The Fed puts any Santa rally to bed

From the entire team at Market Matters we’d like to wish you a very Merry Christmas - hope you have a wonderful festive period and a prosperous 2019. Thank you for your continued support throughout the year and we look forward to a big year in 2019.

Today will be the last Market Matters Report for 2018, recommencing on Monday 14th January 2019. Importantly, over the break we will be sending alerts if we transact / amend either portfolio while we’ll also provide updates should the market have any significant movements.

From me personally, 2018 has been a busy year, a challenging one at times as each day we attempt to provide unique insight, present our views of the world and write about markets as we see them - I hope you’ve found them beneficial. The Markets Matters team has grown through the year and I’m incredibly proud of the contribution each important person has made. 2019 is shaping up to be another big one.

Once again, thanks for your support.

James

At 6am yesterday, the SPI futures were targeting an opening by the ASX200 around 5650, a few comments by Fed Chair Jerome Powell followed by a ~700-point backflip by the Dow and the picture was dramatically transformed by the few “not so dovish comments”. Even at around midday, the local market was trading in the black, we thought a solid effort considering the 1.5% decline by US stocks and perhaps finally a platform for some sort of December rally – well that was totally wrong!

An almost tsunami of selling hit the Asian region in the afternoon as the US futures rapidly fell another 1%, the Japanese Nikkei 2.8% and the Hang Seng 0.9%. The SPI selling was huge, especially after 3pm when we saw the market collapse well over 50-points, finally closing down 74-points / 1.3%.

Without question, MM has got this December wrong. We were looking for a rally towards 5900 where we intended to significantly increase our cash position and skew our portfolio to a more conservative bias – instead we’ve seen the ASX200 decline almost 3% this month. In fact the ASX200 is likely to test its long term support line illustrated below, not an ideal time to be an aggressive seller.

Our longer term view that the ASX200 will test 5000 in 2019 / 2020 remains in play but in hindsight we’ve let ourselves get too close to the market as we tried to add some short-term value / alpha, it’s not been a fun December for many Australian investors – us included!

In a nutshell, we were extremely well positioned in October when the market got hit with the Growth Portfolio holding a large cash position plus 2 decent size negative ETF holdings, but our optimism would certainly appear to have got the better of us:

1 – We allocated ~15% into the market basically between 5600 and 5650 – now only 2.5% away but it feels worse!

2 – We took our $$ too early on our negative facing ETF’s positions in October.

In short, we went “all in long” in the more aggressive Growth Portfolio around 3% ago, clearly wrong unless some big surprises unfold in the last few days of December.

MM remains in “sell mode” but ideally looking for higher levels to increase our cash levels and perhaps initiate short positions via ETF’s.

Overnight US markets were again volatile with the Dow at one stage flirting with unchanged, while also plunging to down 650-points at 6am, to eventually closing down ~460 points. The ASX200 appears to have received its medicine yesterday and has actually spent most of the night in the green and it’s still looking to open up flat – BHP’s trading up 26c in the US, implying the resources will have a better day today.

Today’s report is again going to look at the MM Growth Portfolio as we look to de-risk / gain some flexibility in the weeks ahead, unfortunately not at the levels we had anticipated.

NB This does not mean we are going to panic and dump a large part of our portfolio but we do need to regain a degree of flexibility in the weeks ahead.

ASX200 Index Chart

US stocks were trading down 400-points at 7am this morning, having bounced reasonably well from their intra-day low.

MM is looking for a bounce from current levels but this Decembers plunge is likely to have further to run into at least early 2019.

US S&P500 Index Chart

The MM Growth Portfolio

We are not ignoring the Income Portfolio this morning, but it’s not generally as active as our flagship Growth Portfolio and we’re less exposed to stocks masking it less volatile, and we are watching a couple of the stocks very closely that have exposure to the Australian consumer i.e. Nick Scali and Super Retail Group.

The MM Growth Portfolio’s 4% cash level is too low when panic hits our market, we generally pride ourselves on being cashed up at moments like today, but unfortunately not this time.

However its important to look forward NOT back, we are human like all investors and do / will get it wrong, it’s simply how we deal with these situations that defines us.

For example, if we held a large cash position now we would be looking to allocate it into the market on long-term support, hence pressing the “panic” sell button feels likely to compound a tough month.

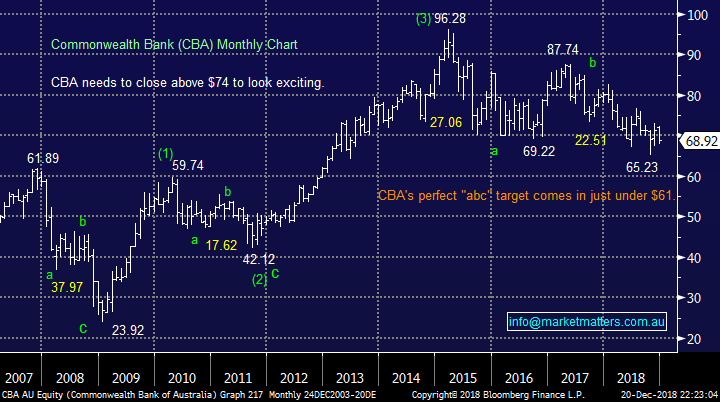

The Banks

We are holding 30% of the MM Growth Portfolio in 3 of the big 4 banks, overweight but we believe the banks now have the worst behind them following royal commission.

Their largely sustainable dividends feel attractive at current levels, especially if global bond yields are set to rise at a more modest pace e.g. CBA is yielding 6.25% fully franked.

MM is unlikely to sell our banks in the weeks ahead.

Commonwealth Bank (ASX: CBA) Chart

The Insurance Sector

During 2018 we have reduced our SUN position down to only 4% from 12% while our QBE position is also now only sitting at 4%.

Technically SUN is now bearish, targeting a further ~15% downside.

MM is very likely to sell SUN in the weeks ahead and potentially QBE as well.

Suncorp (ASX: SUN) Chart

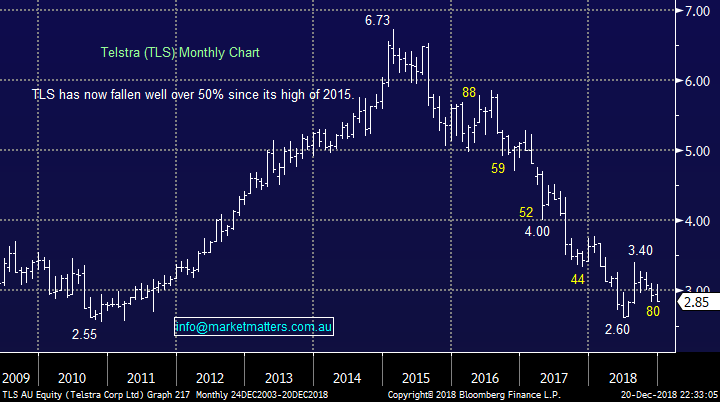

Telcos

MM likes the Telco’s into 2019 especially if we do endure a prolonged bear market – historically Telcos outperform in weak markets and the Australian sector has been smacked since 2014.

MM is unlikely to sell our TLS in the weeks ahead.

Telstra (ASX: TLS) Chart

Diversified Financials

MM now holds 5% in JHG and 3% in Challenger, I’m certainly glad we reduced our JHG holding but clearly regret not flicking the lot.

A bounce in either will be very tempting for our sell finger. JHG caught our eye yesterday by holding up in the face of large futures selling, it’s certainly overdue a bounce with $29 an initial target.

MM is likely to sell JHG in the coming weeks and potentially CGF.

Janus Henderson (ASX: JHG) Chart

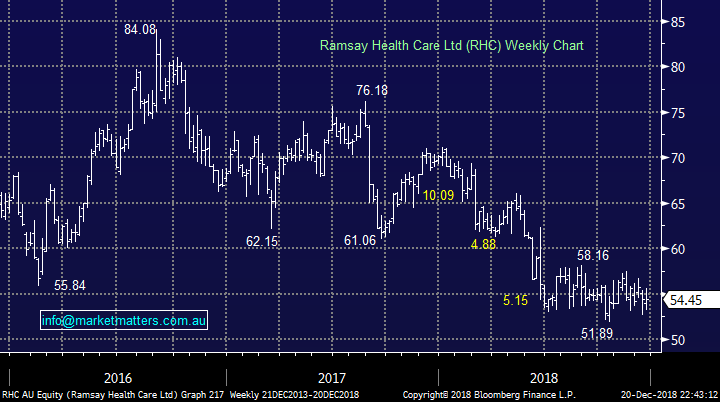

Healthcare stocks

MM now holds 3% in CSL, Cochlear and Ramsay Healthcare while all 3 are quality companies we caught the falling knives a touch too soon in all 3.

We still believe there’s a strong possibility that at least one of these 3 can rally to more attractive sell levels in the weeks ahead – RHC was actually up nicely yesterday.

MM is likely to sell at least one of our holdings in the coming weeks from this sector.

Ramsay Healthcare (ASX: RHC) Chart

Resources & Materials stocks

MM now holds 5% in RIO and Western Areas (ASX: WSA) and 5% in the highly corelated Emerging Markets ETF – this hurt yesterday as the sector was smashed – never likely to fare well when enconomists think a recession is on the cards.

Until we see a major turnaround in sentiment towards the global economy these positions are likely to continue to struggle.

MM is likely to sell at least one of these holdings in the coming weeks.

RIO Tinto (ASX: RIO) Chart

We also hold 5% of the Growth Portfolio in Orica (ASX: ORI) which is holding up ok in a weak market following a decent report and subsequent broker upgrade. Operationally, the business is performing well.

Orica (ASX: ORI) Chart

Growth stocks

MM now holds 5% in Aristocrat (ASX: ALL) and 3% in APX, ALU and XRO with the last 3 purchased into recent panic selling.

The recent purchases have been swinging between profit and loss over the last few weeks, while ALL has been smashed following a disappointing trading update – at this stage we are now sellers of ALL ~$23. The stock is clearly on the nose and the fact many brokers / fund managers love it, is now concerning us.

MM is likely to sell at least one of these holdings in the coming weeks.

Aristocrat (ASX: ALL) Chart

Conclusion

MM remains in “sell mode” but ideally looking for higher levels to increase our cash levels and perhaps initiate short positions via ETF’s.

Importantly, while we do not intend to panic out of positions, more flexibility across our portfolio is clearly required given recent market moves.

NB, today is the last day at MM for the year, and we resume back on the 14th of January from a reports perspective, however we will still be sending live alerts if / when we transact in the market.

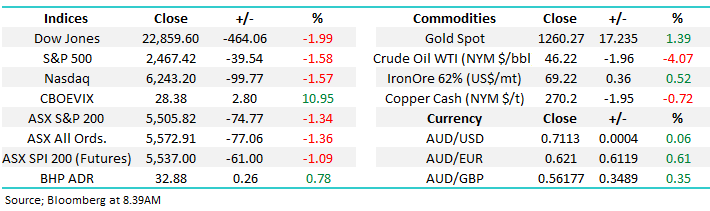

Overnight Market Matters Wrap

• The US equity markets continued to sell off aggressively, with the Dow off ~2.0% and both the broader S&P 500 and Nasdaq 100 off close to 1.60% overnight.

• Uncertainty remains, as investors try to piece together the US Fed’s puzzle and where the market should be led to.

• Crude Oil slide from its game of snakes and ladder, off 4.05%, however BHP is expected to outperform the broader market, after ending its US session up an equivalent of 0.78% from Australia’s previous close.

• The March SPI Futures is indicating the ASX 200 to open marginally higher, towards the 5510 level this morning.

Merry Christmas!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.