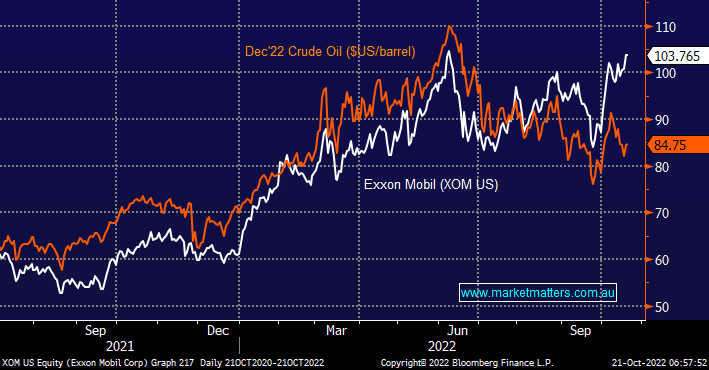

We discussed earlier how the market’s losers keep on taking but the reverse has also been true in 2022 with the winners continuing to give, the Energy Sector has been the standout, as most subscribers know coal stocks have dominated returns across the board year-to-date e.g. so far in 2022 we have Whitehaven (WHC) +284% and Hew Hope (NHC) 221+%. Yesterday we pointed out how while crude oil has fallen ~30% from its June highs stocks in the energy sector keep on rallying as they enjoy bumper profits from elevated prices, even if they are down compared to earlier highs – Woodside Energy (WDS) just delivered a 70% increase in sales to a whopping $9.3bn although its BHP acquisition helped here.

The question we consider today is how long can this rare disconnect continue or will crude oil simply rally back up toward the price of equities. We hold Exxon Mobil (XOM US) in our International Portfolio and have held an unwavering ~$US110 price target through all of the swings in the underlying commodity price. In the case of XOM, we will review our exposure if / when the stock trades ~$US110 because all good things do eventually come to an end although 2nd guessing when has proved costly this year.

- We continue to target the $US110 area for Exxon Mobil (XOM US) or 6-8% higher.