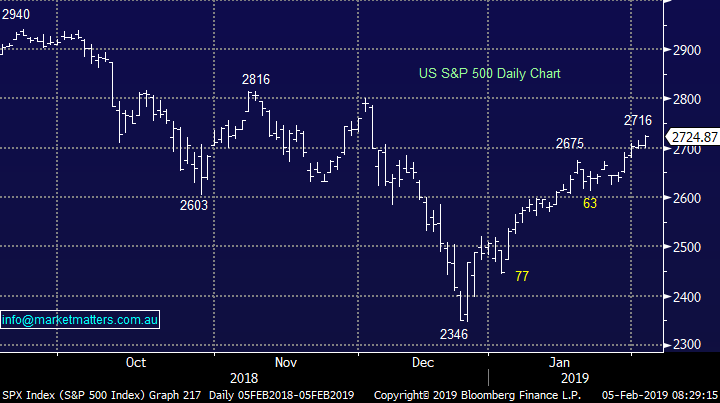

The Hayne Royal Commission has landed (AMP, CBA, WBC, NAB, BOQ)

The ASX200 enjoyed a reasonable start to the week especially considering the worries with the aftermarket release of the Hayne Banking Report, the banks were in fact the main contributors to the markets 28-point / 0.5% advance – Westpac (WBC) & ANZ Bank (ANZ) both up +1.2%.

The report is clearly not as bad / onerous as many feared and the bank shares appeared to get a sniff of that fact on Friday morning e.g. Westpac rallied over 4% from its Friday low to its high yesterday. The SPI futures are generally a “smart” market as professionals can buy / sell $$ positions relatively quickly – at 10pm last night with global markets fairly quiet the SPI was up only 3-points implying a very ho-hum interpretation almost 5 hours following the report release – we expected more action but perhaps the banks last 48-hours bounce is most of the relief rally already complete.

We remain mildly bearish the ASX200 short-term targeting a decent break below 5800 – now around ~2% away. However with the current elevated volatility on the stock level due to reporting season we may press the buy trigger on a situation earlier if the opportunity presents itself. Today we’ve already had JHX (inline), SCP (miss) out with results.

MM is now in “buy mode” due to our large cash position with the ideal level to commence buying on an index level below 5800.

Overnight US markets were again strong surging late in the session with the Dow closing up 175-points helped by heavyweight Apple (AAPL) which rallied almost 3%. The SPI futures have embraced the US strength and are targeting an open ~+0.7% higher.

Today we are going to provide our take on the Hayne Royal Banking Commission but rather than regurgitate numerous recent articles throughout the press our emphasis is focused on how we believe investors should consider the banks going forward.

ASX200 Index Chart

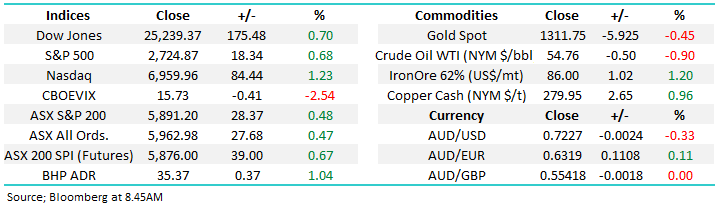

The worst performing stock yesterday was Boral (BLD) which was smacked -7.6% taking its decline over the last 12-months to a painful 44%.

Lower earnings in Australia led to the companies downgrade in a sector that already has low expectations. On the same day we saw December’s Building Approvals come in at a very disappointing -8.4% compared to the anticipated +2%, this is not the time and place to be catching this proverbial falling knife in my opinion.

The MM has no interest in BLD until further notice.

Boral Ltd (ASX: BLD) Chart

Conversely the best performing stock in the ASX200 was happily one of our positions in the MM Growth Portfolio Western Areas (WSA) which closed up almost 6%. No change with our view, If we are correct this nickel miner should continue its bullish advance over the weeks ahead.

MM remains bullish WSA while the stock is above $2.25, our target area of ~$2.80 remains intact..

Western Areas (ASX: WSA) Chart

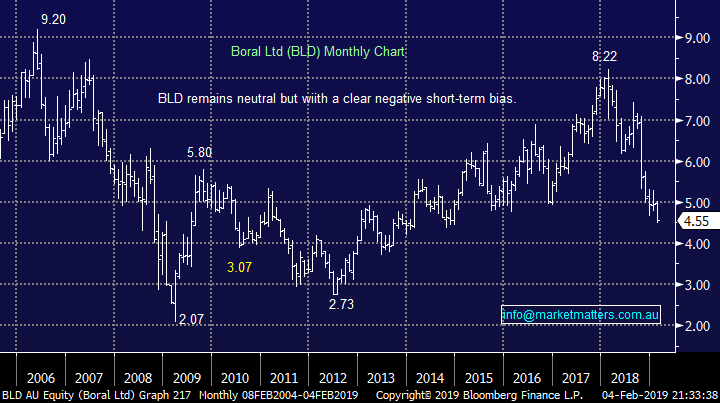

One company that arguably fared worse than the banks from the Hayne Report is AMP who looks likely to be forced to face the music with their customers sooner than they would have liked – fees / margins are likely to fall and ongoing outflows feel almost inevitable. While the relief around vertical integration is a small win, and strength should be sold into in our view – the same applies to IFL.

We still see no reason to be a hero with AMP.

AMP Ltd (ASX: AMP) Chart

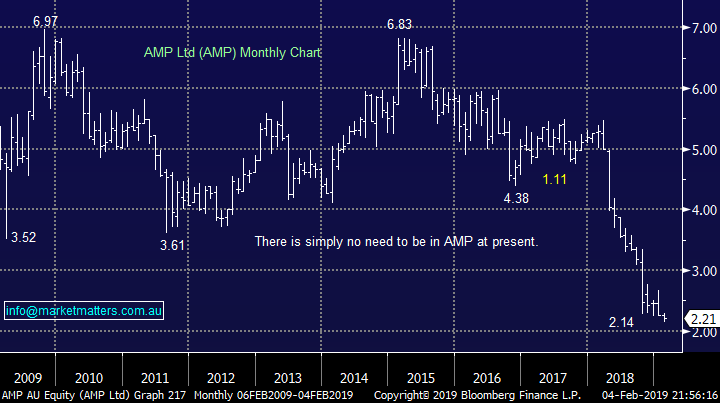

The US markets were again strong last night as they enjoy the new “Powell Put” which has replaced the previous “Bernanke Put” which helped fuel the huge global advance by stocks after the GFC.

The term refers to the Fed being prepared to support assets (stocks) if / when they get the wobbles, in today’s case by not raising interest rates in 2019 as previously flagged last year and potentially reducing balance sheet run off.

US S&P500 Chart

How should we play the banks après report?

With the risk of the unknown mostly gone will investors now chase banks? Remember short positions have doubled since October although I wonder if these have also been initiated with one eye on the falling Australian housing prices / large household debt levels. I believe the Australian Financial Review summed up most initial thoughts perfectly:

“The big four banks have emerged from the Hayne royal commission with their reputations severely damaged, but with no obvious threat to their core money making operations” – AFR.

We all knew that greater regulatory scrutiny was going to be enforced in the report but I can see no major surprises which I believe must be good news for the banks – note I did not say great, that would be a stabilising property market leading to a subsequent pick up in lending.

We think of the “big 4” Westpac (WBC) is the main beneficiary given their vertical integration and brand footprint. Conversely, Hayne was particularly hostile with his comments towards NAB Chairman and CEO but the NAB CEO will probably depart this month with the chair retiring later in the year. Also overall we believe the banks will win in the long run from the much discussed changing remuneration structure of mortgage brokers who in many cases are probably polishing their CV’s as I type.

When I look at the relative performance of both Australian banks and major resources over the last year my initial thought appears even more logical. Now we have the uncertainty of the Hayne report behind us I believe some fund managers will be considering taking profit on the likes of BHP and reallocating into the banks.

MM believes the banks will outperform resources in 2019 – we are positioned accordingly.

Westpac (WBC) v BHP Billiton (BHP) Chart

With global interest rates appearing to be on hold for at least this year and our own even touted to close to being reduced from their all-time low of 1.5% the dividend yield of our banks are looking increasingly attractive – the “big 4” are currently yielding between 6.1% and 8.2% fully franked.

As a group I see limited downside from today’s levels unless we see domestic property decline aggressively from current levels - perhaps we will see the RBA cut rates after all.

Let’s take a quick look at a few of the individual names remembering that since the RC was announced, ANZ has lost 14%, CBA is down 11%, NAB is off 17% and WBC has fallen by 21%.

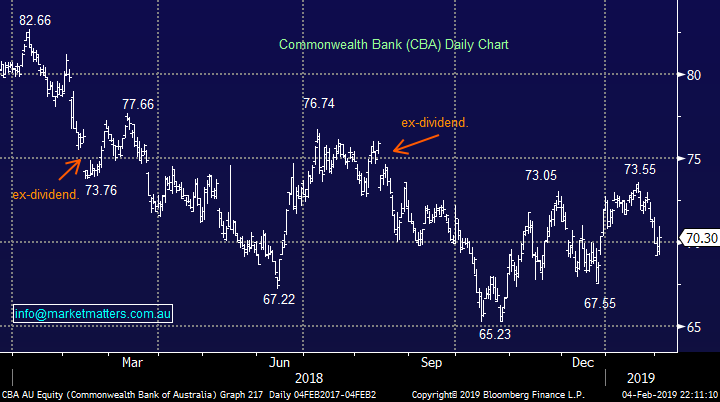

1 Commonwealth Bank (CBA) $70.30

CBA has been trading around the $70 region for around a year and it’s hard to imagine a meaningful advance until we see property stabilise but always remember equity market are generally looking 6-months ahead.

CBA currently yields 6.13% fully franked and is due to trade ex-dividend ~$2.01 in mid-February – only 10-days until a very attractive dividend. Investors who buy today should enjoy a greater than 8% fully franked yield over the next 13-months.

Technically we are now neutral / bullish with CBA with some clarity likely to unfold in the weeks ahead.

MM likes CBA into weakness below $70 and would be accumulating if we had no position.

Commonwealth Bank (ASX: CBA) Chart

2 National Australia Bank (NAB) $24.03

NAB may be worst performing bank early on today but I believe the comments towards their upper management by Mr Hayne will quickly be forgotten.

NAB currently yields 8.2% fully franked but doesn’t trade ex-dividend again until May.

Technically we are neutral NAB here but would be keen buyers into weakness below the recent $22.52 low while on the upside we may trim our position between $26 and $28.

MM likes NAB into panic weakness below $22.50 which now feels unlikely.

National Australia Bank (ASX: NAB) Chart

3 Westpac Bank (WBC) $24.87

WBC is our pick for a potential bounce today for the majors. We would want at least ~$27.50 before considering taking a little profit i.e. 10% higher.

WBC currently yields ~7.6% fully franked but like NAB doesn’t trade ex-dividend again until May.

MM likes WBC into panic weakness below $23 which like NAB feels unlikely.

Westpac bank (ASX: WBC) Chart

4 Bank of Queensland (BOQ) $10.27

The Bank of Queensland (BOQ) has fallen over 16% over the last year which is not unlike much of the sector. However we feel their property exposure should currently be feeling less “heat” as property prices in the Sunshine State do not look under the same pressure as the likes of Sydney and Melbourne.

BOQ currently yields ~7.4% fully franked with its next dividend due in late April.

MM likes BOQ at current levels.

Bank of Queensland (ASX: BOQ) Chart

What other stocks could be impacted?

While the focus is squarely on the banks, there are other areas that will be impacted, some more aggressively. This includes mortgage brokers such as Mortgage Choice (ASX:MOC) and Yellow Brick Road (ASX:YBR) along with Home loans (ASX: HOM) the old resimac business and Finsure which is goldfields money (ASX:GMY), one of the largest aggregated brokers in the country,

With the abolition of trail commissions (and rightly so) in the longer term, this could impact businesses like iSelect (ASX: ISU).

The other area hit is in car and other product finance. There is a recommendation that businesses acting as an intermediary (like a car yard or seller of electronics /furniture for example) would have to undertake consumer credit checks and the like at the checkout. If this is applied strictly this could affect say a JB Hi Fi, Harvey Norman, Thorn Group, or even Buy Now Pay Later companies like Zip Co (ASX:Z1P) and AfterPay Touch (ASX:APT).

It may also affect listed car dealerships such as an AHG, APE or an ASG if they earn revenue from finance applications as intermediaries. Taking one step further, it could also affect new car sale volumes further which would extend into businesses such as GUD, ARB and the like.

Conclusion

MM is comfortable with our current overweight banking position but is unlikely to increase the sector exposure unless we get a surprise aggressive sell off from current levels.

This was a big report, and while our focus has been on the banks, as we own them, there are more far reaching consequences in businesses that have not garnered the headlines

Overnight Market Matters Wrap

· The technology sector led the US equity indices higher overnight, ahead of the release of further quarterly earnings, with Google parent Alphabet due to report aftermarket. So far about half of US companies have reported, with 68% of those beating expectations according to Factset.

· Commodities were mixed, with oil and gold retracing from recent highs but base metals including copper and aluminium stronger

· Apart from the banking sector expected to outperform the broader market today, investors will also brace for the RBA interest rate decision, where it is expected to be unchanged at 1.50%.

· The March SPI Futures is indicating the ASX 200 to open 47 points higher towards the 5940 level this morning with the banking risk expected to dissipate following the Hayne report.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.