Happy New Year to all MM subscribers!

I hope the entire Market Matters community enjoyed a well-earned break over Christmas, recharged the batteries and refocussed for a big year ahead – I know I certainly did. This morning’s report will be a brief market / plan update following our recent selling, tomorrow I will answer some questions that have built up over the holidays and then on Wednesday we will release our comprehensive “2019 Outlook Report”.

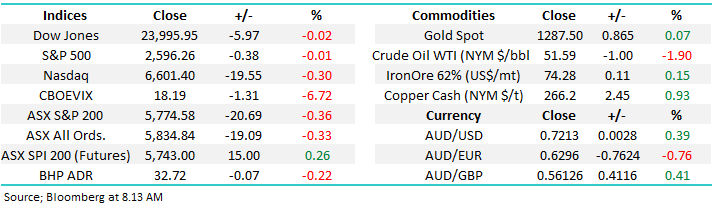

MM had been looking for a Christmas rally for most of December to no avail, now the last 3-weeks have produced an explosive 398-point / 7.4% rally. The AX200 is now knocking on the 5800 door after fighting to hold 5400 support in late December. While the market’s followed our anticipated pathway, it’s been running a touch late this year.

Medium-term we now believe the local market is correcting its almost 1000-point / 15% decline from late August i.e. remember markets rarely go in a straight line from A to B. If this view proves correct we are likely to see a choppy multi-month rally towards 5900 – only 2% higher.

Considering the ASX200’s decline took 18-weeks to unfold, a corrective bounce into at least early March would be the norm. While this opinion remains intact MM expects to be tweaking our portfolio in Q1 of 2019 by selling strength and buying weakness while becoming more conservative / bearish as we approach 5900 – interestingly our target during most of December.

Hence we remain in “sell mode” but in a more fussy position now that our cash level is sitting at 17%, plus we will not be adverse to buying any sharp pullbacks in stocks for relatively short-term plays.

NB in my experience market squeezes / bounces do have a habit of unfolding further than many expect, just as we saw on the recent pullback to ~5400, hence a test of 6000 on the upside would not surprise.

ASX200 Index Chart

The MM Growth Portfolio

We will run a similar process on the Income Portfolio on Wednesday however in the last week or so our flagship Growth Portfolio has sold out of our Suncorp (ASX: SUN), Xero (ASX: XRO), CSL Ltd (ASX: CSL) and Ramsay Healthcare (ASX: RHC) positions raising our cash level to 17% - these sells were flagged in our New Year’s Eve Update (click here).

As touched on earlier while we are still in “sell mode” there are now far fewer stocks in our crosshairs, plus any decent weakness is likely to see us press a few buy buttons.

In the last report on New Year’s Eve we flagged potential selling in;

1 – Stocks / positions we no longer wish to hold moving forward e.g. Suncorp (ASX: SUN).

2 – Stocks that have hit our targeted sell areas e.g. Xero (ASX: XRO) around $44.

MM’s updated potential / likely sell list for January:

1 - iShares Emerging markets ETF (ASX: IEM) above 58.

2 – Altium (ASX: ALU) above $23.50.

Considering our thoughts around Q1 for 2019 a cash holding of 20-25% into strength feels ok.

Altium (ASX: ALU) Chart

Potential buying

We’ve outlined earlier how we see markets evolving into 2019 hence we need a shopping list for one final attempt lower by local stocks as we essentially look to tweak the MM Growth Portfolio over the coming weeks - it will be very easy for equities to regain their bearish sentiment.

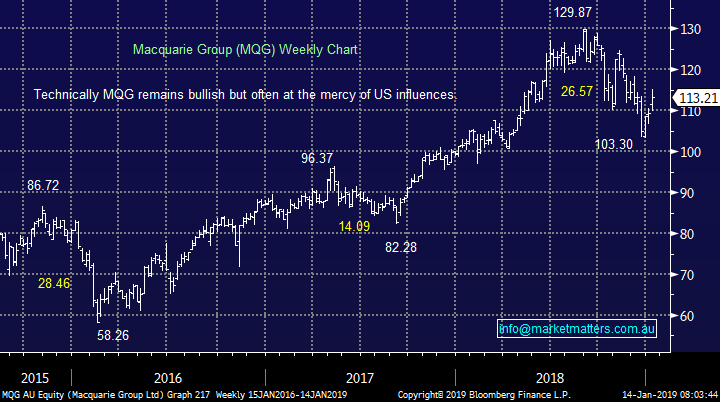

Currently some of our favourite stocks into weakness from Fridays close are listed below with MQG the current standout.

1 – Macquarie Bank (ASX: MQG) $113.21.

2 – Cleanaway Waste (ASX: CWY) $1.75.

3 – New Hope Corp (ASX: NHC) $3.70.

4 – A2 Milk (ASX: A2M) $10.71.

5 – NIB Holdings (ASX: NHF) $5.24

Macquarie Group (ASX: MQG) Chart

Conclusion

MM is looking to rejig our Growth Portfolio in line with our view that markets “chop” higher during Q1 of 2019.

NB Markets are volatile and extremely fluid at the moment so we must / will remain flexible on what comes next.

Overnight Market Matters Wrap

· The US equity markets closed marginally lower on Friday as concerns around the current government shutdown are weighing on investor sentiment, while contingency plans are being drawn up for a standstill that could continue to February.

· US Earnings season kicks off tonight and we expect this will become the markets main focus over and above the current US-China Trade talks, while the Brexit bill in Europe is expected to be voted down.

· All metals on the LME were higher except for aluminium, with nickel the best performer, up ~2%. Iron ore eked out a small gain, while gold and oil fell.

· The March SPI Futures is indicating the ASX 200 to open 24 points higher, testing the 5800 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.