stock’ however over the past 5 years it’s traded on PE multiples between 11.6x at the low and 17.1x at the high, and now trades on 14.8x with ~13% forecasted earnings growth. Clearly a more mature growth business without huge amounts of ‘blue sky’ factored in.

Over recent months we’ve been discussing Apple looking for an opportunity in the stock ~$US200 and now the stocks finally corrected ~15% presenting in our opinion some decent risk / reward.

MM is bullish Apple Inc (AAPL) from around the $US200 area.

Apple Inc (AAPL) US Chart

The SPI is calling the ASX200 to open up around 10-points with strength overnight in iron ore likely to help – BHP is up close to 1.5% implying the resources will return to favour today.

NB For the subscribers who watch markets very closely, the Dow now closes at 8am AEST, not 7am like last week.

Today’s report is again going to look at the bottom 20% of the ASX200 by market cap. I expect another couple of reports are required to tick all the boxes we want to consider in this area.

As we said previously, opportunities are often overlooked in smaller stocks and at least one of these is likely to have a cracking 2019.

ASX200 Chart

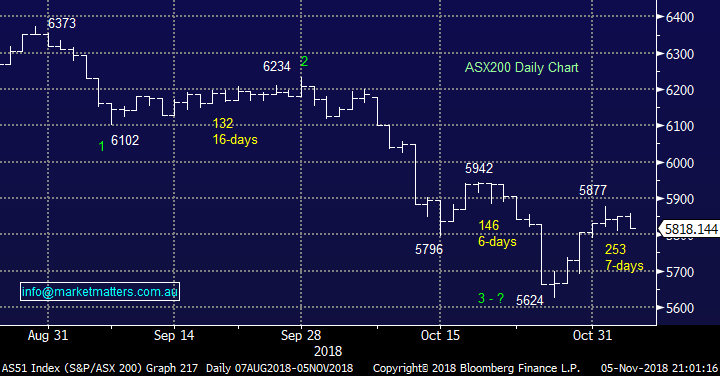

If we bore into the market in the short-term by looking at the December SPI futures ideally we will see the next 50-75 points to the upside but doubt very much that any advances will be sustained and / or particularly impulsive.

ASX200 September SPI Futures Chart

Westpac (WBC) made it 3 out of 3 for the big banks reporting this time of year i.e. another average set of numbers being met fairly warmly because the markets positioned with a very clear bearish skew.

MM is bullish WBC from current levels especially below $25.50 before its 94c fully franked dividend on Wednesday – feels unlikely now.

Westpac (WBC) Chart

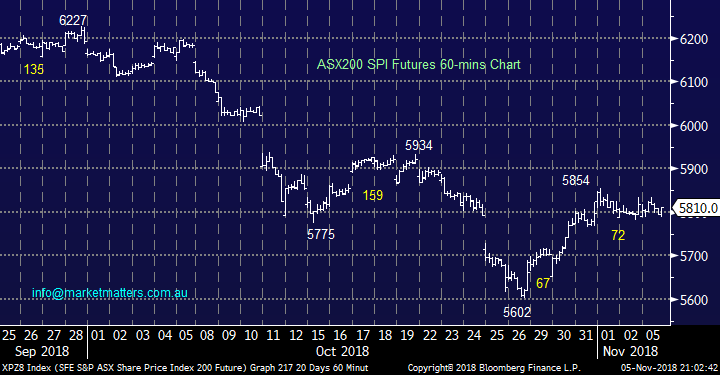

1 Elders Limited (ELD) $7.32

Agribusiness Elders (ELD) has a market cap of $821m, a valuation that has swung around pretty dramatically in the last year primarily due to the drought that has savaged Australia’s farmers.

The stock was last hammered back in July when they announced an update to the market highlighting the damage the drought was causing.

We have discussed the stock previously when it was sub $7 with a bullish bias looking for a rally towards $8, this has now in part materialised.

MM is neutral / bullish from current levels but the risk / reward is no longer attractive.

Elders Limited (ELD) Chart

2 Eclipx Group (ECX) $2.27

The fleet leasing /diversified financial business ECX is the 10th smallest stock in the ASX200 with a market cap of $821m although this has been almost halved in the last year.

We exited the stock from our Income Portfolio around $2.54 in late October, certainly a lot better than the stocks low in August and 10% above where it is today.

Investors who chase the almost 7% fully franked yield currently on offer should consider the risks to both capital and this very same dividend moving forward.

ECX manage / finance over 100,00 vehicles with well over $2bn of assets under management but the company downgraded its earnings forecasts due to insolvency auction volumes hitting decade lows – this may change if our economy follows housing prices lower.

ECX is a reasonably high risk play at present but definitely a stock to have on the radar.

We are neutral ECX but keeping an eye on it for a potential bottom / turnaround story.

Eclipx Group (ECX) Chart

3 Resolute Mining (RSG) $1.015

Resolute Mining (RSG) is the 3rd stock we’ve looked at today with a market cap of $821m – its crowded at the small end of town!

RSG is a gold producer / explorer which operates in Mali, Ghana and Queensland they have been striving to get their high average cost of production lower, a new mine in Mali should attain this in 2019 followed by one in Ghana in 2022.

At this stage we are neutral RSG with a slight negative bias, a break below multi-month lows under 94c feels a strong possibility.

MM is neutral / negative RSG until we turn very bullish the underlying gold price.

Resolute Mining (RSG) Chart

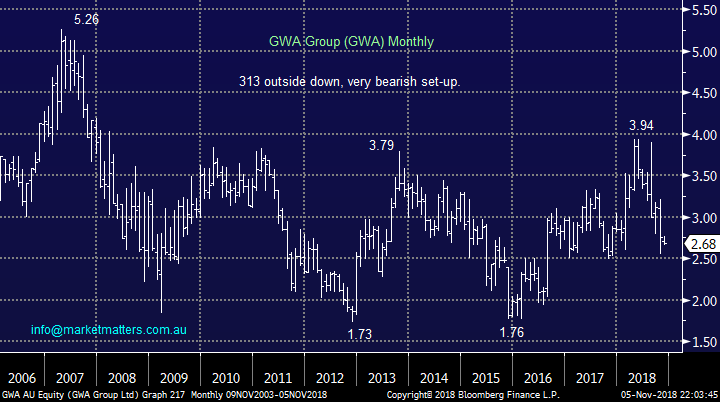

4 GWA Group (GWA) $2.68

GWA Group manufactures building fittings for households and commercial premises, they have a market cap of $824m with a share price that’s little changed over the last decade.

The business operates household names Caroma and Dorf while focusing on water solutions with plans / hopes to capture global market share.

In April they announced revenue up 2% and EBITDA 5%, not exciting but their yield of 6.7% fully franked does feel sustainable.

Technically we are bearish GWA targeting sub $2 although $2.50 is clear strong short-term support.

We are neutral / negative GWA and are not yet tempted by its yield.

GWA Group (GWA) Chart

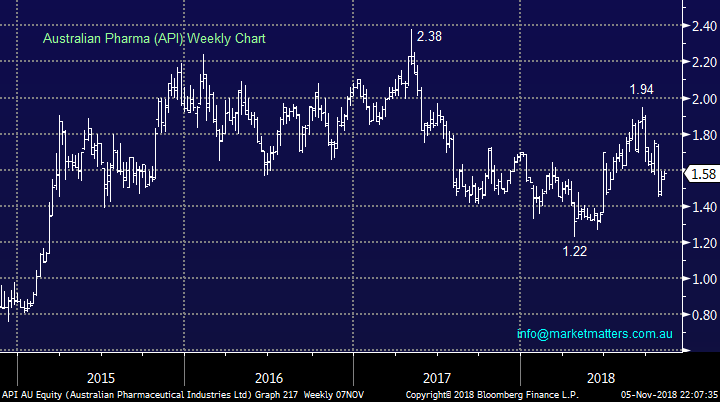

5 Australian Pharma (API) $1.58

Pharmacy business API has a market cap of $849m and has been on the acquisition trail of late buying Clearskin Clinics for $127m, a move that helped the share price.

The business has struggled since the loss of its Chemist Warehouse supply contract and Octobers numbers illustrated this, although the board anticipated growth next year but were not brave enough to put a number on their forecast.

The companies valuation is ok if they can grow moving forward as is its 4.4% fully franked yield BUT it’s a big “if”.

We are neutral API at present.

Australian Pharma (API) Chart

Conclusion

We remain mildly bullish stocks from current levels but looking to reduce our market exposure into strength, ideally ~5925 for the ASX200.

Unfortunately we found no exciting opportunities amongst the 5 stocks looked at today.

We do now like Apple at current levels i.e. around $US200.

Overseas Indices

We are now neutral / bullish US stocks with an initial target now only a few % higher.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January. To turn us bullish we need to see strength above 11,800.

German DAX Chart

Overnight Market Matters Wrap

• The US equity markets closed mixed, with the Dow and broader S&P 500 ending in positive territory, while Apple shares fell to a three month low, leading the Nasdaq 100 to close 0.4% lower after a report that they won’t increase production of the iPhone XR.

• US sanctions of Iran have increased concerns around a tightening oil market. The US plans to punish countries trading with Iran but has granted a number of exemptions – Crude oil lost ground from this, down 0.65%.

• Metals on the LME sold off while iron ore rallied as Chinese President Xi said that China will further open up to foreign investment and will cut import tariffs

• BHP is expected to outperform the broader market, after ending its US session up an equivalent of 1.33% from Australia’s previous close.

• The December SPI futures is indicating the ASX 200 to open 12 points higher towards the 5830 level, with a quiet session expected due to Melbourne cup and with analyst consensus of no rate change in today’s RBA meet.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.