Its “Overseas Wednesday” time again (APT, BABA, TCS IN, 2318 HK, HSBA LN, WMT US, SAN FP)

Yesterday the ASX200 endured a relatively weak session but aggressive late buying reduced the losses to under 1% - the weakness was fairly broad based with only ~30% of the market managing to close in the green. When the “big 4” banks and the large cap miners fall around 1% it becomes nigh on impossible for our market to get off the canvas.

The volatility on the stock level as reporting season comes to a close remains relatively elevated with 11 stocks in the ASX200 moving by over 5%. What caught our attention was the return to grace of some the previously smacked financials led by Platinum Asset Management which rallied almost 6% although it remains down 23% for the year plus the humbling of Afterpay (APT) which fell over 11% following the release of its FY19 results – more on that later.

MM remains in a patient “buy mode” with relatively elevated cash levels.

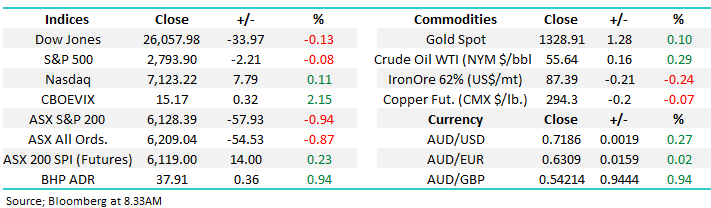

Overnight US markets were mixed and the SPI is calling our market to open up around 20-points, regaining half of yesterday’s losses.

Today we are again going to look at 3 of the best and worst stocks on global markets during the last week.

ASX200 March SPI Futures Chart

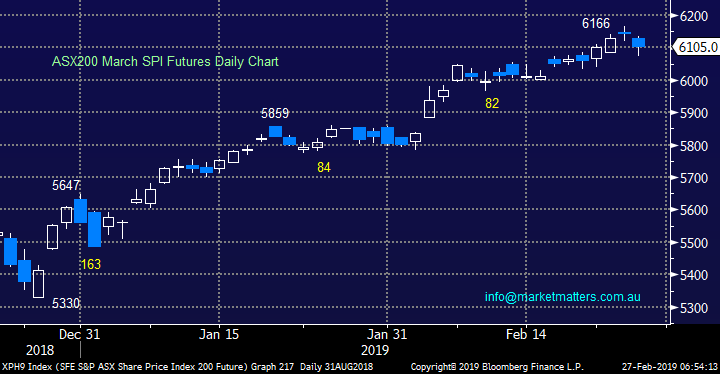

Firstly a quick look at in vogue Afterpay which fell over 11% following the release of its FY19 results, it felt like the transient money was long the “buy now pay later” stock leading to a quick dash for the exit. Looking intra-day there was an initial gap lower on open which is understandable given the numbers before the traders once again bought the weakness and the stock rallied from the lows. That’s been the customary trend in this (and other ‘go too’ stocks) in recent times, however we then saw sustained selling hit and the stock grinded lower throughout the day – this implies to us that further weakness is likely.

It’s hard to fault growth in the business with active customers rising almost 120% to 3.1 million and active merchants up over 100% to 23,200. Profitability is secondary at the moment however expenditure continued to track higher as APT accelerates its push into the US, and is also soon to launch in the UK.

MM likes APT as an aggressive play ~$16 (over 10% lower) with stops below $14.50 i.e. around 10% risk.

Afterpay Touch (ASX: APT) Chart

Another quick look at our pet market of 2019, the “Aussie Dollar”. The $A is now very close to regaining all of its losses following the RBA’s switch to a more dovish stance 3-weeks ago i.e. the market now believes the next interest rate move in Australia is more likely a cut than the previously anticipated increase.

MM remains bullish the $A calling the next 10% up as opposed to the consensus which still appears to be down.

Hence please excuse the repetition but MM remains wary of the crowded trade of if in doubt buy “$US earners”.

Australian Dollar Chart

Overseas indices

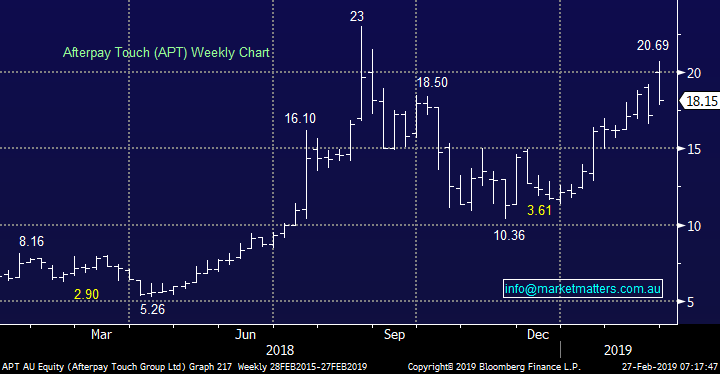

No change with US markets, we still believe they have a strong risk to the downside with our target ~5-6% lower. Overnight the Russell 2000 which usually leads the US market fell -0.7% making it the weakest index – not a bullish sign.

US Russell 2000 Chart

No change with European indices who have reached major resistance and our target area following their 13% bounce, we are now neutral to bearish from a simple risk / reward basis.

This reaffirms our believe that patience is likely to be rewarded with buying of the market in general – clearly not necessarily on a stock by stock basis.

Euro Stoxx 50 Chart

3 of the best performing global stocks.

This week has seen more 2-way price action by global equities with only 5 stocks in the top 100 rallying by over 5% while the 3 largest falls were only between 2.6% and 3.6%, clearly a net bullish bias but in quieter week.

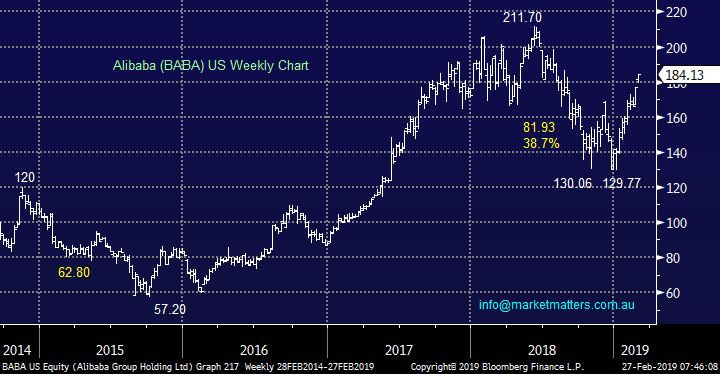

1 Alibaba (BABA) $184.13

The e-commerce giant has been a stock on our radar over recent months, over the last 5-days it has rallied over 8% adding to the 23% gain in January. The stock is perfectly positioned for the improving US & China trade relations – the Chinese Shanghai Composite has bounced almost 15% over the last 3-weeks.

We continue to like BABA seeing ~20% upside while stops can be ran below $US160 providing ok risk / reward.

We are bullish BABA targeting the $US220 area.

Alibaba (BABA US) Chart

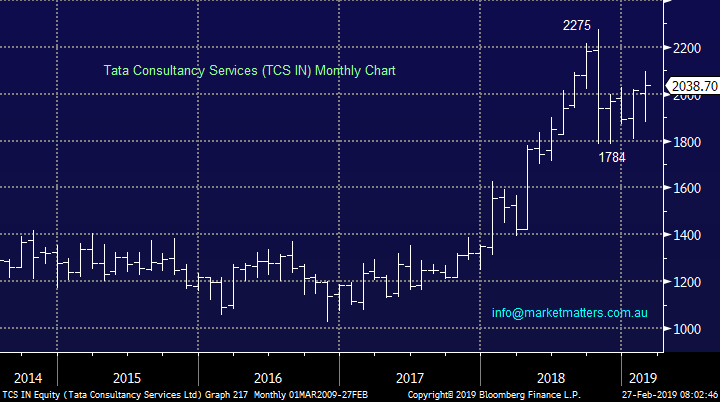

2 Tata Consultancy Services (TCS IN) INR2038.70

The Indian global IT business has grown to one of the largest companies in the world yet I would guess that 70% of our subscribers have not heard of it – Australia tends to focus far more on the US and Europe as opposed to our Asian neighbours. The business employs well over 400,000 people to give an idea to this Mumbai based companies footprint.

The stock fell hard last October after releasing their September quarter numbers, the stock has regained about half of these losses, including 7% over the last 5-days. However overall we don’t feel it hast been a particularly convincing performance.

MM is neutral TCS.

Tata Consultancy Services (TCS IN) Chart

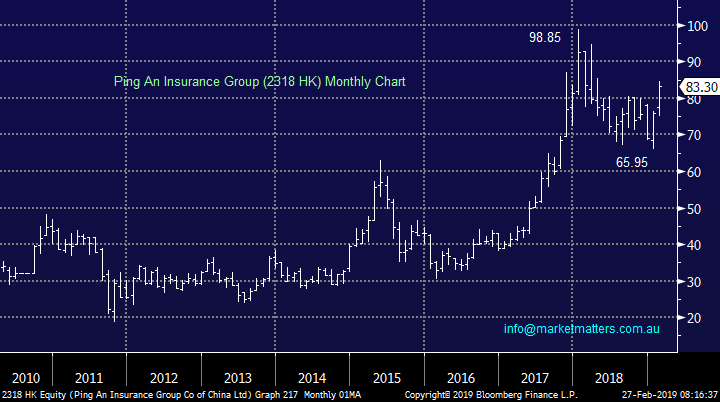

3 Ping An Insurance Group (2318 HK) HK83.30

This financial services business listed in Hong Kong has rallied strongly over recent weeks, like Alibaba, following the Chinese Index higher i.e. Over 6% in the last 5-days. Ping An is actually the largest Chinese insurer and the most popular mainland company in 2018 for overseas investors – unfortunately looks like most of them are still losing.

Interestingly Ping An is aiming to eventually get 50% of its earnings from technology & development, the companies market cap has rallied over $100bn since 2017 due primarily to investments in on-line services.

MM likes the technical risk / reward in buying Ping An here with stops below 80, under 5%, although the general pattern is not yet as compelling. However if the stock starts to get revalued more like an IT business than an insurance company it could rally very fast.

MM is neutral / bullish Ping An.

Ping An Insurance Group (2318 HK) Chart

3 of the worst performing stocks.

The losers were happily not a particularly large or damaged group this week.

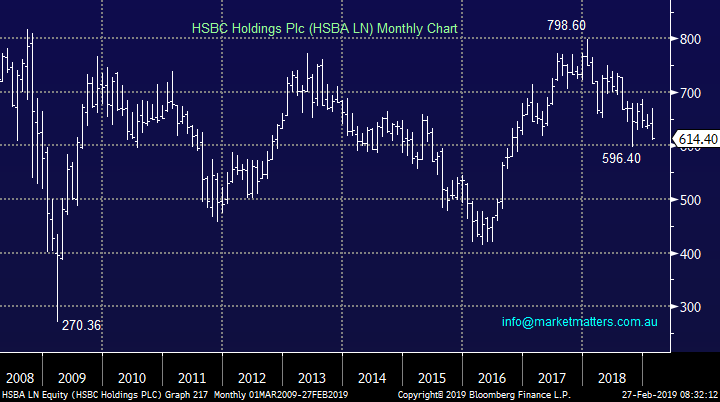

1 HSBC Holdings (HSBA LN) GBP614.40

HSBC was looking solid last time we looked at the sector but alas its failed to keep pace with its global peer group and fresh multi-month lows are very close to hand.

The international banking and financial group continues to struggle and we prefer our “Big 4” at current prices.

MM is now neutral HSBC Holdings.

HSBC Holdings (HSBA LN) Chart

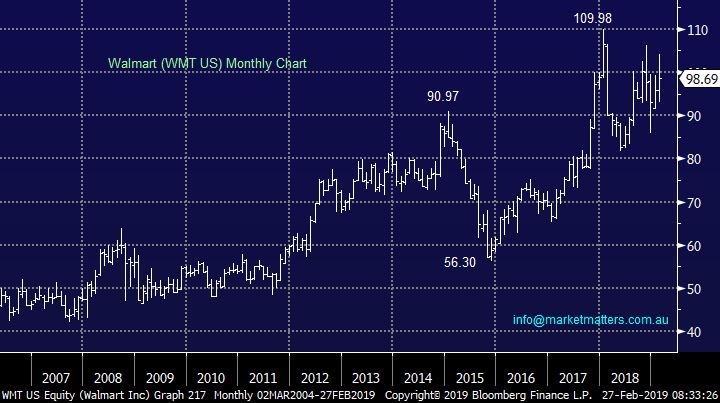

2 Walmart (WMT US) $US98.69

US icon Walmart continues to struggle since its strong advance in 2017. The discount store which sells almost everything simply smashed earnings estimates this month but the stock has failed to hold the gains, even in a strong market.

Their e-commerce growth remains strong and was up well over 40% for the quarter and sales outlook was maintained for 2020 but it appears that Decembers poor numbers have not been forgotten.

MM is neutral Walmart.

Walmart (WMT US) Chart

3 Sanofi (SAN FP) Eur72.74

French Pharmaceutical company Sanofi has struggled for well over 3-years and we see no reason to fight this entrenched trend, our “Gut Feel” is actually negative looking for fresh multi-year lows.

MM is neutral / negative Sanofi.

Sanofi (SAN FP) Chart

Conclusion

Of the 6 stocks looked at today Alibaba is our clear standout favourite with Ping An Insurance Group an interesting second

Overnight Market Matters Wrap

· The US equities closed mixed overnight, with the majors losing most of its session gains in the last hour as investors digest the first day of testimony by US Fed Chairman, Powell.

· Powell said that the economic outlook is positive with no inflation concerns. However, there were some conflicting signals that warrant a patient approach with regards to any policy changes.

· US consumer confidence broke a three month losing streak in February, while December housing starts, which were delayed by the government shutdown, fell to the lowest level since September 2016.

· BHP is expected to trace back most of yesterday’s losses after ending its US session up an equivalent of 0.94% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 19 points higher towards the 6150 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.