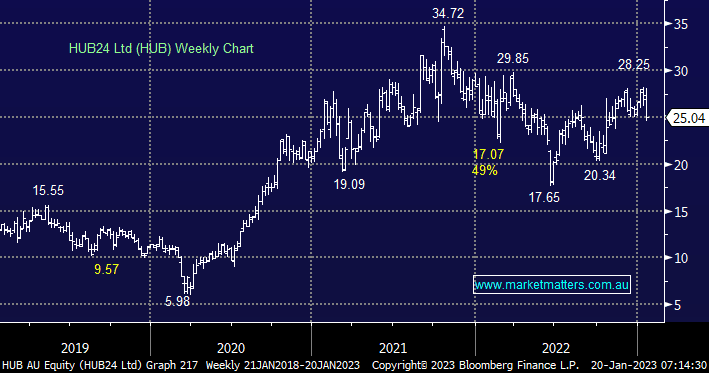

HUB has fallen -5.83% so far this year after the investment platform business disappointed the market with its 2Q Funds Under Administration (FUA) numbers, they reported net inflows of $2.8b, down from $3b in the first quarter and $3.3b in 2Q22 i.e. not ideal for a stock priced for growth. Also, net inflows were 13% lower in the first half compared to the same period last financial year with the company blaming investor sentiment and macro outlook for the slowing FUA growth. We recently sold HUB at higher levels in the Flagship Growth Portfolio on valuation grounds around $28.

- We like this business but following these FUA numbers an Est valuation of 39.75x for 2023 feels rich.