The ramifications of this morning’s US rate rise

Yesterday the ASX200 basically trod water ahead of the US Fed’s decision and statement on interest rates, arguably the focus of many investors’ minds during this choppy and volatile month. Overall it was an ok day with all the Banking Sector closing in the green while the energy stocks were smacked following the breakdown in oil e.g. Origin -5.7% and Santos -3.7%.

Today’s report is a touch shorter than usual given the timing of the Fed’s decision at 6am AEST this morning – anything written before hand was likely to be made redundant in a matter of minutes. How accurate that thought became with the Dow up almost 400-points before 6am, prior to the Fed, and then at around 7am we had plunged almost 900-points to be down ~500-points. Extreme volatility to say the least!

A summary of the Fed this morning:

1 – The Fed raised interest rates by 0.25% for the fourth time this year to a federal funds target rate of 2.25-2.5% - this was as expected.

2 – They reduced expectations of rate hikes in 2019 to 2 from 3 – the market has been expecting only 1 next year which still may be correct.

3 – Fed Chair Jerome Powell said future decisions would be very data dependant – he stressed this point on many occasions throughout the press conference

4 – He ‘talked up’ the US economy and downplayed the impact of stock market volatility

5 – The median 2020 and 2021 forecasts for GDP growth were unchanged at 2% and 1.8%.

I was in front of the screen as the decision to increase rates came through and while the market sold off slightly, the real decline was not felt until Powell held the press conference which lasted around 45minutes. My initial take was that he was perhaps not as conciliatory around market volatility as many had expected focusing more on the strength of the US economy, the stock market is just one indicator that dovetails into their decision making process. While they did downgrade growth forecasts for next year it wasn’t particularly new news with many forecasters already expecting a slowing environment in 2019 and 2020 – the stock market is certainly telling us that and historically the best barometer for the US economy is the stock market, not the Fed.

The other aspect that caught my attention was discussion of the Fed Balance sheet following its massive expansion through QE. Powell seemed adamant that a natural reduction of that balance sheet as bonds matured was the best approach rather than any ‘tweak / manual intervention’ if the market warranted it. I also got the sense that the fed was perhaps being more backward looking while the stock market is currently being more forward looking as we know it is.

In a nutshell, I think there's a disconnect between the way the market is seeing the economy 6-9 months down the track versus where the Fed sees it today. As we have said before, Fed Chair Jerome Powell has inherited one tough job!

Clearly the market was positioned for a more dovish Fed this morning and some short-term “dovish bets” clearly took a bath as the Fed largely held its line.

Dovish – “When monetary policy is dovish, it means that policymakers favour looser, more accommodating policy, because they want to stimulate growth in the economy. The folks at the Federal Reserve accomplish this primarily by lowering interest rates.”

Overnight the Dow finally finished its roller-coaster ride down 350-points / 1.5% but the SPI futures are only calling the ASX200 to fall 19-points on the open, my “gut feel” is we will actually close up today.

MM remains in “sell mode” but ideally looking for higher levels to increase our cash levels and perhaps initiate short positions via ETF’s.

Today’s report is going to look at a few snapshots of how the Feds stance potentially affects markets.

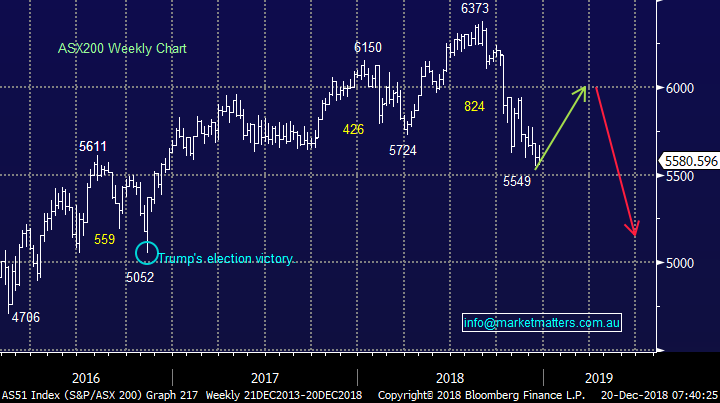

ASX200 Index Chart

The volatility in US stocks was huge but not unexpected following such a pivotal Fed decision / statement. The market was strong leading into the decision but rolled over during the press conference.

I actually felt the decision and the rationale were ok and the fact that they have already dropped expectations from 3 to 2 rate hikes was a step in the right direction for stocks plus his focus on data dependency means this could easily become 1, or even zero, if the US economy stalls in early 2019.

However we are no longer in a bull market and stocks need clearly defined good news to rally while anything lukewarm is leading to weakness.

Importantly over 50% of the S&P500 is now down over 20% i.e. in a bear market with the selling concentrated in sectors that require economic growth to flourish i.e. the market is now convinced the US will be in a recession in the next 2-years, and is clearly pricing that in.

US S&P500 Index Chart

3 sector / market takeout’s

1 The $US & $A

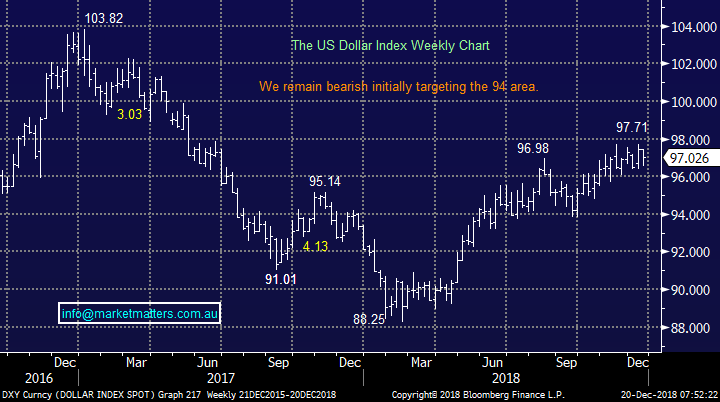

The $US still closed down overnight even though the Fed was more hawkish than many had expected (i.e. less dovish). In our opinion this is not the characteristic of a market looking to rally from here.

We remain short-term bearish the $US against a basket of currencies which implies equities are close to calming down for a while although it hasn’t felt like it since 6am!!

The $US Index Chart

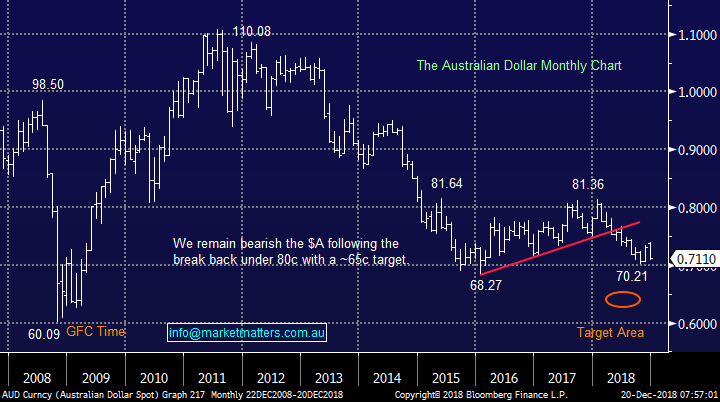

We remain bearish the $A ultimately targeting the mid 60c area against the $US.

Overnight even while the $US struggled the “little Aussie battler” was smacked 1%, at one stage falling below 71c.

This implies 2 themes for 2019 / 2020:

1 - $US earners should continue to outperform in the Australian market e.g. CSL, Cochlear, Aristocrat and ResMed.

2 – The $A is often regarded as a proxy for global growth hence things do look poor economically moving forward i.e. sell rallies in stocks is probably going to be our mantra in 2019.

The $A Chart

2 Intertest rates

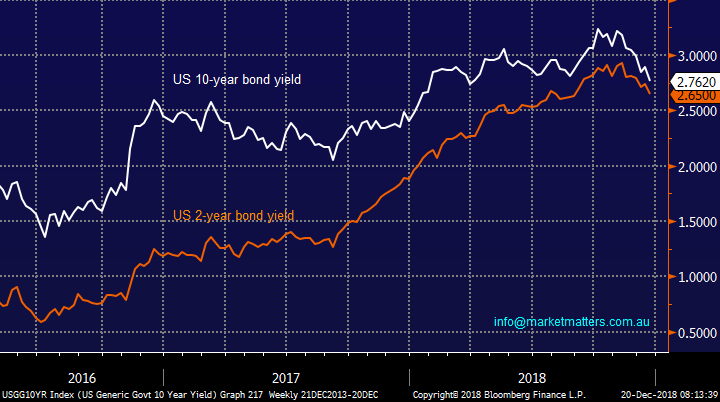

The US 10-year bond yield, arguably the most watched interest rate on the planet, however this has now simply corrected a similar magnitude as it did in early / mid 2017. Even this morning as the Fed delivered a statement which was less dovish than hoped bond yields slipped.

In other words the market voted that the Fed was actually going to push the US economy into recession and hence interest rates will eventually fall. Overnight the worst performing sector of the S&P500 was the Consumer Discretionary stocks while Utilities & Real Estate took the best 2 slots – another illustration that fund managers are positioning for a recession.

US 2 & 10-year bond yields Chart

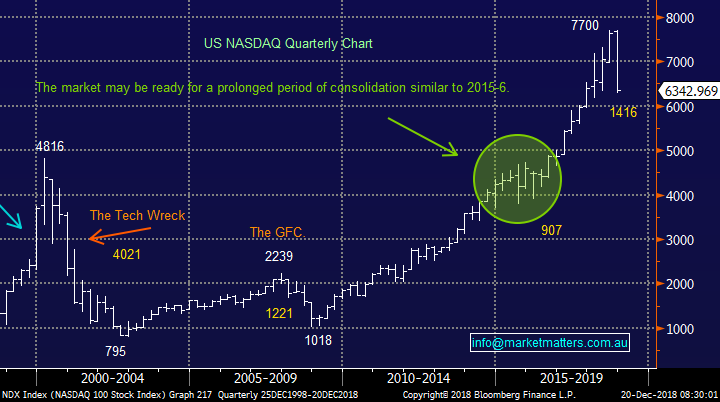

3 The NASDAQ & growth

Our long-term view at MM for the tech based NASDAQ was its would consolidate for a few years as it did in 2015/6. If this proves to be correct accumulating a position after an almost 20% correction makes sense. The market is convinced we are going into a recession and growth / tech stocks are clearly “on the nose” – perhaps they have gone too far, too fast with this pessimism, the US economy is still firing solidly at present according to JP!

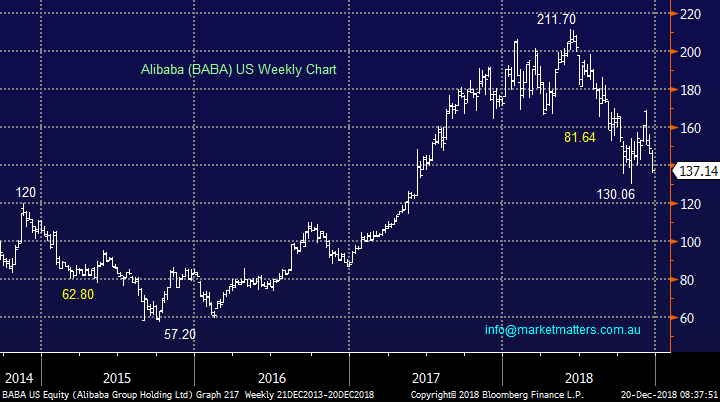

We like Apple and Alibaba at current levels targeting at least a 20% bounce.

NASDAQ Chart

APPLE (AAPL US) Chart

Alibaba (BABA) Chart

Conclusion

While the recent market moves are testing our resolve, we are still not convinced that the Christmas rally is a dead duck.

Clearly our market has been soft however downside momentum is waning

We remain bullish but concede we’re more on the neutral side of that call now, but importantly, we’re not bearish after such a savage decline in.

Overnight Market Matters Wrap

· The US sold off late in the session following the Fed comments after raising its key interest rate by 0.25%, its fourth and final for the year of 2018. The selloff in their afternoon was triggered by central bank trimming its 2019 hike forecasts to two from three, calling risks "roughly balanced" and flagging threats from a softening world economy. The Fed chairman’s commentary had a dovish tone and outlook, despite the hawkish move.

· Oil extended gains after the EIA said U.S. crude inventories fell last week amid a surge in winter fuel demand. Saudi Arabia earlier predicted that OPEC, Russia and other allies would continue to trim output beyond the first half of 2019.

· Metals traders face a wild 2019 if LME stockpiles keep falling. Glencore said inventories of nickel, zinc and copper are already at record lows when measured by days of consumption and expects supplies to keep falling next year even if demand growth weakens.

· BHP is expected to underperform the broader market after ending its US session down an equivalent of 1.07% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 19 points lower towards the 5560 level this morning, however volatility is expected due to December index expiry this morning, and stock option expiry this afternoon.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.