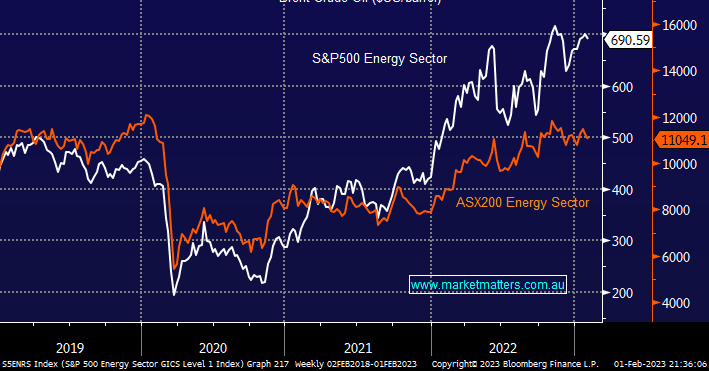

The oil price has been range trading over the last 4 months albeit near the lower level of prices for the last 18 months. The US Energy Sector has significantly outperformed its Australian peers over the last year and although we believe both sectors are now looking tired its MM’s view that better risk/reward is now on offer locally however we’re conscious that in both absolute and relative terms trends have been extending post Covid hence we’re adopting a neutral bias at this stage until the next cycle shows its hand – our main concern is the market is too comfortably long the sector which has soared post Covid.

- We are looking for the ASX & US S&P500 Energy Sectors to converge through 2023.

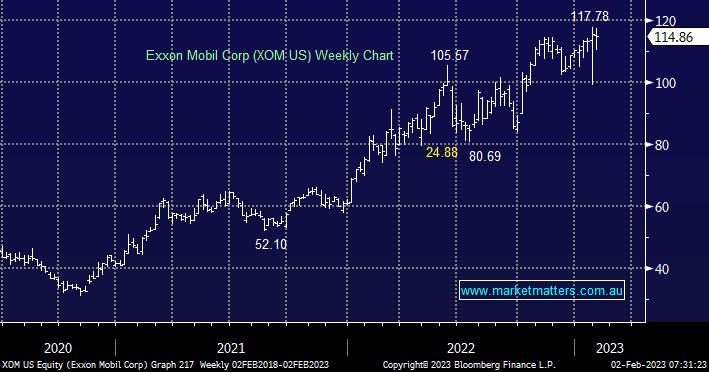

The Whitehouse described Exxon’s (XOM US) recent record profit of $US55.7bn as outrageous although we cannot see how the company is to blame for the awful atrocities unfolding in Ukraine. With central banks hiking rates and governments tight for money after Covid we can see other countries consider following the UK and imposing “special taxes” on profits raising the concern that the more successful/profitable the sector becomes the more they will become a target for the powers that be.

- We are long XOM US in our International Portfolio, hence we are monitoring its breakout to new highs very carefully – our finger is edging closer to the sell button!