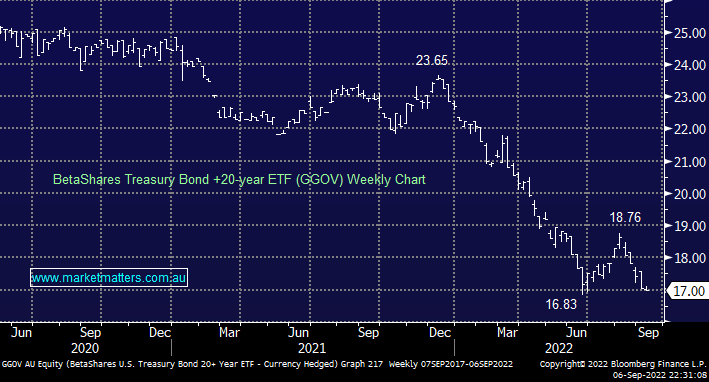

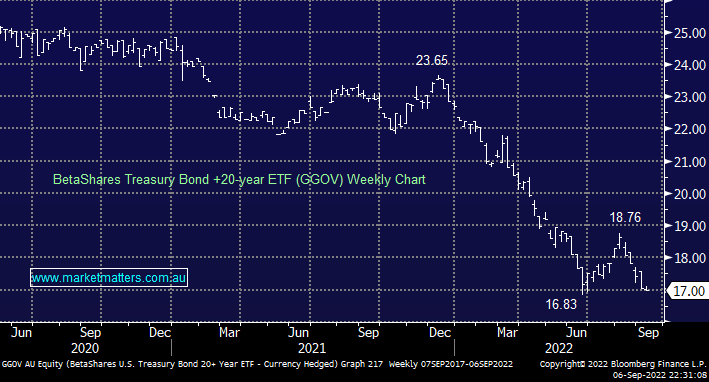

Clearly, this position would be against the strong trend of the last 9-months hence we have no interest in playing our view via an aggressive leveraged ETF plus we are remaining fussy towards our entry-level. We like the ASX traded BetaShares GGOV ETF as a bullish vehicle for exposure to longer-dated US bonds e.g. it bounced +11.5% from its June low as US 10-year bond yields pulled back from 3.5% towards 2.5% illustrating its lack of leverage, if we are correct then we can envisage a ~15% rally by the ETF from fresh 2022 lows but importantly we are comfortable with the downside risks not believing yields will surge through June highs.

- We can see the GGOV test the $16.50 area if the US 10-year yields test / break their June high.