Looking for clues from the “insiders” (directors) activity (RHC, ORA, CCP, IAG, BVS, BIN, ELD)

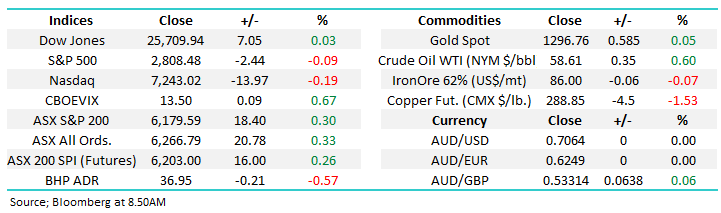

The ASX200 recovered yesterday from morning weakness to close up 18-points / 0.3% taking the recovery from Wednesdays low to ~1%, still not very encouraging if we consider the local market is down -1.6% over the last 6 trading days while the US S&P500 is up +2% over the same period. Under the hood we saw the Energy & Information Technology Sectors lead the gains but overall the last few days pullback feels corrective as buyers continue to surface into weakness.

This week has been a great example of how fickle markets can be in terms of the news / factors which influence them i.e. back in mid-2016 the shock BREXIT vote sent a tsunami of worry through financial markets with the VIX (volatility index) doubling as equities were smacked, especially those European facing, and the British Pound fell over 10% as the outcome of the infamous vote became clear. Yet here we are this week watching a shambles of an attempt to settle a BREXIT deal by the March cut of date evaporate before our eyes and markets are complacently telling us “she’ll be right” – time will tell on this particular issue but were waiting for the next elephant in the room with both the US – China trade deal and interest rates rallying too fast appear to be in the rear view mirror.

MM remains neutral the ASX200 after its strong rally from late December lows and we are not afraid to buy selective stocks.

Overnight US markets were choppy closing basically unchanged but the SPI futures are strong closing up 16-points, even with BHP trading down 20c, implying another test of the psychological 6200 area.

Today we are going to look at a 5 stocks where recent insider selling has recently caught our eye and is at least worth considering.

ASX200 March SPI Futures Chart

MM is currently long Bingo Industries (BIN) from $1.21 but a weekly close around $1.62, or better, will reinforce our bullish view – we are likely to increase our holding – watch for alerts.

The waste management and recycling business remains ~50% below its highs from 2018 but following last months approval of its acquisition of Dial A Dump by the ACCC we believe the companies well positioned to generate strong growth of the years ahead.

MM remains bullish BIN targeting over $2.

Bingo Industries (BIN) Chart

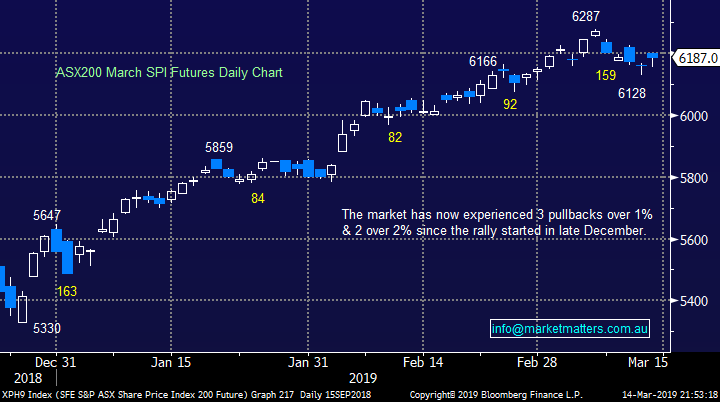

We have discussed potential opportunities in Elders during most of 2019 as the Australian rural sector endures some really tough times which has underpinned some corporate activity in recent times, and we expect more to come. However their shares remain well over 30% below their 2018 high with the stock actually falling over 10% in January alone illustrating the risks with “picking bottoms” too early, particularly in this sector.

However the ELD share price is slowly drifting towards our targeted buy zone where we won’t be afraid to take a small 2% “dog position”.

MM likes ELD closer to the $5.60 area from both a technical and fundamental basis.

Elders (ELD) Chart

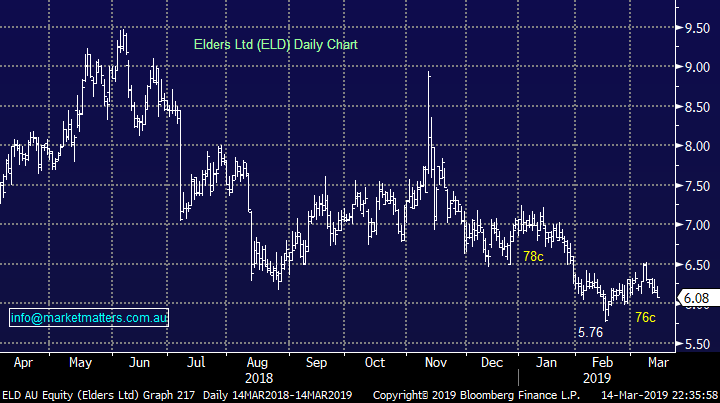

Global Indices

No change, while the tech based NASDAQ remains strong, making fresh highs for 2019 this week, the small cap Russell 200 remains 3.3% below the same milestone i.e. divergence with our favourite index as a leading indicator continues to catch our eye.

We will continue to avoid stocks that are highly correlated to the US at this point in time e.g. Macquarie Bank (MQG) & the broad based growth sector.

US Russell 2000 Chart

Also no change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Any significant Increase in our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

Recent Insider (director) buying & selling of note

At MM we are firm believers that human emotion determines that ignoring insiders activities in a particular company is fraught with danger, just consider the below 3 scenarios:

1 – A director needs to sell some of their holdings for personal reasons, say to buy a house, but they know the company is about to shoot the lights out with its next profit report, will he / she press the sell button now or muddle through financially on a personal level to ensure a larger pay day down the track?

2 – A director knows their business is cum downgrade and it will cost them millions, do they lock in some cash now by lightening their holdings ahead of the pending bad news? This one happens too often.

3 – A director sees the shares of their stock falling but they know all’s well under the hood do they step and buy some cheap / undervalued shares sending a psychological positive message to the market?

Obviously there are other permutations and directors get the health of their particular business wrong, like us they are human, but we believe it’s an indicator that should at least be on all investors radar.

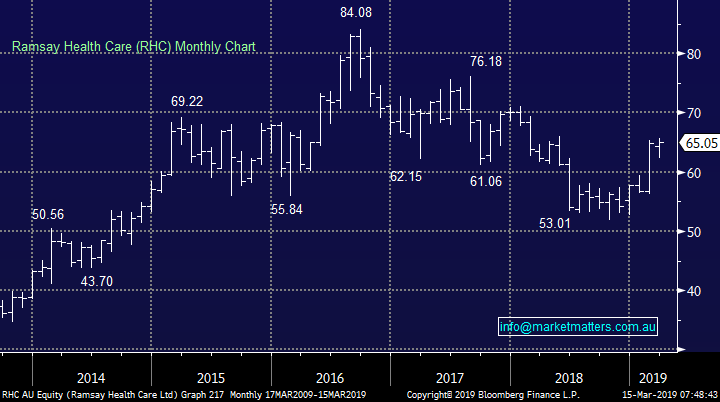

1 Ramsay Healthcare (RHC) $65.05

Private hospital operator RHC has enjoyed a reasonable recovery from its 2018 lows with last months result taking the stock over 10% higher. Last week director Bruce Soden sold over $3m worth of stock at $63.72, the highest price in around 10-months at the time.

Considering the sale was following a solid profit report we don’t regard it as anything too concerning, just an opportune time to take some $$ from the table by Mr Soden.

MM is neutral / positive RHC at current levels.

Ramsay Healthcare (RHC) Chart

2 Orora Ltd (ORA) $3.07

Two directors of packaging business Orora (ORA) have sold shares over last 10-days for a total of $2.5m – the Chairman and MD/ CEO.

Considering we have a technical sell set-up targeting another 10% downside and the packaging industry is struggling as a group at the moment we take this as confirmation to leave the stock alone.

MM is neutral / negative ORA.

Orora Ltd (ORA) Chart

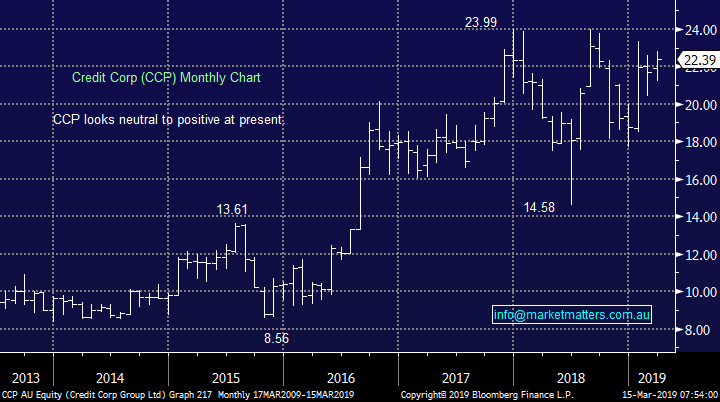

3 Credit Corp (CCP) $22.39

Collection and credit management business CCP is within a good month of making fresh all-time highs as the business continues to operate strongly, albeit with some significant share price volatility along the way.

The companies Chairman has sold just under $700k worth of stock this month but it follows his pattern in 2018 and the shares have had an impressive 12-months hence we see nothing sinister in this selling.

MM is neutral to bullish CCP.

Credit Corp (CCP) Chart

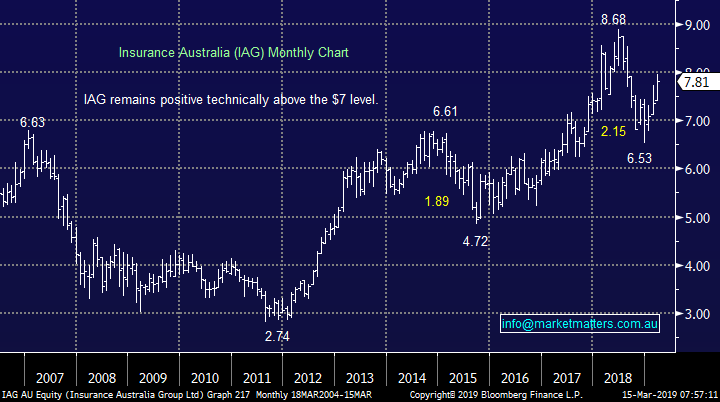

4 Insurance Australia Group (IAG) $7.81

Insurance company IAG is a business MM has been considering buying over recent weeks, potentially as a switch with our QBE Insurance (QBE) holding. So far this month the MD / CEO has sold over $1.8m worth of stock between IAG Finance (NZ) and IAG shares in Australia while an independent director bought a relatively small $100k holding in November.

I would rather not be seeing this in a stock we are considering buying but we still maintain a bullish view - optimum short-term entry is ~5% lower which feels a big ask today.

MM remains bullish IAG with stops below $7.15.

Insurance Australia Group (IAG) Chart

5 Bravura Solutions (BVS) $5.46

BVS provides wealth management software to the big end of town in the financial sector and its offering has clearly been a big hit with the industry as can be seen from its share price appreciation. However, so far since February 3 directors have sold stock for a total ~$4.3m, this willingness by the board to lock in some money above $5 concerns me, especially for a business with a high P/E of 36x.

Technically we would be sellers into fresh highs above $5.70 but remember it’s a statistically dangerous game selling fresh all-time highs.

MM is neutral / bearish BVS.

Bravura Solutions (BVS) Chart

Conclusion

Of the 5 stocks I looked at today my main concerns are with Orora (ORA) and Bravura Solutions (BVS) both of which we would not buy at current levels.

Overnight Market Matters Wrap

· The US majors showed little direction overnight, trading between gains and losses before closing near unchanged

· As expected, British MP’s voted to delay Brexit giving Prime Minister May time to get a deal through parliament.

· The market is focusing on any news regarding a US-China trade deal. Trump and Xi will not meet until next month at the earliest, rather than later this month. They would also like an agreement in place before any meeting to avoid losing face, should Trump walk away from a deal.

· The March SPI Futures is indicating the ASX 200 to trade higher on the open, up 30 points towards the 6200 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.