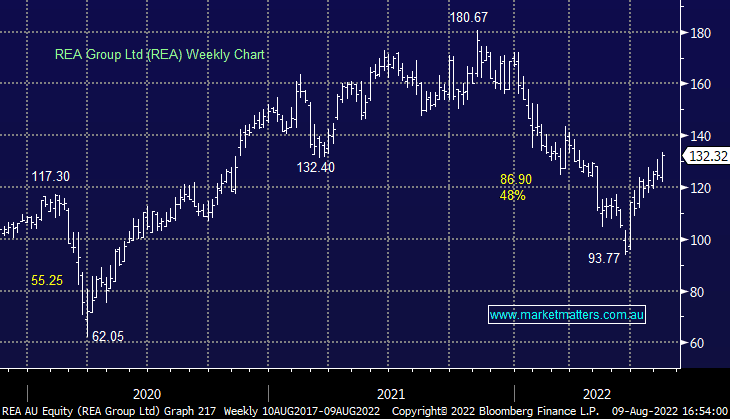

REA +6.69%: the property classifieds business announced their FY22 results today largely in line with expectations, with poor international performance offset by more bullish commentary. Revenue was $1.16b for the year, while Core EBITDA at $673.5m was a ~2% miss to consensus at $685m. Operating expenditure was up 11%, driven by wage inflation, new product development and marketing, though the market took a positive view that it will lead to more revenue. Guidance suggests these cost pressures should normalize in FY23. They have their work cut out for them, looking to integrate the recent acquisition of Mortgage Choice as well as putting the required investment into building their Indian business to be a market leader in that geography. Australian residential volumes have remained resilient into FY23 with volumes up 7% in July despite the broad negativity in the Aussie market. All in all a strong result and shareholders will receive an 89c div, up from 72c last year.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

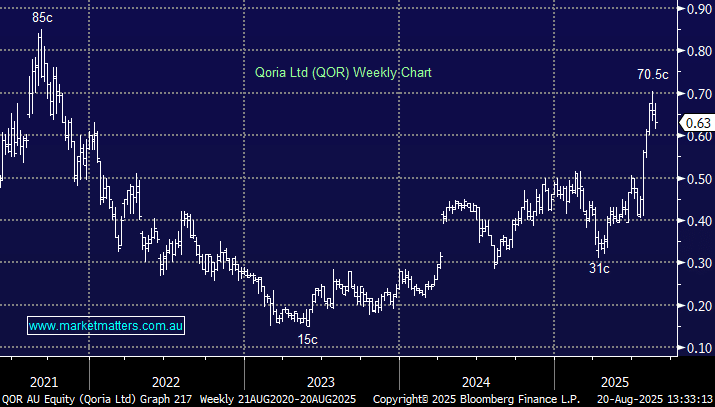

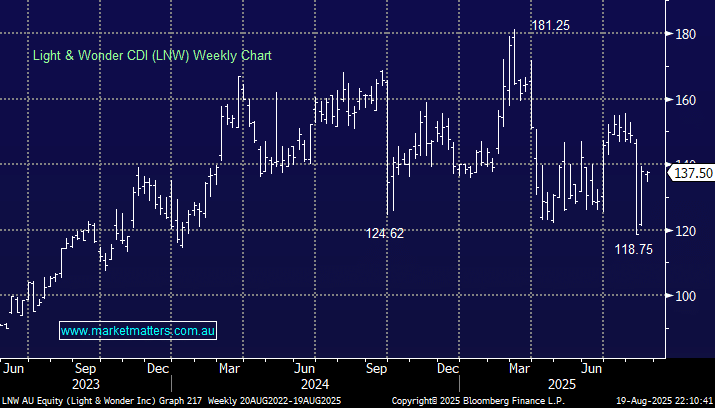

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

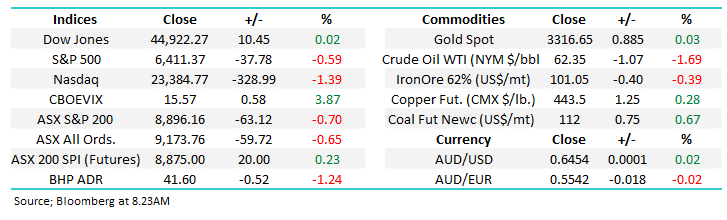

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Close

Close

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Close

Close

MM is now neutral REA around $130

Add To Hit List

Related Q&A

Thoughts on REA, CAR, & WES please

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

What’s MM’s favourite 5 stocks for short term bull run?

Technical analysis of global indices please

Short term price targets for various stocks

Questions on CSL, REA & FMG

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.