Income Portfolio Alert – Macquarie Group Hybrid

Today Macquarie Group announced a new hybrid issue to raise around $500m, however they’re likely to do a little more – we’d assume something around the $600m mark. This is not a roll of an existing security unlike the recent NAB offer, however at around $600m it is a smaller deal.

The Market Matters Income portfolio intends to bid into the deal with a 5% weighting.

Key points

1. The rate will be set through the book build process with a range of 4.15% - 4.35% over the 90 day bank bill rate ( ~1.90%) – however it will likely land at the lower end, assume 4.15%. This implies a rate of 6.05%.

2. This is a typical tier 1 capital note, the same structure as the recent NAB deal however with two slight variances.

a) Macquarie has a lower franking component so the note has a higher cash element, which is good. Notes are franked at 45%.

b) Macquarie list 3 call dates instead of two. First call is 7.5 years, 2nd call is 8.5 years and 3rd is 9.5 years – which is typical of a Macquarie Note – in short, this gives them more headroom if they need it however, we’ve only ever seen them call on the first date (however never say never)

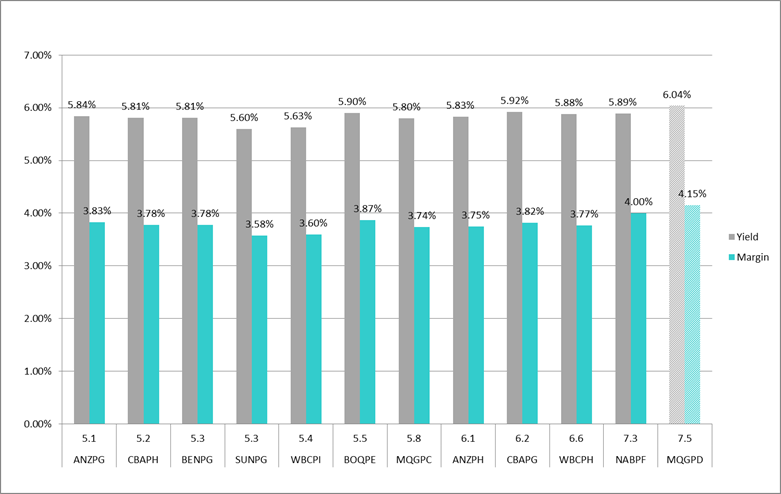

3. The rate of 4.15% over is reasonable, although I don’t think they’re paying ‘overs’ in this instance. NAB at 4.00% v MQG at 4.15% highlights that NAB was a very good deal.

4. The last security issued by Macquarie into the market was done at a 4.00% margin, and that was the MQGPC. It now has 5.8 years till first call date and is trading at a margin of ~3.71% and a current capital price of $102.05

Ultimately, the new MQG note looks fair around current levels, and as per the recent NAB note, expect demand to be strong.

The below table looks at comparable longer dated issues

Key Dates

Broker Book Build; will likely close this week. If Subscribers would like to bid through my desk at Shaw and Partners, please email ([email protected]) or call (02) 92381561 to register interest. You would need to set up an account at Shaw prior to settlement.

Security holder offer; MQG shareholders can bid through the security holder offer, however there is likely to be a large scale back

Commencement of trading; 28th March 2019

Investors can access the Prospectus here.

Key Risks

Investments in MCN4 are an investment in MGL and may be affected by the ongoing performance, financial position and solvency of MGL and the Macquarie Group. MCN4 are not deposit liabilities and are not protected accounts for the purposes of the depositor protection provisions in Division 2 of Part II of the Banking Act or of the Financial Claims Scheme established under Division 2 AA of Part II of under the Banking Act. MCN4 are not guaranteed by any government, government agency or compensation scheme of Australia or by any other person or any other jurisdiction.

If an investor is unsure about whether to apply for MCN4, you should ensure that they have the opportunity to access professional guidance from a financial adviser or other professional adviser about the Offer.

ASIC has published guidance on hybrid securities on their MoneySmart website which may be relevant to your consideration of Macquarie Group Capital Notes 4. You can find this guidance by searching ‘hybrid securities’ at www.moneysmart.gov.au. The guidance includes a series of questions you may wish to consider, and a short quiz you can complete to check your understanding of how hybrids work, their features and risks.

Conclusion (s)

We plan to add the new MQG hybrid to the MM Income Portfolio with a 5% weighting

Have a great day!

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.