Overseas Wednesday is back on time! (CTX, FMG, AMZN US, C US, MSFT US, DIS US, FB US)

The ASX200 traded for its 7th day in a very tight range, totally ignoring the strong gains on Wall Street , for now – the ASX200 is trading down -1.4% from its early March high whereas over the same period the US S&P500 has rallied +3%. The internals of our local market are softening although it remains supported into weakness which remains no surprise to us with March Futures & Options expiry looming on Wednesday i.e. less than 40% of the market closed up yesterday with only strong gains in the likes of BHP & RIO helping keep the losses to negligible 2-points.

Yesterday we saw Wistech Global (WTC) enter a trading halt as they look to “tap” the market for ~$280-300m, following in the footsteps of Appen (APX) by raising capital into strength, this looks like a smart move in our opinion. Also, after the market closed the Neilson’s announced they were selling $300m of their stake in Platinum Asset Mgt. (PTM) at approx. a 10% discount to the days close. Some smart people and companies are taking advantage of the markets ~17% surge since late December implying that we have reached full / overvalued levels although there still appears to remain plenty of appetite from cashed up fund managers who have missed this latest leg of the decade old bull market.

MM remains neutral the ASX200 after its strong rally from late December lows but we are not afraid to buy selective stocks.

Overnight US markets fell into the close with the Dow closing marginally lower, well over 200-points below its intra-day high. The reversal was courtesy of concerns around the US – China trade where a positive outcome looks to have been priced into the markets surge to fresh 2019 highs. The SPI futures are pointing an open up 10-points by the local market which feels a touch optimistic with BHP closing down over-0.8% in the US.

Today we are looking at 5 overseas stocks that have caught our eye over the last 5 trading days.

ASX200 March SPI Futures Chart

The Australian 3-year bond yield has fallen below the Reserve Bank Of Australia’s (RBA) cash rate for the first time in 2 ½ years, unfortunately accentuating how growth worries are fuelling bets for interest rate cuts both in Australia and abroad.

The yields on our 3-year bonds are more sensitive to rate moves than longer maturities, like the widely watched 10-year bonds. The RBA, who highlighted concerns over consumption growth on Tuesday, have kept its cash rate target at a record-low 1.50 percent since August 2016. The only question most market pundits are now asking is will they cut once, or twice, in 2019 – we believe they are likely to hold off as long as possible but it appears they are definitely swimming against the tide. Employment data tomorrow will be key here.

We should not get too euphoric around these potential interest rate cuts as they represent almost confirmation that Australia is starring down the barrel of a recession in the next 1-2 years.

MM’s best guess is the RBA will cut rates once in 2019, probably on Melbourne Cup Day in November.

Australian 3-year bond yield v RBA Cash Rate Chart

Yesterday we saw Caltex (CTX) get hit -3.54% following the news that 1Q Retail Fuel Margins have softened due to the rapid rebound in the crude oil price and competitor activity. While CTX remains cheap and they have a buy-back under way, weak margins on fuel and a difficult operating environment in terms of retail means CTX looks set to continue to struggle.

While the stocks now trading on a theoretically cheap Est P/E of only 13.8x for 2019, while yielding 4.28% fully franked, the technical picture remains very average.

MM is bearish CTX targeting the $23-$24 area – an easy leave alone.

Caltex (CTX) Chart

In the Weekend Report we discussed Fortescue (FMG) as our “Trade of the Week” being a sell around the $7 area. Yesterday the stock retraced early gains to close 2% below its 2-year high.

Its important for us to clarify that this is a bearish technical view on a stock that we actually like fundamentally, in other words we are simply looking for a ~15% correction after the stocks doubled in 6-months, no big call in the scheme of things.

MM bearish FMG targeting $6 over the coming weeks / months.

Fortescue Metals (FMG) Chart

The Overseas movers during the last 5-days.

Global market have maintained their upside bias over the last week with only 11% of the worlds top 100 by market cap. closing down over the last 5 trading days although the upside momentum is waning slightly with only 5 stocks in the same group rallying by over 5%.

Today we have selected an interesting mixture of US stocks as we deliberate if / when the market will correct the last 3-months strong gains

1 Amazon (AMZN US) $US1761.85

Online retailer goliath Amazon (AMZN) has soared +5.3% over the last 5 days becoming a standout performer as it makes fresh 20119 highs. At times its tough to predict what comes next for AMZN after they just announced the closure of their 87 pop up stores but the juggernaut keeps on rolling. Many investors may not be aware that most of AMZN’s profits are made by its cloud computing operations & web services division – both large growth areas.

Interestingly, overnight we saw FedEx fall sharply after cutting its annual profit forecast for the second time in three months on slowing global growth.

Technically MM can see AMZN moving ahead in one of two ways but we are a touch 50-50 on which one:

1 – On going strength straight up towards $US2000 hence bulls can but here with stops only ~4% away.

2 – We will now see some rotation between $US1600 and $US1800, bulls should accumulate into weakness.

MM eventually sees AMZN above its all-time high, its all about entry levels.

Amazon (AMZN US) Chart

2 Citigroup (C US) $US65.63

US investment bank Citigroup has rallied over +4.5% in recent trading sessions although it remains well below its 2017 highs. If the business can turn around its struggling fixed interest trading unit, which had a tough time during last quarters extreme volatility, the bank should improve its relative performance to its peers.

MM is neutral and would not be surprised to see a 10% decline from current levels.

Citigroup (C US) Chart

3 Microsoft (MSFT US) $117.65

Microsoft (MSFT) has rallied over 3.5% over the last 5-days to make the fresh all-time highs we have been targeting for the last few months. Technically we will be concerned if the stock closes back below $US115 hence for now its bullish with relatively close stops.

MM is neutral / bullish MSFT at current levels.

Microsoft (MSFT US) Chart

4 Walt Disney (DIS US) $US110

Mickey Mouse and co. have fallen over 4% this week as the shares fail to make the fresh all-time highs we have been targeting in 2019. At this stage we would rather buy a pullback in AMZN than DIS.

The recent issue appears to be around the company’s decision to increase the prices for some of its theme parks – just as it has consistently for over 30-years e.g. the increase to the 4 parks in Florida is under 10% to a huge 23% depending on the package purchased with the price hits aimed at the top end of town. We believe this will be forgotten very quickly.

MM is neutral Disney at this stage.

Walt Disney (DIS US) Chart

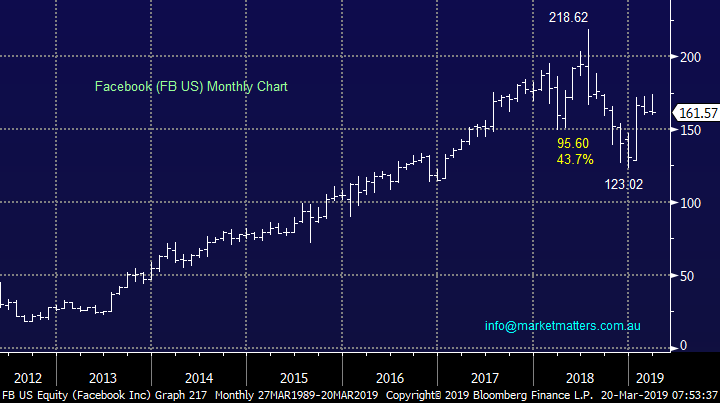

5 Facebook (FB US) $US161.57

Social media king Facebook has been the worst performing stock in the world’s top 100 this week falling over 6% and it remains a stock we are not keen on – the headwinds appear to be continually increasing.

MM is neutral / bearish Facebook.

Facebook (FB US) Chart

Conclusion

Of the 5 stocks looked at today our favourite is Amazon while Facebook is at the other end of the spectrum.

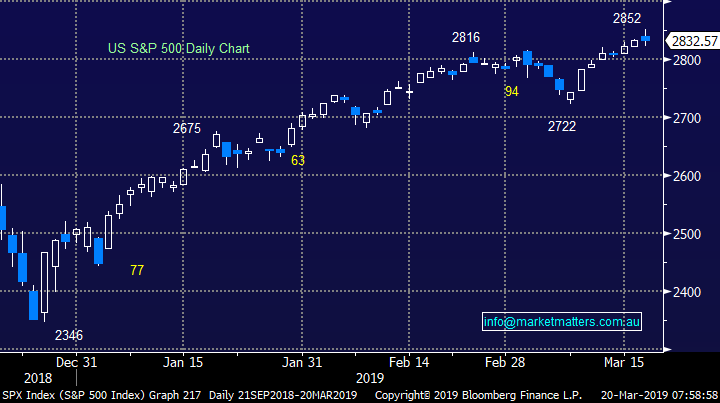

Global Indices

No major change but US stocks, like our own are proving very resilient to any meaningful pullback. We cannot be negative the US S&P500 Index short-term while it holds above 2810, only 0.8% lower.

However we will continue to avoid stocks that are highly correlated to the US at this point in time e.g. Macquarie Bank (MQG).

US S&P500 Chart

Also no change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Any significant Increase in our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

Overnight Market Matters Wrap

· The US closed with little change overnight ahead of the FOMC meeting tomorrow morning at 5.00 AM our time.

· European markets on the other hand all closed in positive territory, led by the German market in particular (+1.1%), despite ongoing concerns over whether the EU will allow an extension on the UK’s looking exit from Europe, with a meeting scheduled of EU leaders to decide on Thursday.

· BHP is expected to underperform the broader market after ending its US session down an equivalent of -0.85% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 11 points higher testing the 6200 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding or mission including negligence.