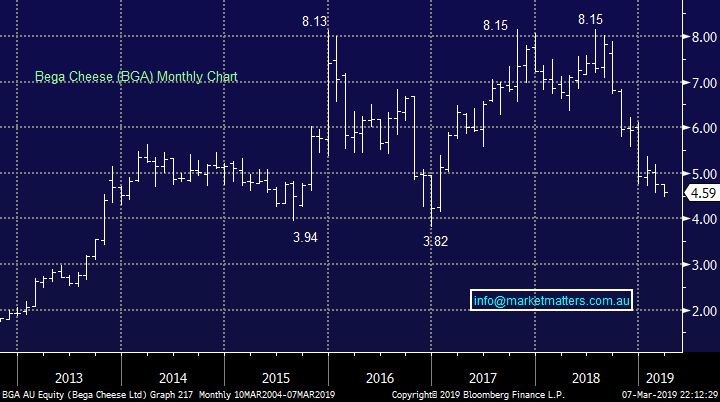

Evaluating the Agricultural Sector as it gains a bid tone (HLS, CGC, GNC, ELD, AAC, BGA, NUF)

Happy International Women’s Day – as a Dad to two strong willed, independent girls with the world at their feet, and a husband to a woman who is showing them the way, I’m incredibly proud.

The ASX200 continued with its impressive rally managing to gain 18-points even after the Dow fell 133-points and BHP, RIO, S32, ASX and QBE to name a few all traded ex-dividend – if March continues in the same rhythm as the last 3-months we could see the local index knocking on the 6500 door before we know it, certainly never say never in this market. Two things I’m hearing almost daily are “where do you think the top is” and “I’m looking to buy the next pullback”, I know we’ve said the later a few times ourselves but until I hear “this markets going to the moon” the surprises may easily continue to be on the upside as stocks climb the wall of worry.

I think the fact that a number of our large stocks are rallying after they trade ex-dividend implies overseas buying I.e. international investors aren’t fussed by the franking credits that so many of us almost obsess over, just read that papers around Bill Shortens plans if Labor win the looming election in May, another event that has kept so many investors on the sidelines and currently to their detriment.

Again yesterday we only saw 31% of the ASX200 close in the red, not the numbers of a top, they are usually formed when the index rises but is dragged up by a reducing number of strong participants. interestingly one of the weakest sectors was the growth orientated “Software & Services sector”, an index that’s relatively strongly correlated to US indices. In yesterday’s report we said “ We would avoid stocks that re highly correlated to the US at this point in time e.g. Macquarie Bank (MQG)”, that sentence should have also included the growth stocks.

MM is now neutral the ASX200 after its +15% rally from late December lows but we are not afraid to buy selective stocks.

Overnight US markets were weaker with the Dow down 200-points, the SPI is pointing to the ASX200 to open down around 30-points with BHP ~1% lower in the US.

Today we are going to look at 5 stocks in the Australian Agricultural sector as we scour the landscape for solid risk / reward opportunities in a soaring and relatively “rich” market.

ASX200 Accumulation Index Chart

During the Australian trading session we saw decent weakness from US futures -0.25% and Asia which closed down ~0.5% on average but we continue to ignore negative influences, whatever happened to the old phrase “when the US sneezes we catch a cold”. There will be a point where traders believe we have become too expensive compared to global indices, including taking the $A into account, but we don’t seem to be there yet.

However when the traders / hedge funds do press that switch button the movements can be large and surprise many, just as we are currently seeing on the upside. The elastic band is stretching but it doesn’t feel taught yet.

My experience tells me we will experience a sharp catch up for a few days at least but don’t be surprised if it occurs when people stop expecting it – a strong overnight session for the $A will put me on high alert, of course if / when it does occur.

ASX200 v US S&P500 Chart

We keep looking at Healius (HLS) but it doesn’t feel right, the takeover offer from Chinese company Jangho is at $3.25 but the stock remains 15% below the bid following the HLS board rejecting it. We question if the Chinese operator will raise there bid, they already own 16% of the business.

Yesterday we heard “(Bloomberg) -- Chinese engineering and construction company Jangho Group Co. plans to raise A$2 billion ($1.4 billion) selling shares to back its bid for Australian health-care services provider Healius Ltd., the Australian Financial Review reported, without saying where it got the information. In January, the Chinese company offered to acquire the stake in Healius that it doesn’t already own for A$3.25 a share in cash. Jangho already holds about 16 percent of the Australian company. However, the proposal was rejected by the Healius board.”

They certainly sound serious and they have coincidentally bid a price not seen since August 2018.

We can see 15-20% upside but a similar degree of downside if they walk away and that’s probably what feels “not quit right”.

Around the $2.60 area the risk / reward will look more attractive.

Healius (HLS) Chart

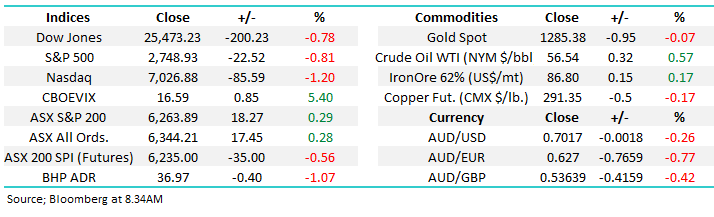

Global Indices

The small cap Russell 2000 which we often use as a leading indicator for US stocks has struggled over recent days and closed over ~5% below its recent high this morning but just as we pointed out earlier its having no effect locally, so far– we actually sense during our daytime investors / fund managers are buying Australia (SPI) and selling the US (S&P500) which implies our recent outperformance may have further to run but not necessarily pre strength.

We would continue to avoid stocks that are highly correlated to the US at this point in time e.g. Macquarie Bank (MQG) & the growth sector.

US Russell 2000 Chart

Similarly European indices are encountering selling from our targeted sell zones, we remain cautious or even bearish the region at this stage.

Increasing our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

The Australian Agricultural Stocks

Following on from the “Catching our eye” section in yesterday afternoons report we felt this morning was an ideal opportunity to re-evaluate the Agricultural sector in more detail, especially following our recent Weekend comments – “M&A activity in the Agricultural sector is heating up. This is typical when highly cyclical stocks decline on the back of shorter term transient factors like weather.”:

1 - Costa Group (CGC) downgraded in January due to weak prices for berries, tomatoes and avocados rather than structural issues – the 40% decline in share price was aggressive, cattle company Australian Agricultural (AAC) has been hit from QLD floods - the share price is more than 40% below the years high

2 - GrainCorp (GNC) received a takeover bid in December when its share price was depressed while Ruralco Holdings (RHL) received one this week from Canadian giant Nutrien and their shares subsequently rallied 45%.

Buying structurally sound companies into cyclical weakness can yield great results with limited downside if the buying is well timed.

1 Costa Group (CGC) $5.42

We are long GGC in the Growth Portfolio after raising our optimum entry level following a decent company report on the 27th of February – we got some stick on that but we must remain flexible and only time will tell if we are correct.

CGC has been on our radar since the start of the year and we now believe our previous entry target of ~$4 was unrealistic, however we would average our position in that area assuming no structural issues had raised their head.

Since the release of their 1H results the stock has been strong - they booked NPAT of $8.5m, which was low relative to this time last year but in line with expectations – they had already warned the market and downgraded in early January and were subsequently whacked from ~$7 to ~$4.50 on what we thought were seasonal factors. Other metrics were on the softer side but importantly, guidance was strong and they expect profit growth of ‘at least’ 30% for CY19, plus they said crop performance and weather conditions have been generally positive in the early part of the year.

We feel our buying is opportunistic just as HLS are accusing Jangho of being.

From a technical perspective a clear break above $6 would target our +$7 target area i.e. ~20% higher.

Costa Group (CGC) Chart

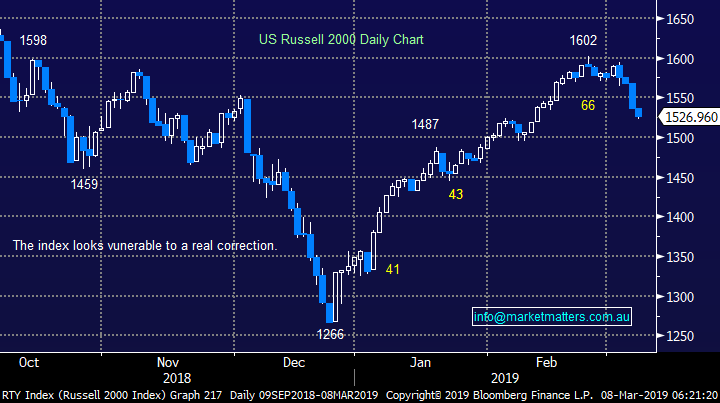

2 Elders (ELD) $6.49

Elders is almost a household name in Australia operating rural services businesses that encompass most of the farming community. Even after a recent bounce Elders (ELD) is well over 30% below its 2018 high, a relatively similar look to CGC. ELD actually fell over 10% in January alone illustrating the risks with “picking bottoms” too early.

Recently ELD has been struggling since they released their full year results in November casting doubts over the boards revenue growth target of 5-10%. However the business is currently only trading on Est P/E for 2019 of 11.1x certainly putting it on the cheap side of the ledger. At its last AGM they did suggest some parts of the of the drought stricken communities were improving slowly.

Also, we should also remember that ELD have a property division that sells in excess of $5bn worth of properties per year, I think we can assume a few tough years for this part of the business.

We like ELD into this drought inspired weakness but the current risk / reward after the recent +12% bounce is not compelling. Watch this space.

Elders Ltd (ELD) Chart

3 Australian Agricultural Company (AAC) $1

AAC is an integrated cattle and beef producer which runs the countries largest head of wagyu cattle – its all the rage in Sydney but obviously not enough impact on the companies bottom line in tough drought & flooding times. Ironically it’s now the Queensland floods that have hammered the companies share price to levels not seen since 2003, it’s a tough business when the weather has such a huge impact on profitability and one clearly only worth buying at the correct price.

Following the damage to its QLD livestock and infrastructure the company is undoubtedly going through touch economic and importantly social times, to put things in perspective this was a once in a century flood – don’t underestimate our farmers, they are a very tough breed who will fight back!

Importantly last month the company said ““The current operating conditions are not expected to affect the company’s ability to fulfil supply obligations or the rollout of its branded beef strategy, which continues to be a key focus. While we are still assessing the impact of this tragic situation, our balance sheet and financial position remains strong.” Definitely encouraging words in tough times. I have to be conscious of not voting with my heart on this one as I deeply feel for our farmers:

MM likes the risk reward of accumulating AAC between 80 and 88c i.e. no hurry yet.

Unfortunately AAC has prohibitive volume issues for MM only turning over $1m yesterday, we certainly need to be buying a wall of selling with this one and any position will be small

Australian Agricultural Company (AAC) Chart

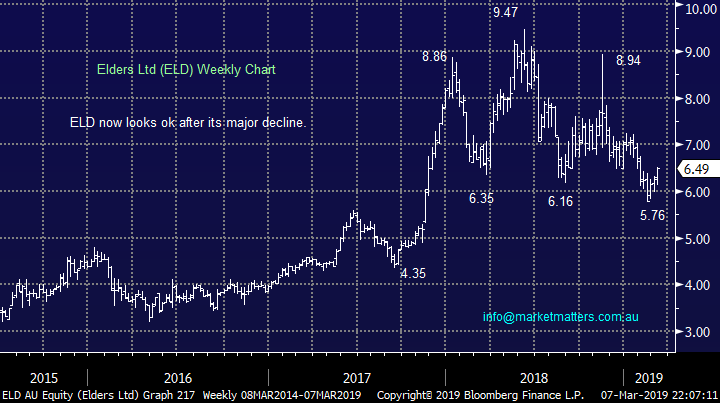

4 Bega Cheese (BGA) $4.59

Will Bega Cheese (BGA) follow in the footsteps of Warrnambool Cheese (WCB) and become a takeover target? The share price definitely doesn’t think so as its drifted lower consistently from its 2017 highs.

This is another stock that has been hit hard since they released their half year results but the downside momentum looks to be slowly diminishing i.e. the selling may be exhausting itself. The results released late last month showed revenue up 6% to almost $650m but profit metrics were lower, the company retained its EBITDA guidance ~$130m, a healthy increase on last years $110m if it can be achieved.

However the stock is far from cheap trading on an Est P/E of 44x for 2019 while it yields 2.4% fully franked.

A bounce in BGA looks close at hand but its not an investment that excites us at this stage.

Bega Cheese (BGA) Chart

5 Nufarm (NUF) $5.39

We have discussed Nufarm (NUF) a few times recently including some much appreciated 2-way questions in our Monday Question Report. When the farmers struggle so does NUF who supply their agricultural chemicals.

The stock recently bounced to $5.65 following an upgrade by Deutsche Bank on valuation grounds after the stock recently traded down to 4-year lows. The company which distributes crop protection products has understandably been under weather related pressure, but has found at least one friend in DB which gave the stock a price target of $6. DB said the company was trading on a 23% discount to its long term EV/EBITDA multiple, and a 20% discount to the average PE whilst seeing upside in its canola seed technology.

However most of the DB inspired gains have quickly evaporated even in a rising market, not a good sign. The stocks currently trading on a Est P/E for 20119 of 13.6x which is not exciting for the bargain hunters.

We are watching NUF closely with our ideal technical and valuation risk / reward entry level still ~$4.75.

Nufarm (NUF) Chart

Conclusion

We like the agricultural space into 2019 / 2020 but at this stage we are still targeting lower levels before pressing any further buy buttons following our foray into CGC.

Overnight Market Matters Wrap

· Both the US and European markets sold off after the European Central Bank slashed its forecasts for growth in Europe this year from 1.7% to 1.1% and announced further stimulatory measures, while one of the US Federal Reserve Governors also warned of signs of slowing US growth resulting from global growth weakness.

· BHP is expected to underperform the broader market after ending its US session off an equivalent of -1.07% from Australia’s previous close below the $37.00 level.

· The March SPI Futures is indicating the ASX 200 to open 28 points lower towards the 6235 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.