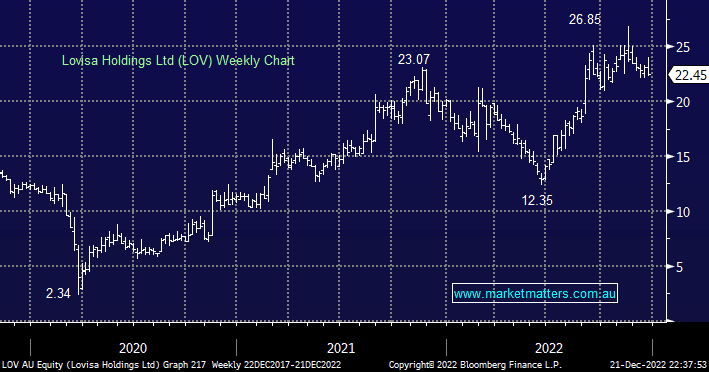

Fashion jeweller/retailer LOV delivered an excellent result back in August with revenue coming in at $459m, up 59% on FY22 while its high gross margins climbed to 78.9%. However, the stocks more than doubled through 2022 and we believe it’s fully priced around $22.50 trading on 31.5x earning for FY’23.

- We believe LOV is surrounded by relatively “cheap alternatives” in the Retail Sector making it hard to envisage any meaningful upside over the coming months.