NEC -2.91%: the media group struggled today despite a decent 1H, weighed on by non-committal guidance at the result. Revenue of $1.4b was in line with consensus, as was NPAT at $189.5m with the result driven by market share gains in free-to-air and a beat by streaming platform Stan while radio was in line and 9Now missed slightly. The company shied away from any firm guidance, saying 3Q FTA revenues will be softer while costs will be higher. Stan is expected to do well, particularly on margins as price increases are passed through.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

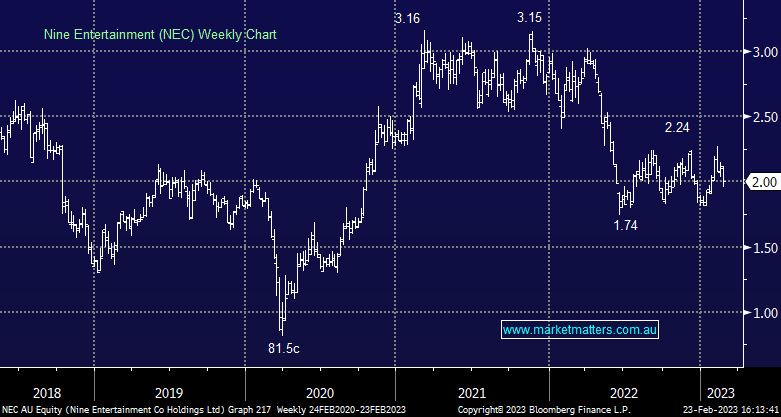

MM remains a patient holder of NEC sub $2

Add To Hit List

In these Portfolios

Related Q&A

NEC and APX

AMP, WOW, NEC

Is the market getting it wrong on NEC?

Will Media company be in focus for coming financial year ?

Your thoughts on CTD and NEC, please

MM view of NEC & HVN

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.