Examining Stocks to Hold into Christmas / 2019 – (CIM, CYB, APX, ASL, CWY, VEA, MPL, SDA, AAPL)

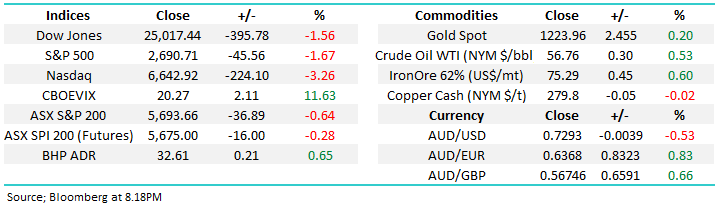

The ASX200 was weak again yesterday, falling 37-points / 0.6% with the Information Technology & Energy Sectors leading the decline, while only the Real Estate stocks managed to close in the black. Volumes were significantly lower than when we plunged lower early last week with more an absence of buying than selling the narrative of the day. It appears our tech space had a sniff of what lays ahead for the US NASDAQ which was smacked overnight falling -3.3% with heavyweight Apple Inc. leading the way, falling -3.96%.

The Asian region was a “bull party”, yet we again failed to join with Japan, Hong Kong and China all advancing between 0.5% and 1%, optimism is clearly improving in the region on a US – China trade agreement. The $US index remained soft during our session which also points to diminishing concerns around what comes next from President Trump & Co.

Our “Gut Feel” is the markets looking for a low before rallying into Christmas, the SPI future’s surged higher after 4pm which was the first sign we’ve seen of investors / traders looking to buy late in a session, in any meaningful manner, since late October. However it can easily take a few bites at the cherry before a low is actually found.

MM remains short-term mildly bearish targeting a retest and probable break of the psychological 5600 area – but we would be buyers of this weakness.

Overnight US / Europe stocks were weak led by the NASDAQ tech stocks which fell over 3% while the Dow outperformed only falling -395-points, however the SPI is implying the ASX200 will only open down around 15-points following strength in resources e.g. BHP Billiton (ASX: BHP) closed up almost 0.6% in the US.

Today’s report is going to look at 5 stocks which either rallied or fell by over 5% yesterday – as we consider our ideal portfolio mix into Christmas / 2019.

ASX200 Chart

MM is considering a switch in the next few days depending on how the respective stocks trade over the coming sessions:

1 CIMIC Group (ASX: CIM) $43.03 Engineering & construction business CIM has declined 17% from its 2018 high and around 10% since MM went long for the Growth Portfolio in October – the stock is being tainted with the same brush as recent market “blow ups” Lend Lease (ASX: LLC) and RCR Tomlinson (ASX: RCR) and it feels unlikely the stock will recover any time soon.

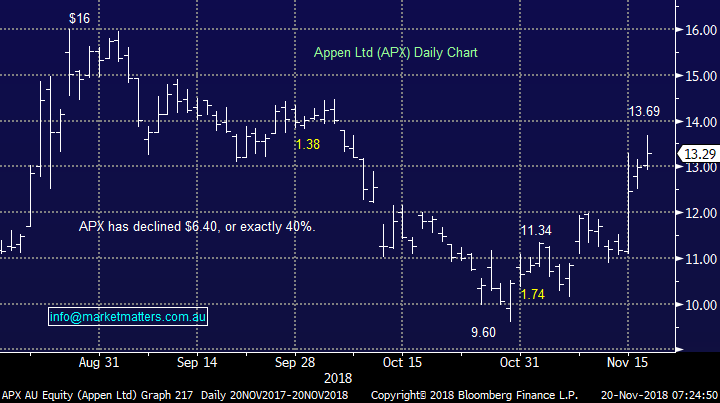

2 Appen (ASX: APX) $13.29 We like this business but like many in the group it had been simply trading way too expensive above $15- it’s a global leader in machine learning and artificial intelligence, a very hot sector over the last few years. The stock’s now trading on an ok valuation considering its long-term growth potential, especially following the recent business upgrade to its earnings guidance by definition reducing short-term stock specific risks - considering their growth profile I like the stock at $12.50 or below

Appen Ltd (APX) Chart

3 CYBG Plc (ASX: CYB) $4.45 UK bank CYB has corrected over 30% since August due to BREXIT concerns and a subsequent weak Pound. However, we like the stock and its recent merger with Virgin Money. CYB is due to report this afternoon which may change this view, or our idea of a suitable entry level, however the stock is on our radar for assessment post earnings.

CYBG (CYB) Chart

Evaluating 5 stocks that are on the move

Yesterday only 23 stocks in the ASX200 moved by over 3% illustrating the lack of activity at the company level, it will be interesting to see if this continues today following overnight losses in the US, the SPI implies it will. The movement in the 5 stocks we have evaluated today is potentially more relevant than would often be the case as they were clearly the “odd ones out” i.e. only 8 stocks in the ASX200 moved by over 5% yesterday, including the 5 touched on today.

1 Ausdrill (ASX: ASL) $1.53

Yesterday ASL rallied +7.4% / 10.5c closing at $1.53 but at this stage it just looks like a bounce within the downtrend for the specialist drilling services company which is down over 36% this year– not a good time for engineering stocks as discussed earlier.

Technically we want a close above $1.60 or around $1.30 to look interesting i.e. its neutral just here.

Ausdrill (ASL) Chart

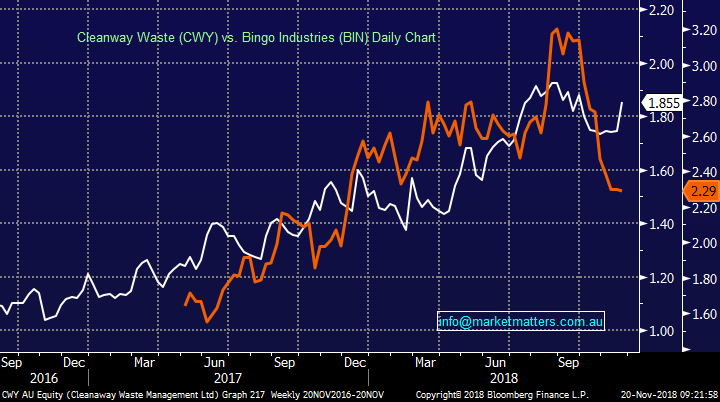

2 Cleanaway Waste (ASX: CWY) $1.855

Yesterday CWY rallied +6.3% / 11c the $1.855 after being upgraded by Credit Suisse to “outperform”.

We like this waste business and see it in a growth sector moving forward, the question still remains at what price.

However while there is a lot to like with the business we must consider the other side of the coin, like with all investments there are risks / negatives, for CWY these include higher competition in the domestic market and the decline of recycled commodities prices.

Cleanaway Waste (CWY) Chart

Rival Bingo (BIN) which is currently trying for approval to takeover Dial-a-dump has been very weak and trades on a meaningful discount to CWY. From a value perspective, BIN looks better.

Clearway Waste (CWY) White vs Bingo Industries (BIN) Orange

MM will sit on the fence for a while longer and let the dust settle after yesterday’s spike higher, remember it was not on company news but just a broker opinion.

3 Viva Energy (ASX: VEA) $1.80

Yesterday VEA tumbled 12.2% / 25c on the news that it will not meet its prospectus forecasted earnings – the stock floated in mid-July. VEA CEO Scott Wyatt primarily blamed Coles for not reaching its full potential of sales through its 1150 service stations – we question if he was too optimistic in the prospectus to get a better float price ! Also, margin contraction in its Geelong refinery have not helped the miss.

The company now expects underlying NPAT for FY 2018 to be $280 million compared to prior forecasts $324 million, an 13.5% miss.

MM has no interest in a business whose first major announcement since floating is a downgrade.

Viva Energy (VEA) Chart

4 Medibank Private (ASX: MPL) $2.60

Yesterday MPL tumbled 6.14% / 17c on the news that they had lost the Australian Defence Force (ADF) private health insurer position after 6-years, this is estimated to be worth ~$30m of MPL’s operating profit. The contact covered 80k people and based on the MPL ‘hit’ of $30m at the operating profit line, MPL was making $375 a person.

MPL now looks ok value below $2.50 but we see no reason to be chasing this business in 2018 – simply too hard.

MM is neutral MPL.

Medibank Private (MPL) Chart

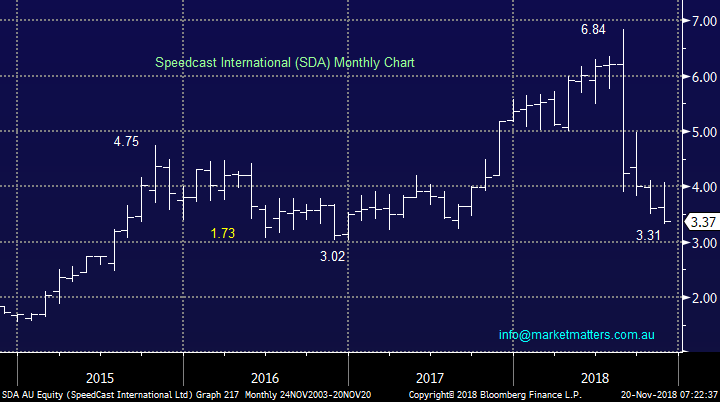

5 SpeedCast International (ASX: SDA) $3.37

Yesterday satellite based communications company SDA saw its shares tumble another 5.6% / 20c as the stocks demise continues.

It’s concerning to see professional traders continue to increase their bearish bets on a stock into major weakness - short interest is now just shy of 10%.

MM still has no interest in SDA until further notice.

SpeedCast International (SDA) Chart

Conclusion

Nothing very exciting in the 5 stocks who had decent moves yesterday, in fact the best result from the group was neutral with a couple of clear “avoid”.

However we do like the potential switch from CIM to APX while CYB looks interesting here and we’ll asses it again post earnings report.

Overseas Indices

The US NASDAQ was smacked 3.26% last night, more than we expected but with the likes of Facebook and Apple under the cosh it’s a tough time for tech e.g. Apple fell almost 4%.

I deliberately left our Weekend Chart labelled as below, we have not given up on the green arrow but clearly it’s a volatile time in the growth sector.

US NASDAQ Chart

US Apple (US) Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

Overnight Market Matters Wrap

· The sell-off in the US resumed overnight, particularly in the tech. heavy NASDAQ with the ‘FAANG’ group of stocks notably under pressure at the start of the Thanksgiving week in the US which is expected to result in weak volumes ahead of Thursday’s holiday (Friday AEST).

· The Dow and S&P 500 were also both down about 1.6% as ongoing concerns about the US-China trade spat and the pending UK exit from Europe (Brexit) weighed on sentiment.

· On the commodities front, iron ore, copper and gold were all slightly firmer, alongside with crude oil.

· The December SPI Futures is indicating the ASX 200 to open 27 points lower, towards the 5665 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.