Are there opportunities in the local Capital Goods sector as it gains momentum (EHL, CIM, SVW, RWC, MND)

Firstly a quick reminder for anyone whose forgotten today is Valentine’s Day – also called Saint Valentine’s Day, or the Feast of Saint Valentine.

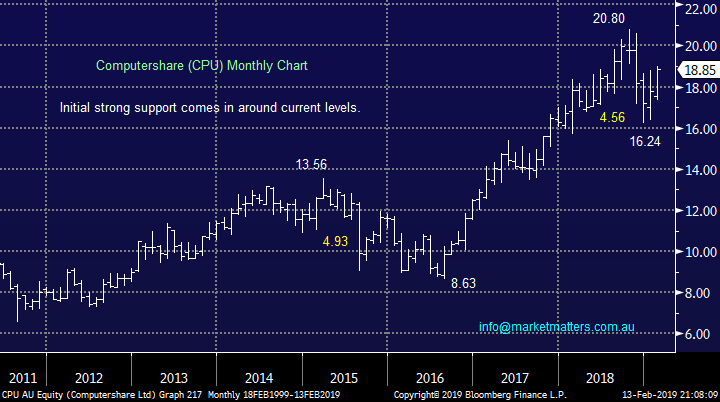

The ASX200 wobbled yesterday experiencing a disappointing day falling 3-points after we take CBA’s dividend into account which was not an impressive performance compared to the overnight 372-point / 1.5% gain by the Dow. The broad market was fairly quiet but reporting season had a big impact under the hood with the following stocks catching our eye Northern Star (NST), Beach Petroleum (BPT) and Computershare (CPU) on the upside while Bapcor (BAP), Carsales.com (CAR) and CSL (CSL) all struggled.

We also noticed the local Real Estate Sector had a tough session with most members closing down although recent “dog” Lend Lease (LLC) has found a little love managing to rally +3.7% i.e. more market reversion, this time within a particular sector. Also, the classic “yield play” stocks Transurban and Sydney Airports (SYD) closed down ~0.5% implying the market is taking some money off the table from stocks that have rallied strongly since the Fed became far more dovish – both TCL and SYD enjoy a lower interest rate environment.

MM remains in “buy mode “due to both our medium-term market view and relatively large cash position – we allocated 3% into Ausdrill (ASL) yesterday leaving room to average if it pulls back.

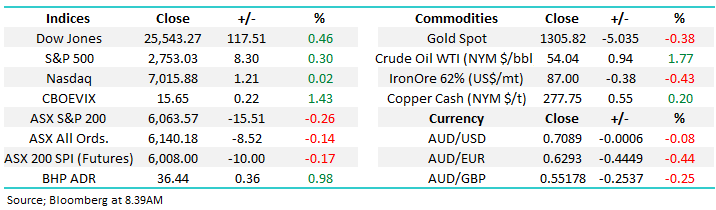

Overnight US markets were a touch firmer with the Dow closing up 117-points but the SPI is calling the ASX200 to fall ~10-points early, ignoring a strong session for BHP, as I said previously “we feel tired”.

Today we are going to evaluate the Australian capital goods sector which continues to remain solid after its almost 20% rally from the December panic lows.

ASX200 March SPI Futures Chart

Yesterday CBA traded ex-dividend $2 fully franked but their shares are still over 9% above the October 2018 low.

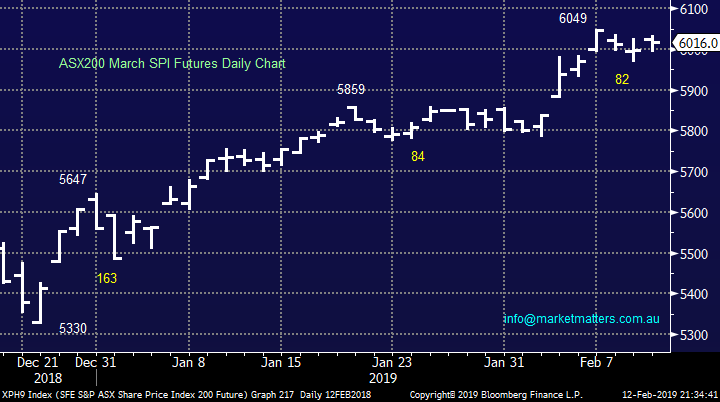

Over the last month we have seen Westpac (WBC) rally 3% while National Australia Bank (NAB) is down slightly but Bendigo Bank (BEN) after an average report has fallen almost 11% in just 5-days. BEN trades ex-dividend 35c fully franked in early March i.e. 7% fully franked, or over 10% grossed up.

MM will consider switching part of our “big 4” holdings into BEN if the relative spread continues to widen.

Bendigo Bank (ASX: BEN) Chart

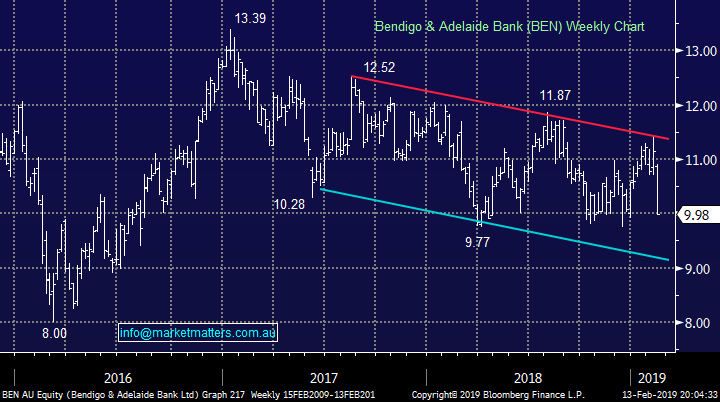

A potential aggressive play / trading opportunity caught our eye after the close yesterday with Computershare (CPU).

CPU rallied almost 6% following the release of excellent 1H numbers plus an upgrade to guidance. They said FY19 profit would increase by 12.5%, which is up on the 10% they had previously guided towards, and above current consensus which sat at growth of 10.7%.

As I said last night for those looking for a global business with strong consistent earnings, CPU fits the bill, my only real concern is around their recent acquisition of Equatex, a European employee share plan administration business, for €355 million – they look to have overpaid plus this is becoming a very competitive, technology driven area of the market. MM is neutral CPU at current prices but for those aggressive players among our subscribers the technical picture is interesting:

Traders can buy CPU targeting the $22 area, while stops can be used below $18.20 – excellent risk / reward.

Computershare (ASX: CPU) Chart

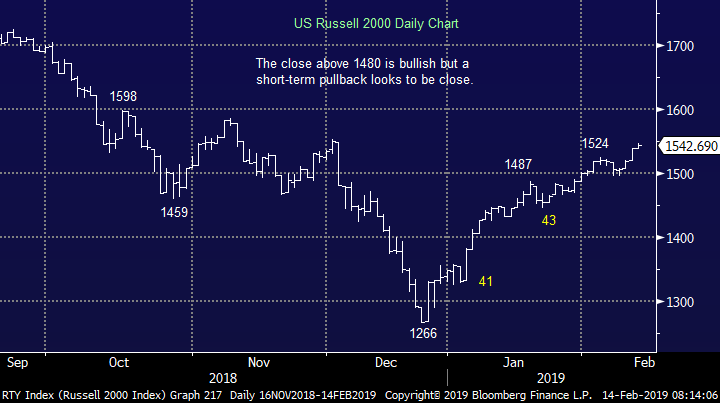

No change, we still feel US markets now have a strong risk to the downside with our target ~5-6% lower but this has clearly been challenged of late.

US Russell 2000 Chart

The Australian Capital Goods sector remains buoyant.

The local Capital Goods sector contains 6 stocks within the ASX200 and they have been very solid of late i.e. Emeco Holdings (EHL), CIMIC (CIM), Monadelphous (MND), GWA Group (GWA), Seven Group (SVW) and Reliance Worldwide (RWC).

Since the December sell off these group of stocks have rallied ~20% compared to the ASX200’s just under 13%, implying to us that if we do see a reasonable correction in the weeks / months ahead this is a prime to sector to be considering. The tracking of the ASX200 by the sector is interestingly almost perfect which is illustrated by the chart below.

Today we have briefly looked at all of the 6 stocks in the sector.

ASX200 v ASX200 Capital Goods index Chart

1 Emeco Holdings (EHL) $2.87

EHL rents earthmoving equipment to the mining industries in Australia and Indonesia. The stock has been under pressure due to concerns around China’s economy and hence the mining industry but as sentiment swings around US-China trade so does the EHL share price.

The mining services business has come out the other side of a very challenging period during 16/17 where a major recapitalisation occurred. They now seem to be kicking goals reducing debt while they have also grown through a number of acquisitions including a $80 million purchase of bulldozers rental business Matilda Equipment.

The shares are currently trading on a P/E of 12.8x but are paying no yield.

MM likes EHL at current levels but would implement stops below $2.60 – just under 10% risk.

Emeco Holdings (ASX: EHL) Chart

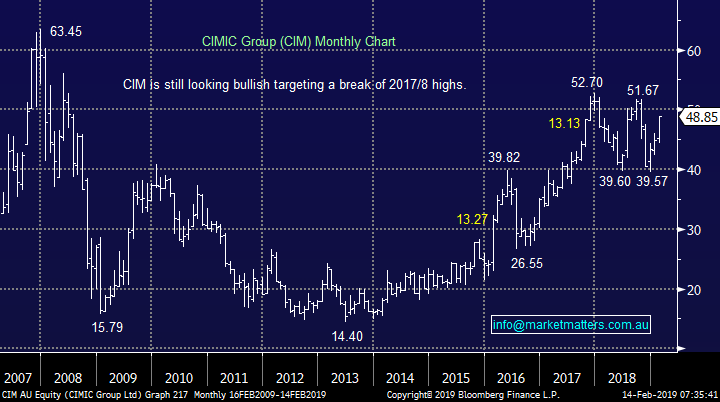

2 CIMIC (CIM) $48.85

Engineering and construction business CIM has rallied strongly in the last 2-months supported by a solid profit report for the last calendar year including Net profit up 11% to $781m and an order book worth $36.7bn. The business is currently positioned strongly with bids for well over $100bn worth of business for 2019 plus $300bn in 2020 – they are not quiet! The risk obviously lies in delivery , especially given the slim margins traditional in this business.

CIM has been on our radar for a few weeks but has held above our previous optimum $45 entry level.

MM still likes CIM and would potentially ‘pay up’ to $47

CIMIC (ASX: CIM) Chart

3 Monadelphous (MND) $16.40

MND runs a similar operation to CIMIC however is slightly less diversified. After a tough few years across the industry, both the resources and energy sectors are starting to improve and this is being shown through strong work wins across the MND book.

MND report on Tuesday and this will be the next catalyst for the stock. With a big short position (~7.5%) and an analyst community that has a sell on MND, a good result here could prove painful for some.

Technically we are 50/50 MND just here.

Monadelphous (MND) Chart

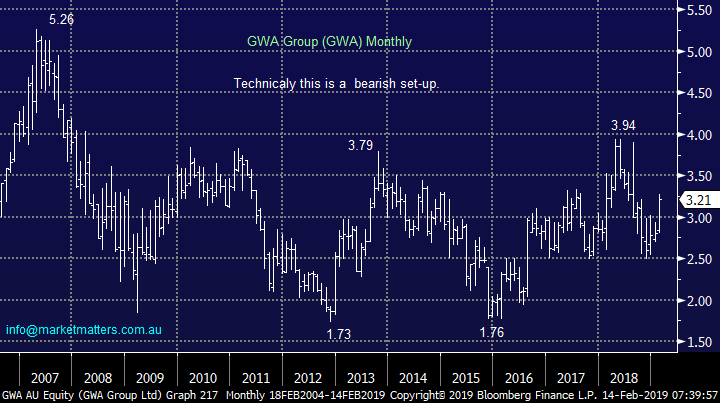

4 GWA Group (GWA) $3.21

Bathroom and kitchen products business GWA has traded within a broad range for the past decade – hardly exciting stuff. Late last year they launched a takeover bid for New-Zealand based taps and shower manufacturer Methven for $112m – they’re clearly searching for ways to transform growth in the business and strengthening their international reach could be the ticket.

However, we’re yet to be convinced and suspect the market will continue to view the stock cautiously as the acquisition evolves

MM has no interest in GWA at current levels

GWA Group (ASX: GWA) Chart

5 Seven Group Holdings (SVW) $17.01

The diversified conglomerate that has exposure to media, telecoms, and heavy equipment has had a tough time since October, declining from ~$23 to ~$13 before recovering to trade around ~$17 today. There was a fairly interesting play on this late last year that has had a negative influence on the company’s share price. They gave holders of the preference shares to ability to ‘get out’ through the stock, the cynic in me suggests that Kerry Stokes orchestrated a good deal, more so for himself. I’ve actually just read his book and its obvious what a shrewd operator he is.

MM is patient on SVW, with interest at ~$15

Seven Group Holdings (ASX: SVW) Chart

6 Reliance Worldwide (RWC) $4.89

Of the stocks in the sector, RWC has attracted most attention since listing in 2016. For those not familiar RWC designs, manufactures and supplies water flow and control systems for plumbing. They recently made a large acquisition in the US and they’ve also embarked on a large expansion in Europe. This is a growth company going places.

MM likes RWC with ideal buying into weakness ~$4.60

Reliance Worldwide (ASX: RWC) Chart

Conclusion

MM is considering the following stocks as potential buys in the weeks to come:

Bullish today – Emeco (ASX:EHL)

Bullish from lower levels – Cimic (ASX:CIM), Seven Group (ASX:SVW), Reliance World (ASX:RWC)

Watch – Monadelphous (ASX:MND) on Tuesday – big shorts & bearish market could create fireworks

Overnight Market Matters Wrap

· The US majors closed in positive territory on a number of factors overnight as US President Trump said the potential for a US-China trade deal is “going along very well”. Optimism was tempered somewhat after Senator Rubio announced a bill to tax buybacks the same way as dividends.

· The message out of the US Fed overnight was positive with growing wages and low unemployment. Inflation has been kept in check by lower energy costs. Fears of another US government shutdown have waned as Trump is expected to sign a bill that will keep the government open as he backs down somewhat on his wall demands.

· LME metals were mixed, iron ore weaker, while crude oil rallied 1.77% despite US inventories rising more than expected.

· The March SPI Futures is indicating the ASX 200 to open marginally lower, towards the 6055 level while all focus will be on the current reporting season – some of the names today are AMP, ASX, EVN, MFG, NCM, S32, SUL, SUN, TLS, TWE & WPL.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.