Subscribers questions (A2M, BAL, BUB, MIN, ALF, BKL, ORG, SEK, CGC, NCM, CAJ, URF, NGI, SHL, CQE)

Major market news was relatively thin on the ground over the weekend with a few more negative comments around the local property market and a slow increase in political commentary ahead of Mays election being about all that most papers found to write about.

This week we will see the release of Australia’s 4th quarter GDP with the distinct risk of a “per capita” recession, in other words population growth is masking some underlying frailties with our economy. To me the strength of the Australian economy comes back to household debt levels ,the lack of wage growth means the average person on the street will be tightening their belts for a few years and while 1 or 2 rate cuts will help it feels unlikely to be meaningful.

MM remains in “ buy mode” with our elevated cash levels but we are currently not planning to chase strength – we are close to adopting a more neutral stance.

Thanks as always for some excellent questions which notably took us out of our usual comfort zone this week, also with a big number of question please excuse my brevity at times – and apologies if we missed yours.

ASX200 Accumulation Index Chart

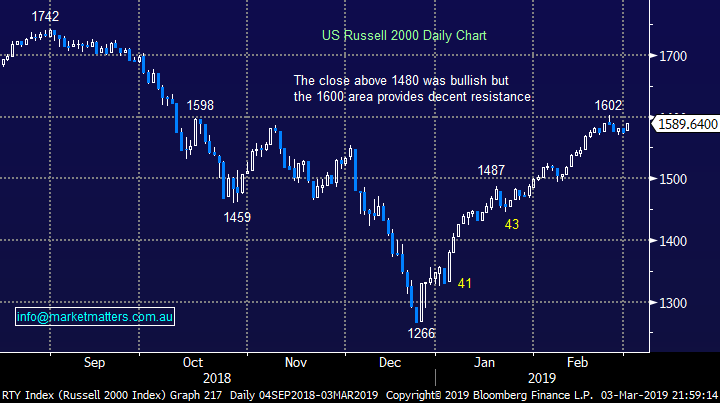

No major change, we believed US stocks will trade higher in the months ahead but a pullback still feels close at hand.

Unlike the ASX200 US stocks chopped around last week, a pop above 1602 by the Russell 2000 would not surprise for a fresh 2019 high but failure to follow through looks a strong possibility.

US Russell 2000 Chart

Question 1

“Hi MM I hold A2 Milk and Bellamy's - as you reported on Friday "Bellamy’s which was smashed after its results added 10% thanks to the Chinese Caixin PMI data and some not-so bad analyst revisions" While last week A2M rallied 10% after its results beating expectations on earnings and guidance plus executing on their Asian growth ambitions. I would like your opinion on price targets for these stocks. Would you be holding or selling? Also is there any interest in rival Bubs Australia? Thanks Debbie G.

Hi Debbie,

1 – A2 Milk (ASX: A2M) – A2 Milk looks great as it continues to deliver with its half year results showing a 55% increase in Net Profit After Tax (NPAT) to over NZD150m. However I do feel the recent growth will be hard to mirror in the years ahead. Short term $14-$15 feels likely but with a current Est. P/E of almost 37x we are not considering at current levels.

2 – Bellamy’s (ASX: BAL) – Bellamy’s has experienced a much rockier few years than A2 Milk and at MM we now regard it as a more trading style stock. After posting a 26% drop in revenue for the 6-months to December 31st the stocks bounced reasonably hard implying the bad news was already built into the price. Fans of the stock could buy with stops below $8.10, or ~8% risk.

3 – Bubs Australia (ASX: BUB) – A simple one here, we are not currently fans of Bubs Australia – volume too hard for us.

A2 Milk (ASX: A2M) Chart

Bellamy’s (ASX: BAL) Chart

Bubs Australia (ASX: BUB) Chart

Question 2

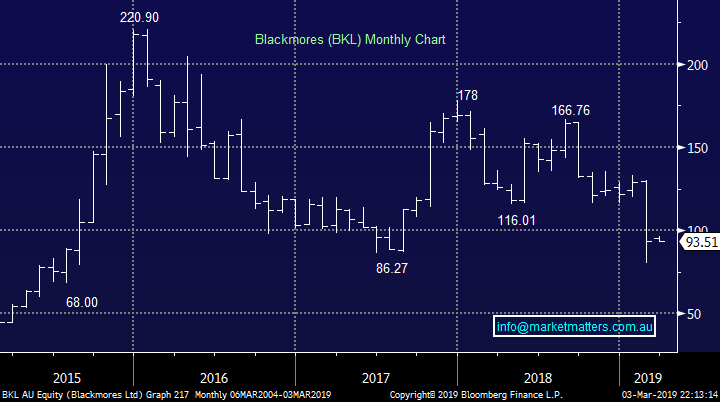

“G,day James, could you please give me your thoughts on these couple. ( MIN ) I could break even at current price or can you see this going upwards? Also (ALF) I'm down about 10% on this one, what are your thoughts here do you think it may come back. I've been looking into ( BKL ) as a long tern hold, do you think it's worth a look at current price.” - Cheers, Pete G.

Hi Pete,

1 - Mineral Resources (ASX: MIN) – This lithium / Iron Ore miner has been as volatile as its sector compatriots Orocobre (ASX: ORE) and Galaxy (ASX: GXY) without taking on the benefit of the resurgent Iron Ore price. At this point in time we are neutral the sector finding it hard to identify decent risk / reward within such a volatile group of stocks.

2 – Australian Leaders (ASX: ALF) – They should report NTA numbers in the next 10 days – the last figure showed NTA of $1.16 plus directors are buying stock which is a small plus. The issue here is that they continue to trade at a discount to their assets and their performance is not good enough to see that gap close. They’re a long/short market neutral approach and in a rising market this is not exciting., It’s a sell however closer to NTA if possible.

3 – Blackmores (ASX: BKL) – We are not fans of the stock and are unlikely to be buyers in 2019.

Mineral Resources (ASX: MIN) Chart

Australian Leaders (ASX: ALF) Chart

Blackmores (ASX: BKL) Chart

Question 3

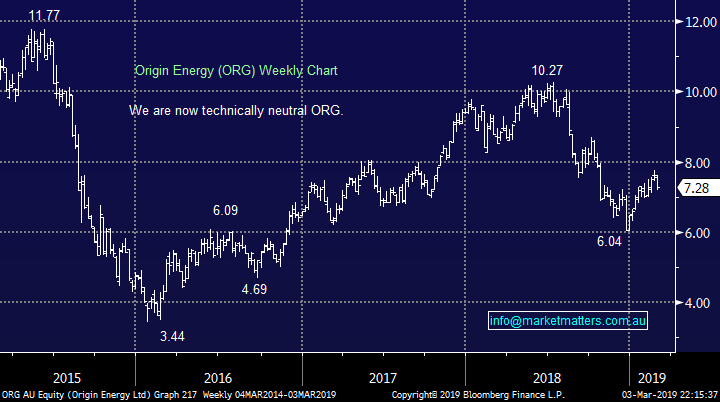

“Hi James, Could I get your opinion about the advisability of holding ORG in the medium term ? As a result of its interest in Australia Pacific LNG, ORG should make good future profits and continue to reduce its debt. However, given the adverse political and consumer pressure in relation to its electricity interests, I am becoming increasingly concerned about possible share price erosion over the medium term. Given this uncertainty, would you be a seller at current prices?” – John K.

Hi John,

We are pretty neutral ORG at present although the business is now back in the black and once again paying a dividend – the last time was 2013! LNG remains fairly tough and after a bounce from ~$6 to ~$8 it seems to me the easy money has been made.

The underlying market trend of decreasing power bills, stronger competition and solar alternatives is not exciting for ORG’s retail division. Hence we have no interest in ORG at present.

Origin Energy (ASX: ORG) Chart

Question 4

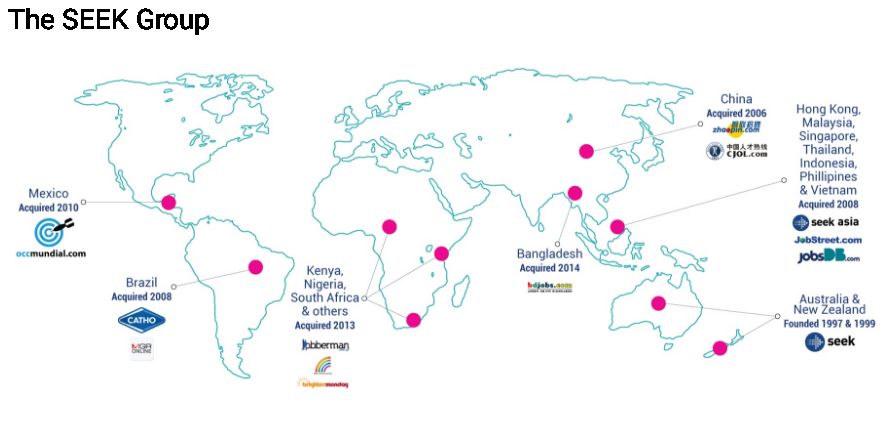

“Hi James and Co, quick question on what your thoughts are on SEEK. I believe it is embedded into Australia but not to sure how its expansion overseas is going.” – Thanks Greg C.

Hi Greg,

Seek delivered some strong numbers for the 6-months to December with total sales revenue up over 20% to $757m but the real growth upside in the stock will come from its Chinese exposure to Zhaopin which encouragingly increased revenue by almost 40% to $319m.

Here’s a quick overview of its international footprint. All businesses are small relative to Australia, and other markets do have more competition / incumbents making it harder, however they are recycling earnings generated in Australia and investing those internationally for growth, which to me is a sensible strategy – it will just take time, money and perseverance – and some of them won’t work.

The stock’s not cheap trading on an Est P/E for 2019 of 32x but it is growing, however we are concerned by the stocks performance since its high in 2018 – technically its actually neutral to bearish.

We took a small profit from our last foray into SEK last July and at this stage are not considering re-entering the on-line Jobs business.

Seek Ltd (ASX: SEK) Chart

Question 5

“Very disappointed and more than a little upset about in call on CGC. You will recall that I wrote to you in the recent past giving reasons why I thought the CGC fall was overdone at around $5. Your response was distinctly negative ( I guess you have my message and your response on file) And now you want to enter the stock at around 10% higher. I very much fail to see your logic and why with a relatively stable company like this you would change your mind so quickly. This is not stock selection, it is almost in the realm of guessing. Maybe you would like to think about assigning a degree of conviction in your calls.” - Thank you Peter H.

“You guys are all over the place. I sold this stock last week at $4.80 after you said you were looking at $4.00. Now you are buying at $5.45.” – Neil W.

Hi Guys,

I’m sorry you feel that way however I elected to wait until they reported earnings last week. Waiting for the company to report, digesting that report and then making a call on the stock in my mind seems sensible. The $4.00 area looked a strong chance technically prior to the update and subsequent strong buying. As I’m sure you know we have to remain flexible and open-minded when investing and especially around reporting season. Buying structurally sound companies into cyclical weakness can yield good results.

We have only allocated 2% into the stock just below $5.50 and we plan to average down towards the $4 area if the stock again comes back under renewed selling pressure.

I also covered the stock / sector in the weekend report – click here

Costa Group (CGC) Chart

Question 6

“Hi, I read your brief re the NAB hybrid. I have just received an email on Macquarie Capital Notes 4, 45% franked and margin 4.1%-4.35%. In the event of a change of government, I think the Macquarie notes would be preferred. Can I get your opinion.” -Thanks, Noel G.

Hi Noel,

We covered in the Income Report last week – click here – in short, it looks attractive and we’re adding it to the Income Portfolio

Question 7

“HI MM Team, I would like your Technical and Fundamental opinion on Newcrest and Sonic Healthcare” – Thanks Tim C.

Hi Tim,

1 – Newcrest (ASX: NCM) – we are watching the gold space closely with a view to taking some exposure later in the year. On Friday night US Gold ETF’s fell by over 2% implying weakness locally today but our initial entry potential for Newcrest is ~5% lower. Fundamentally we like the direction the business is moving in and this is reflected by its strong performance on both the stock level when compared to the market and index. Any sign of inflation on the global stage and the sector may get very excited.

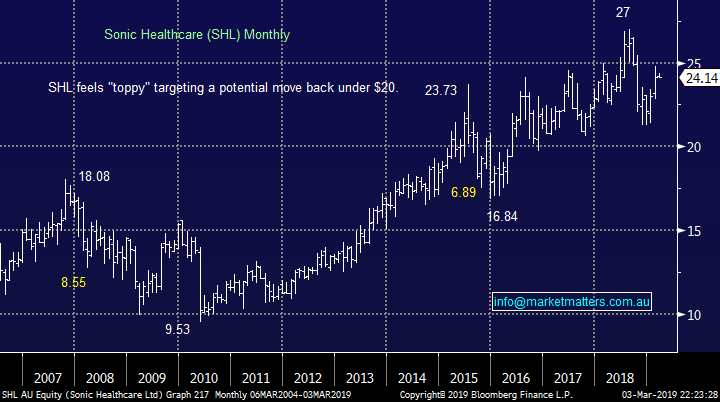

2 – Sonic Healthcare (ASX: SHL) – the stock rallied last month following the release of good half year results showing growth up marginally to $2.9bn and NPAT up 7%. The medical diagnostics business is trading on a fair valuation after its pullback from its 2018 highs. We are neutral ASX: SHL at current levels.

Newcrest Mining (ASX: NCM) Chart

Sonic Healthcare (ASX: SHL) Chart

Question 8

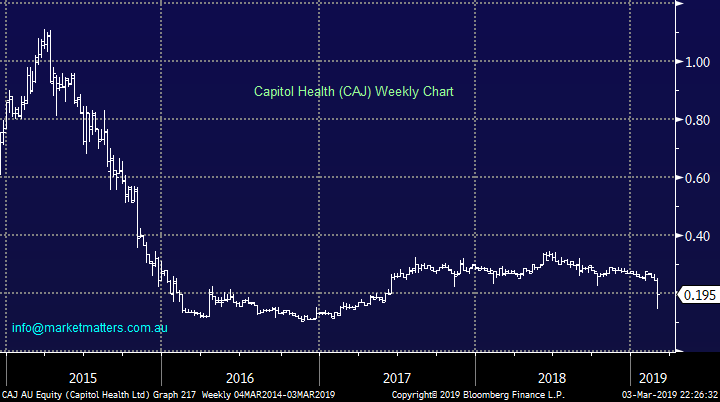

“Hi James Could you please explain what is happening at Capital Health (CAJ)? The result released yesterday seemed ok, however the stock got savaged. What am I missing? At yesterday’s close (27/2) price is it starting to look attractive to MM?” - Cheers Craig.

Hi Craig,

The diagnostic imaging business has been under the pump for a while with sellers appearing prevalent when rallies do unfold. Shaw’s covers the stock although I have to admit that I’ve never owned it.

Jono – the analyst at Shaw who covers it thinks… During one day CAJ has turned into a dividend stock at a material discount to peers. At today’s valuation CAJ is yielding 6% FF at a discount to unlisted clinics on 6.7x EV/EBITDA FY19 and only 6.1x EV/EBITDA 2H19e annualised. We were disappointed with today but the market has over-reacted and so we re-iterate our Buy recommendation

Technically, its not exciting – happy to send the full research note if that would help Craig

Capitol Health (ASX: CAJ) Chart

Question 9

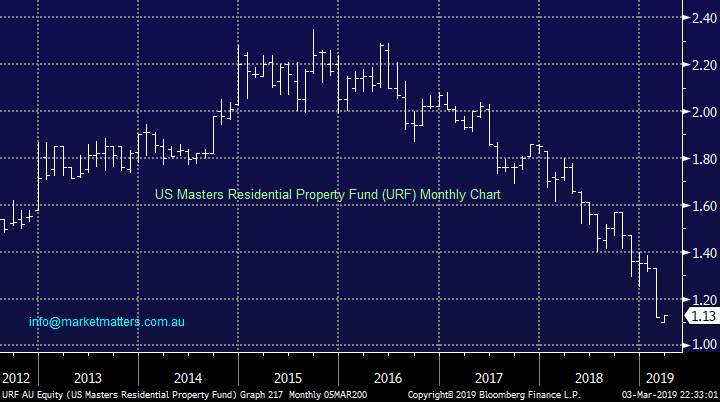

“Hi James I was wondering if you could give me your opinion on URF probably not a share you have followed , I have held these for some time and watched them go from over $2 to now about $1.16 and I am thinking I might have to cut my losses ,do you know anything about URF you can share.” - Cheers Ted R.

Hi Ted,

URF is an Australian listed property trust with exposure top New York metropolitan residential property and unfortunately the have similar issues to ourselves with estimates that their market has slipped up to 20% since its peak in 2015.

We don’t follow NY property closely hence I’m afraid any thoughts here would be guesswork

US Masters Residential Property Fund (ASX: URF) Chart

Question 10

“Guys. What is your technical view on NGI? Stock looks cheap on 8% div yield for a good capital light business. “ – Peter S.

Hi Peter,

This investment management business disappointed the market in January which showed Assets Under Management (AUM) declined for the December 2018 quarter which is turn will lead to a fall in management fee revenue. For those that have followed MM for awhile, you’ll know this was one of the original stocks in the income portfolio when it launched – back then it was called HFA – we took a nice profit in it so it’s one we still keep an eye on.

I agree the stock is relatively cheap but also remember that the likes of Janus (ASX: JHG) and Platinum (PTM) remained cheap for a long time prior to the recent pop higher in prices.

We are neutral at current levels from a technical perspective.

Navigator Global Investments (ASX: NGI) Chart

Question 11

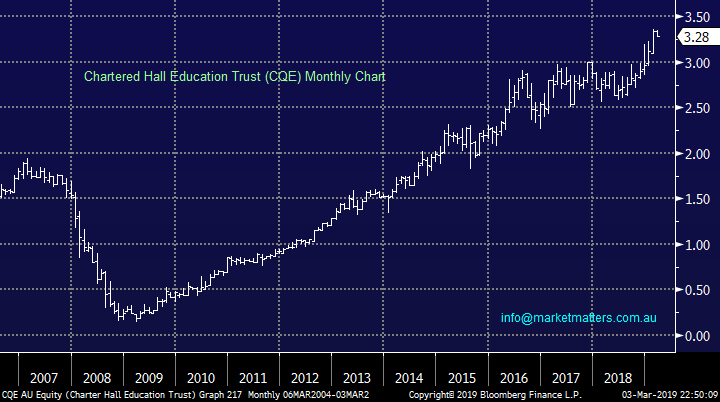

“Hi , this sector have not been discussed previously. Is it possible to discuss Chartered Hall education trust?” - Thanks Kenneth C.

Hi Kenneth,

As we can see below the real estate investment company CQE, which invests in early learning properties, has enjoyed a great run since the GFC and its current 4.7% unfranked yield remains attractive.

We are technically bullish CQE while it can hold above $2.90.

Chartered Hall Education Trust (ASX: CQE) Chart

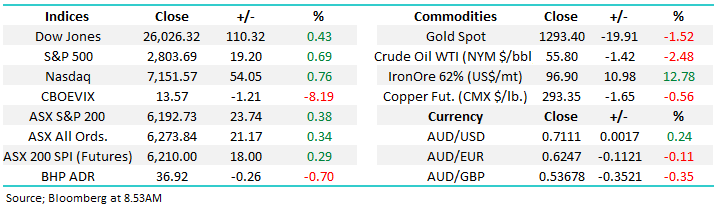

Overnight Market Matters Wrap

· The US equity markets started the first day of March in good form, with all 3 majors ending its session in positive territory after reports that the US and China continued to make solid progress on their trade talks, and that a deal could be signed later this month.

· The Dow closed above 26,000 (+0.43%), the S&P 500 above 2800 (+0.69%) and the Nasdaq 100 above 7150 (+0.76%) - the highest levels since early November - as investors shrugged off weak US manufacturing data and a weaker than expected consumer sentiment index. Tech stocks led the gains, with the Australian tech group Atlassian closing 3% higher at a record closing price of around US$111.

· The Dow and S&P 500 have risen 11.57% and 11.84% year to date respectively, while the tech. heavy Nasdaq 100 is up 12.98% as they fast close in on the October 2018 highs. Despite the progress on trade talks, most commodities were slightly lower, with oil and gold in particular sold off. The gold price dropped around 1.5% back below US$ 1300/oz., on the back of the continuing strength of the US$.

· Iron ore however rose another 3% to just below US$88/tonne. However, BHP is expected to underperform the broader market after ending its US session down an equivalent of -0.70% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 37 points higher towards the 6230 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.