We have discussed LOV of late simply because it’s a stock we like and are long in our Emerging Companies Portfolio. Last month this jewellery retailer delivered an excellent result which came in 8% ahead of consensus for revenue at $459m, up 59% on FY22 while its high gross margins climbed to 78.9%.

- We like this company which added another 22 stores last year as it continues to expand, I walked past the store in Chatswood, Sydney on the weekend and it was simply packed.

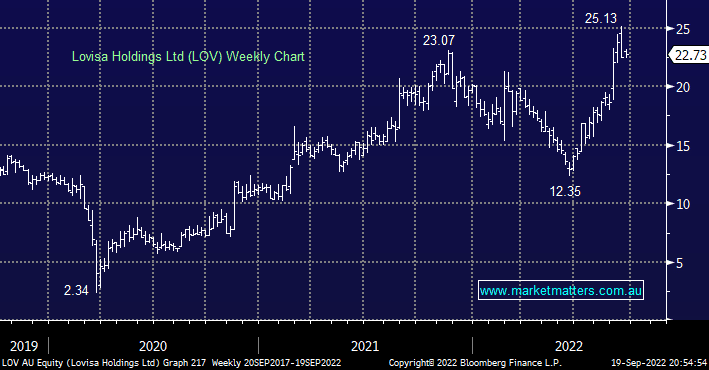

- The stocks not cheap at present trading around 33x Est. earnings for 2023 but after some consolidation in the $20-25 region, we can see higher prices as the business continues to execute well.