Are the tumbling casino stocks presenting value? – (APX, CWN, SGR, SKC)

The ASX200 enjoyed an excellent Melbourne Cup day, rallying almost 1% with the banks driving the market higher e.g. CBA +1.4% and ANZ +1.3%. The resources sector helped bolster both the gains and sentiment with BHP +1.3%, RIO +2.1% and our recent acquisition Western Areas (WSA) +4.2%.

Volumes were subdued as you would expect on Cup Day and the eve of the US mid-terms, but it remains the growth / high value stocks that are out of favour with MYOB (MYO), Wisetech Global (WTC), NEXTDC (NXT) and Appen Limited (APX) all closing in the red.

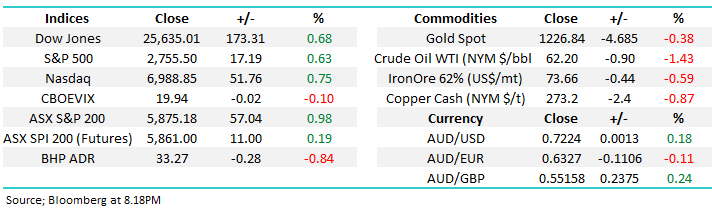

We remain short-term positive the ASX200 initially targeting a break above 5900, but we expect the rally to be far more subdued than Octobers decline – remember 3 of the big 4 banks are going ex-dividend in the next 5-trading days, this will take ~20-points from the index i.e. NAB 8th, ANZ 12th and Westpac (WBC) on the 13th. However I do feel a lot of investors / fund managers are highly cashed up and the path of most pain may be sharp rally into Christmas.

MM remains mildly bullish the ASX200 short-term targeting the 5925-50 area.

Overnight US / Europe markets were mixed with Europe slipping lower led by the FTSE, which closed down -0.9%, while the US closed strongly with the Dow up ~170-points / 0.7%. The SPI futures are calling the local market to open up around 10-points.

**Commonwealth Bank (CBA) has just released a quarterly trading update and the numbers look reasonable given the recent backdrop for the banks. On initial read through, looks a very ‘resilient result’ which CBA are notorious for. I’d expect the stock to be higher on the back of it**

Today’s report is going to focus on Australia’s gaming sector which has been under significant pressure over recent times e.g. Crown (CWN) and Star (SGR) are both down around 12% over the last month.

MM likes exposure to Australian tourism which gaming stocks provide but the question “what is the correct price to pay?”

ASX200 Chart

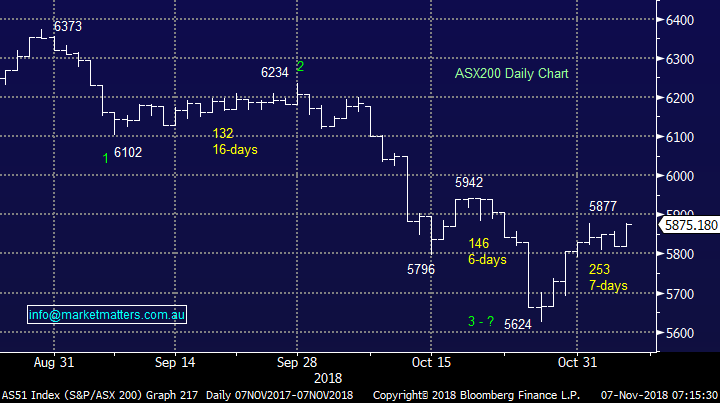

Machine learning business Appen Ltd (APX) was the worst performing stock in the ASX200 yesterday, falling -2.6% on no news. Simply APX is at the epicentre of the anti-growth / high valuation selling that has battered many stocks over recent weeks - APX has corrected a huge 40% from its August high.

APX is a global leader in machine learning and artificial intelligence, a very hot sector over the last few years - a very interesting business with strong prospects, however the fate of the share price is very much linked to the markets appetite for those sort of stocks. While it’s trading on an okay valuation considering its long-term growth potential – it’s not cheap, particularly if we compare it to some of the more mature tech businesses around the globe.

However, as with most things, the elastic band between positivity and negativity often stretches too far and in our opinion, we’re nearing that point on the negative side.

MM likes APX into fresh recent lows under $9.60, ideally around $9 – worth watching.

Appen Ltd (APX) Chart

The local casino stocks suffered a bad Cup Day occupying 3 of the worst 16 stocks by performance, not helped by Crown's (CWN) recent poor trading update. However when we consider the global picture, the local players in the sector have fared okay compared to the hammering both Las Vegas and Macao casinos have suffered in 2018.

Las Vegas has seen both revenues per room and number of visitors falling, a very bad 1-2 combination.

MGM Grand Las Vegas v MGM Grand Macao Chart

1 Crown Resorts (CWN) $11.67

CWN has corrected over 20% in just 4-weeks following a few average trading update and ongoing confusion around major shareholder James Packer.

They operate a casino in Perth plus its high profile presence in Melbourne which is soon to be eclipsed when Barangaroo shifts into gear in Sydney – completion is currently due in 2021.

On paper the stock is reasonably priced and its 5.1% fully franked yield should be sustainable.

Technically the stock looks poor with at least another 10% downside looking likely. Interestingly we looked very closely at the stock / sector when it was breaking out above $14 but it didn’t “feel right” and this time our Gut Feel has proven on the money.

MM is neutral / negative CWN at present.

Crown Resorts (CWN) Chart

2 Star Entertainment Group (SGR) $4.54

SGR has corrected almost 30% from its February high – we took a good profit from this casino / hotel operator in 2017 and have felt relaxed to have no exposure during the stock’s decline.

The Star operates the Treasury Casino & hotel in Brisbane, The Star Gold Coast and the refurbed Star in Sydney, a nice healthy spread of exposure.

Their most recent update looked better than Crown’s with domestic revenue up +6.7% however the stock drifted lower in line with the local and global sectors. The stocks valuation is reasonable and its dividend of 4.5% does not feel under threat.

Technically we have earmarked the low $4 area as ideal buying and at this stage it feels correct.

MM is a potential buyer around 8% lower.

Star Entertainment Group (SGR) Chart

3 Sky City Entertainment (SKC) $3.42

SKC has had a tough few years falling almost 30% from its 2016 high when most of the market was rallying.

The company operates casinos in New Zealand, Darwin and Adelaide plus a variety of restaurants and bars, luxury hotels, convention centres and Auckland's Sky Tower.

Similar to the rest of the sector’s valuation is ok and its dividend of 5.4% does not feel under threat.

Technically SKC looks average and a further 10% decline would not surprise.

MM is neutral SKC at current levels but like its local rivals we have interest ~10% lower.

Sky City Entertainment (SKC) Chart

Conclusion

MM is happy to be currently on the sidelines when it comes to our gaming sector but will have interest ~8% lower.

We remain bullish equities but they are approaching our short-term target hence we may lighten our exposure moving forward.

This time tomorrow we will know if Trumps popularity is as bad as the press likes to make out – I suspect perhaps not!

Overseas Indices

The US S&P500 has now satisfied our downside bearish targets switching us to neutral / bullish with our initial target a test of the 2800 area, or 2% higher.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

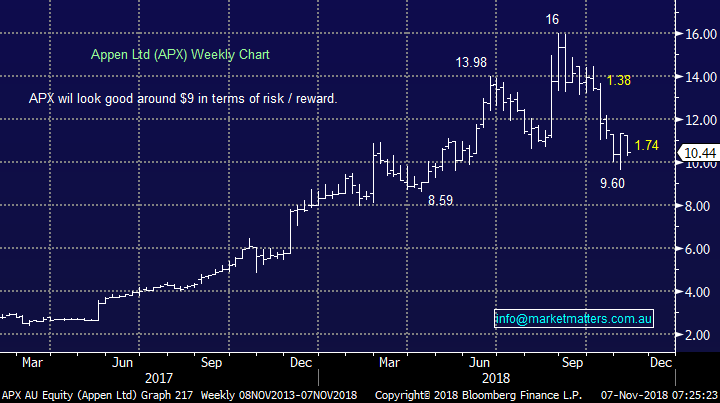

Overnight Market Matters Wrap

• All eyes are waiting on the US mid-term election results with a late rally in the final minutes of the close was seen as investors were confident in the Democrats winning control of the Lower House in a swing away from President Trump, while the Republicans will hold onto a slim majority in the Senate.

• European markets were weaker in the face of continuing Brexit uncertainty, while commodities were also generally weaker. Oil lost another 1.43%, gold -0.38% and base metals were also lower, with copper -0.87%, leading BHP in the US to close an equivalent of -0.84% from Australia’s previous close.

• The December SPI Futures is indicating the ASX 200 to open 8 points higher, testing the 5885 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.