Reporting season throws more curve balls but are they opportunities? (AHG, GWA, ANN, BIN, BEN, BOQ, NHF)

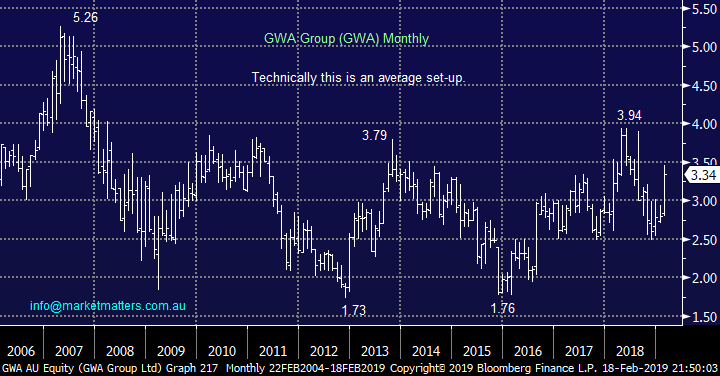

The ASX200 had a pretty average day considering the offshore leads only managing to close up +0.4% compared to the Dows 443-point / 1.7% surge on Friday night but after saying that we still made multi-month fresh highs. The real action was again under the hood, as we like to say, as reporting season continues produce some extreme levels of volatility on the stock level, the standout yesterday was obviously Bingo Industries (BIN) which tumbled almost 50% following a company downgrade – I’m glad we missed that hand grenade!

The backbone of our market was again the resources sector with BHP and RIO both closing up +1.4%. Huge upgrades to Iron Ore price forecasts from brokers around town continue to support the miners. For CY19, Macquarie has upgraded from $64 to $77 while Citi upgraded from $63 to $88. We’d argue the horse has already bolted and upgrades can often create the top in a market.

In terms of our own holdings, we are now closely watching nickel miner Western Areas (WSA), which we hold in our Growth Portfolio, as it closes in on our $2.60-70 target area – only another 3-5% higher. If the resources sector is approaching an inflexion point, albeit on a short-term basis, perhaps the ASX200 can finally experience another ~3% pullback.

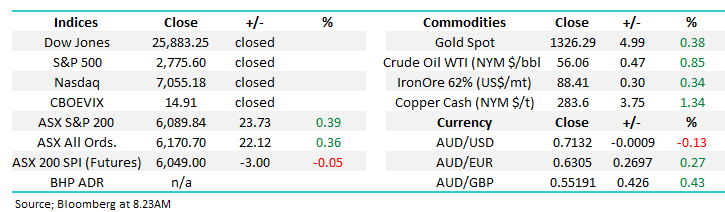

MM’s ideal scenario is a pullback of around 150-points from yesterdays close but we will be looking to buy this move at least short-term.

MM remains in a patient “buy mode” with relatively elevated cash levels.

Overnight US markets were closed for Presidents Day while European indices were quiet, apparently not prepared to move on their own initiative. The ASX200 SPI is calling the ASX200 to open unchanged.

Today we are going to evaluate 3 of the best and worst stocks from yesterday - this is clearly a volatile environment where we can see ourselves pressing both the buy and sell buttons a few times this month.

ASX200 March SPI Futures Chart

It’s now been around a week since the RBA joined the global central banks dovish party but the “Aussie battler” remains firm which at least for now supports our bullish initial target of the 80c area. A market that rallies on bad news is a strong market and in this case we believe a very crowded short.

Yesterday we took a small profit on our Cochlear (COH) position which has enjoyed the tailwind of a weak $A for the last 7-8 years, now it’s time to monitor our other “$US earners” QBE Insurance (QBE) and ResMed (RMD), not a place we want to be overweight.

Australian Dollar ($A) Chart

Overseas indices

The local market has been far more correlated with European indices than the US post the GFC and importantly following the markets 11% recovery we are now neutral / bearish after holding aa bullish view over recent months.

This reaffirms our belief that patience is likely to be rewarded with buying of the market in general – obviously not necessarily on a stock by stock basis.

Euro Stoxx 50 Chart

No change with US markets who were closed last night for President’s Day.

US Russell 2000 Chart

3 of the best performing stocks.

Yesterday while we saw the market gain 23-points only 3-stocks in the ASX200 advanced by over 4% and not all of those were following a report on the day. We’ve had a brief look at the 3 this morning to plan our approach moving forward.

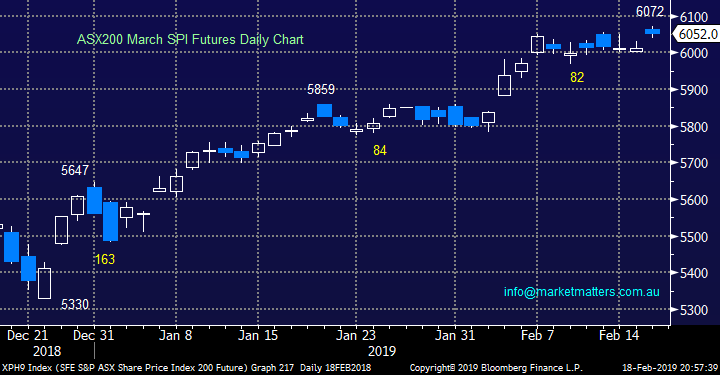

1 Automotive Holdings Group (AHG) $1.77

Yesterday AHG rallied well over 8% after tumbling only a few days ago on the back of a large ‘non-cash’ impairment charge - perhaps the company has got the decks cleared of bad news ahead of their half year numbers due on the 22nd . The company’s MD John McConnell summed up the current position perfectly: “The combined effects of regulatory changes to automotive finance and insurance, the negative wealth sentiment in property prices, particularly in Sydney and Melbourne, and the increased and wider tightening of lending practices have all affected the automotive sector.”

AHG acts as a holding company for a large group of automotive companies which has clearly endured an awful few years - car sales have slowly declined with 2018 showing a decline of ~3% on 2017 – when people are worried about the value of their home and general financial position a new car is not on the menu. The looming household debt issue in Australia which we have discussed over the last year is clearly reflected in the AHG share price, the question now with many people jumping on the bandwagon is when will the worm turn. Stocks like AHG are likely to bottom ~6-months before any improved news filters through the press.

The stock carries a short position under 6% and only sits 39th on the index not making it a major target of the hedge funds. We may have seen a few of these players square up yesterday ahead of the 22nd report. The stocks certainly cheap trading on an Est P/E of 10.6 while the yield over 9% feels rich, or a trap - we are likely to get some light on this later in the week.

MM is neutral at present but would currently have interest on another drive lower towards $1.

Automotive Holdings (ASX: AHG) Chart

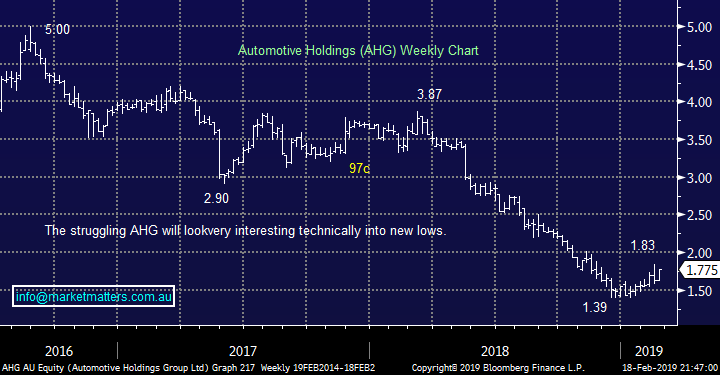

2 GWA Group Ltd (GWA) $13.34

Yesterday GWA rallied well over 4% following the release of stable earnings for the first half of 2019 – the market has profit growth of just 4% factored in. The company’s dividend was also lifted marginally and the stock’s now yielding 5.4% fully franked. A good performance from the manufacturer of building fittings for both households and commercial purposes.

However we are concerned over the ~12-month lag of the current pronounced downturn in the Australian building sector –Bingo is perhaps a red flag here given that demolition pre-empts purchases of new building fixtures / fittings.

The shares are changing hands on a P/E of 16.9x Est 2019 earnings which feels on the rich side considering 4% growth + we may only be in the early stages of a slowing property market.

MM has no interest in GWA at current levels.

GWA Group Ltd (ASX: GWA) Chart

3 Ansell Ltd (ANN) $25.21

Yesterday ANN rallied over 4% after releasing its half-year results which showed revenue was up just over 2% as the company undergoes a major restructure. They also bought back almost $170m worth of shares at $23.42 which looks good compared to yesterdays $25.21 close.

The rubber gloves / healthcare product manufacturer also expects 2019 to come in at the top end of guidance which helped the stock rally but the messy results do make it a touch hard to get a comfortable handle on the business. We are also very wary that ANN generates a significant portion of its revenue in $US a recent tailwind which we believe will become a headwind moving forward.

MM is neutral ANN at present.

Ansell (ASX: ANN) Chart

3 of the worst performing stocks.

The loser dominated on the company specific level with 6 stocks falling by over 4% today we have looked at 3 which we have particular interest in as opposed to the worst performers.

1 Bingo Industries (BIN) $1.17

Yesterday waste collection and recycling business BIN plummeted by over 49% destroying huge shareholder wealth after the company stunned the market with the announcement that they anticipated zero growth in 2019 – not what growth investors want to hear! The reasons BIN cited were less residential developments in NSW and Victoria hence their subsequent reluctance to implement planned price rises.

Throw in the uncertainty of BIN trying to complete the almost $580m acquisition of rubbish collector Dial A Dump Industries, dealing with the ACCC and the expansion at a number of their facilities, it’s a complex environment for their young CEO. Remember, BIN has already raised capital to fund the deal but the ACCC needs to change its initial verdict for it to proceed. It it doesn’t happen, we could expect a 300-400m share buy-back.

The ACCC decision has already been delayed another week until the 28th and we sit very 50-50 on its outcome but if its knocked back a spike lower could be ideal buying.

The risk short-term remains high but moving forward the underlying business does remain attractive with little change to likely FY20+ performance and attractive sector (infrastructure, recycling, landfills, waste volumes).

MM is watching BIN closely with a view to allocating 2% as our first “dog” purchase.

Bingo Industries (ASX: BIN) Chart

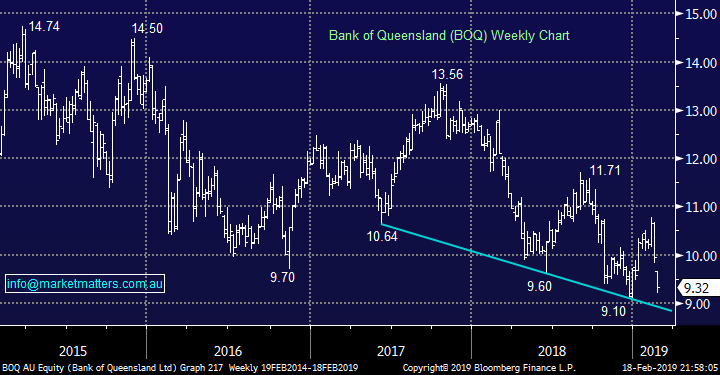

2 Bank of Queensland (BOQ) $9.32

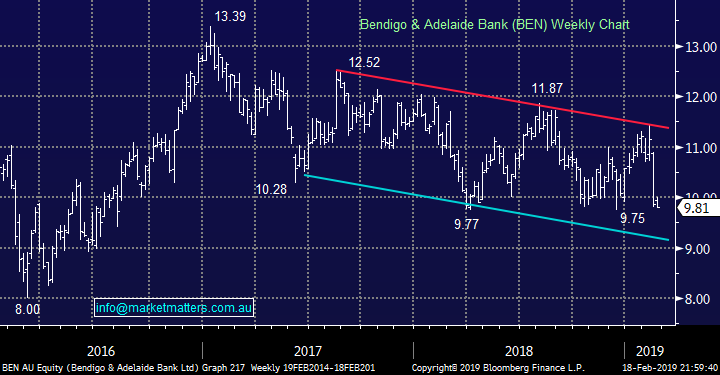

Yesterday BOQ was clobbered -6.3% following closely in the footstep of other regional Bendigo Bank (BEN) last week. BOQ has a reasonably large short position ~7% implying the lacklustre result is not a surprise to all.

As is the case across the Australian credit market, loan growth is weak for BOQ while funding pressure has caused a decline in the net interest margin (NIM). The NIM is expected to fall 2-4bps from a year ago to 1.93%-1.95% while declining non-interest income (fees & charges, trading etc.) plus a lack of loan growth will mean earnings will struggle. Regulatory costs have also climbed and will remain elevated for now thanks to the Royal Commission.

Our ideal technical entries are BOQ ~$8.90 / over 4% lower and Bendigo (BEN) ~$9.50 / again around 4% lower.

We will only think of a switch into ongoing widening of the performance between major and regional banks.

Bank of Queensland (ASX: BOQ) Chart

Bendigo bank (ASX: BEN) Chart

3 NIB Holdings (NHF) $5.68

Yesterday NIB Holdings (NHF) slipped -2.4% lower but noticeably almost 5% from its intra-day high following a miss on its profit expectations for the half with underlying operating profit coming in at $114.3m v ~$125m expected however they did upgrade guidance for the full year from at least $190m to at least $195m, which is actually fairly close to current market expectations.

NHF says that they “do not anticipate the second half of FY19 to be as strong as the first. Key factors expected are unfavourable claims seasonality, the fact that the first half was boosted by a claims provision release within ARHI and likely weak market conditions affecting parts of the Group”. Markets assumed this seasonality – not a new thing. The stock has rallied almost 28% into the result hence a pullback feels likely.

We like NHF into further weakness with ideal initial entry ~$5.50.

NIB Holdings (ASX: NHF) Chart

Conclusion

Of the 6 stocks we reviewed today we had 2 standouts:

1 – Bingo Industries (BIN) which we are watching carefully especially if it spikes down following the ACCC announcement later this month.

2 – NIB Holdings (NHF) we like ~$5.50.

Plus we’re starting to get interested in the regional banks ~4% lower assuming the majors hold up reasonably well.

Overnight Market Matters Wrap

· With the US closed overnight for President’s Day, little change was seen in the European markets as investors wait for further trade talks between the US and China. This week.

· Commodities were slightly firmer, with oil holding at 4-month highs, gold rallying to US$1326.54/oz and copper +1.34% at US$283.60/lb, having firmed 9% in from its early January lows on rising expectations of a trade truce.

· Locally, investors will be looking to the release of the RBA’s latest set of minutes for an interest rate outlook. Company reporting season continues with results this morning from stocks including BHP, Blackmores, Cochlear, Coles, IOOF and Oil Search.

· The March SPI Futures is indicating the ASX 200 to open and test the 6100 level again this morning, up 6 points.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.