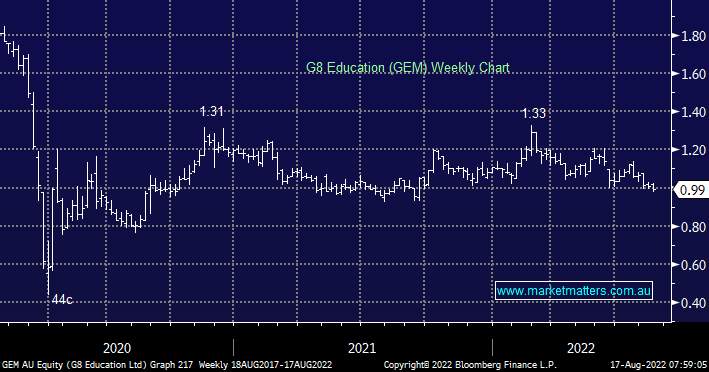

Upon review of FY22, one aspect where MM thinks we can do better is cutting positions when we are wrong, or potentially wrong in a more ruthless fashion. On the 24th of February this year we added G8 Education (GEM) to the Income Portfolio with a 3% weighting at $1.29. We are now down 20% on the position questioning whether or not we should hold or fold. Multiple things feed into our thinking here, which is relevant for MM positions/portfolios right across the board.

- Has the reason we bought the stock in the first place changed?

- Has our market view changed?

- How is the broader portfolio positioned?

- What is the next catalyst for the stock i.e. when will we get more information to test our thesis?

- How much confidence do we have in the position & does the risk/reward stack up?

- Is there a better place for our funds?

We originally bought GEM as an undervalued turnaround play and this view has not changed. Our market view has evolved and we are now more neutral on stocks following an ~11% bounce, however, GEM is a low beta position, meaning it has a low correlation to the broader market. The Income Portfolio is positioned fairly conservatively at present, with 33% in fixed income, 61% in stocks & 6% in cash, while our 3% weighting to GEM is small. The next catalyst is on the 24th of August when they report 1H22 earnings (they are a December year-end) and expectations are low (earnings before interest and tax – EBIT – of $76.5m) however, they do ramp up in FY23 with the market expecting strong earnings growth to resume then, which means guidance will be important. The dividend will likely be 3c fully franked for the half and there is strong growth tipped for outer years, i.e. it is a dividend growth story.