One of our concerns leading into 2023 is for retail stocks that have run higher on recently good sales numbers – or at least numbers better than expected – however, interest rates will bite in 2023 and household savings levels will decline. While the obvious extrapolation is likely to weigh on the property names, we are actually more concerned about retail and what it looks like at the start of CY2023 following the usual Christmas bump. Clearly, there will be some belt-tightening by those rolling off low fixed-rate mortgages next year into much higher variable rates and this should impact consumption. While this is not a new theme, it was well understood during 2022, in many cases, retail stocks have bounced strongly in the 2H as results have generally surprised on the upside, however, markets are about looking forward and next year could be a different story.

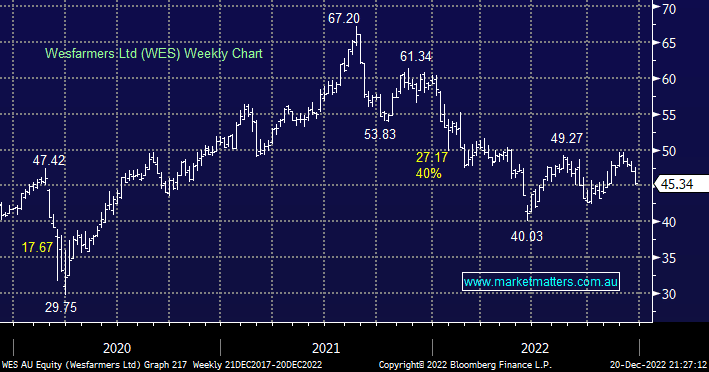

As a refresher, Wesfarmers owns Bunnings, Kmart, Catch and Officeworks, with their retail divisions making up around 82% of their earnings before tax in FY22. Clearly, this is a significant component of their business and with the stock trading on an Est PE of 21x next year’s earnings versus many retailers trading on ~10x-12x, WES clearly need to grow – a tougher ask in this environment. While their other divisions provide somewhat of a stabilizer, and their Lithium business is tipped to grow (worth around $6.00 per WES share on some estimates), we are growing more concerned about WES in the short term, and we are looking to exit our position.