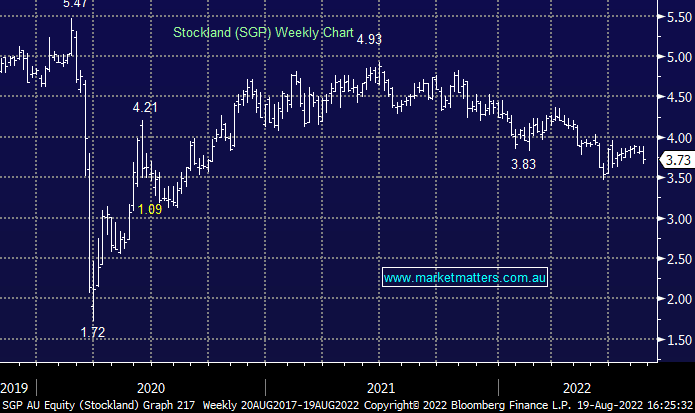

SGP -2.10%: FY22 was a better year for Stockland with Funds From Operations (FFO) coming in at $851m, up 8% y/y and above the estimate of $837.5m. That dropped down to FFO per security of $0.357 vs. consensus of $0.33 while the final distribution was solid at $0.146. FY23 guidance was above consensus, but they then went on to say that July sales were soft and enquiries had halved – i.e. not a good start to the year and no doubt the reason for some selling today. “While macro-economic conditions remain uncertain, the underlying performance of our business segments give us good visibility for the year ahead,” CEO Tarun Gupta said “Importantly, we enter FY23 in a very strong capital position, with gearing sitting below our target range of 20-30% on a proforma basis”.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

Close

Close

Tuesday 3rd June – ASX +29pts, IEL, 360, TWE

Tuesday 3rd June – ASX +29pts, IEL, 360, TWE

Close

Close

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

Tuesday 3rd June – Dow up +35pts, SPI up +69pts

Tuesday 3rd June – Dow up +35pts, SPI up +69pts

Close

Close

MM remains a comfortable holder of SGP in our Income Portfolio

Add To Hit List

Related Q&A

ASX Real Estate Stocks

Opinion and/or analysis LYC, APA, SGP

Thoughts on some property stocks please

Ask James- REITS

How to play bond yields & real-estate stocks?

What stocks for property exposure?

Relevant suggested news and content from the site

Video

WATCH

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

FY26 is shaping up as a year where strategic portfolio positioning will matter more than ever. Hear from James Gerrish & Shawn Hickman as they detail MM's current views.

Podcast

LISTEN

Tuesday 3rd June – ASX +29pts, IEL, 360, TWE

Daily Podcast Direct from the Desk

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Podcast

LISTEN

Tuesday 3rd June – Dow up +35pts, SPI up +69pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.