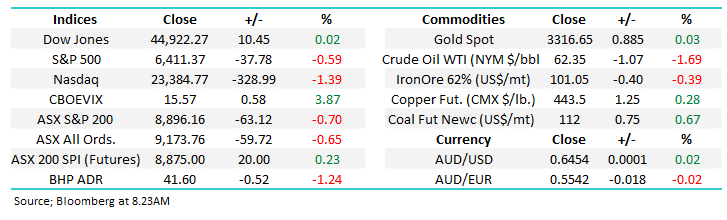

PayPal (PYPL US) rallied +9% overnight after delivering a good result and importantly, guidance for the year ahead, plus they announced $US900mn in savings from cost-cutting, a huge $US15bn share buy-back and news that activist investor Elliot had taken a $2bn stake in the company with plans afoot to turn around the payments provider. The valuations across the new age payments sector have been crunched since 2021 i.e. PYPL was trading at a discount of ~40% to pre-COVID multiples before last night’s move.

- Traditional payment businesses Mastercard and Visa have enjoyed strong results and held up well, interestingly these stocks are actually trading in line or at a slight premium to their pre-COVID average.

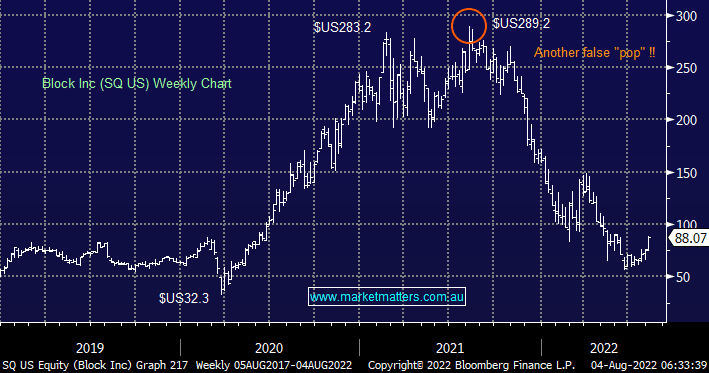

However Block Inc (SQ US) which bought Afterpay is at a whopping discount of ~80% to its pre-COVID multiples, the companies due to report tonight after the close (USA time) and if it’s “ok” we could see a huge “short squeeze”. The valuation has become very cheap for this market leader in SME terminals, business lending, & BNPL – we believe the risk/reward now favours aggressive buyers in Block Inc (SQ US) before its result tonight which by definition will flow down to Block Inc CDI (SQ2) in Australia tomorrow.