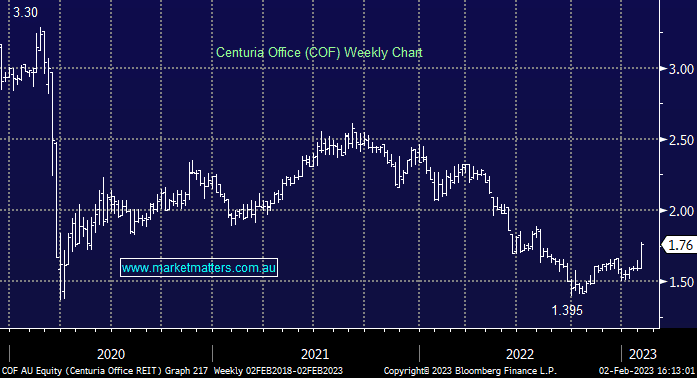

COF +7.98%: A slight beat on a number of key metrics at their 1H23 results today led to a reasonable pop in the share price which shows how bearish the market is towards office assets, and property more generally. Funds from operations (FFO) came in at $48.6m, a ~2% beat while the dividend of 7.1cps had already been pre-announced. Leasing volumes were solid and ahead of expectations while NTA of $2.40 was down on the $2.50 recorded in June 22, but clearly not a disaster and is still ~36% above the current unit price.

Gearing is a touch high at 35.6% and they only really have short-term hedging in place, so there is risk around that, but it’s manageable. Occupancy increased from 94.7% in June to 96.4% while their WALE stayed steady at 4.2 years. Guidance for FFO of 15.8c was unchanged and inline with consensus while the dividend should be 14.1c, putting it on an 8% yield. We own Centuria Capital (CNI) in our Income Portfolio which in turn owns 14.3% of COF and view these trends as broadly positive, or at the very least, not as bad as expected. We also have a position in Dexus (DXS) making us ‘overweight’ the much-maligned office space.