Subscribers questions (BBOZ, HUB, PPS, ECX)

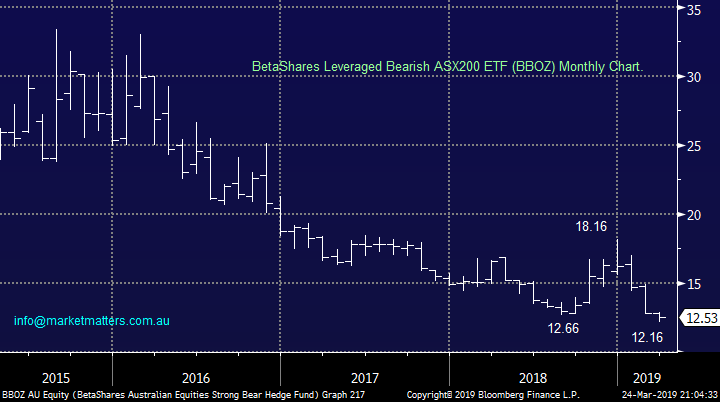

Last week’s quiet price action by the ASX200 looks like being very passé this morning as we have 3 pieces of news combining to create a very interesting mosaic to commence this last week of March:

1 – Global stocks were smacked on Friday with the average drop ~2%, the SPI futures are pointing to an early fall by the ASX200 of 50-points led by BHP which fell close to 2% in the US. A potential recession looming on the horizon has again unnerved markets with very poor economic data from Germany and some inversion on US bill / bond yields the catalyst this time.

2 – The Liberals won the NSW state election casting an element of doubt in pundits minds around the Federal Election in May – the bookmakers now have Labor at $1.18 and the Liberals at $4.5, the odds have readjusted slightly but are still strongly implying Mr Shorten will be our next Prime Minister however we’ve seen with both President Trump and BREXIT that both polls and bookmakers are fallible – the local market is likely to react positively to any hopes that Liberals can retain power in the weeks ahead, not long now!

3 – Almost $28 billion of dividends will be received by investors in March and April, courtesy of the likes of BHP, CBA and Telstra, with a bumper $10bn set to hit investors' back pockets this week. This is a major contributor to March / Aprils usual strength in the local market with the average gain during this period over the last 10-years greater than 3%.

This mornings likely weakness would theoretically be an ideal opportunity for investors to start accumulating stocks with some of these dividends but the 460-point plunge by the Dow may understandably scare many plus as we know consumer confidence is struggling in Australia as the bureaucratically engineered property correction shows no signs of slowing.

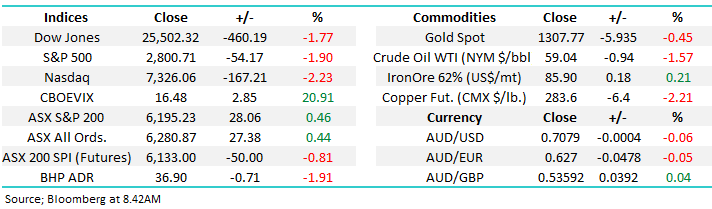

MM remains in “ buy mode” primarily due to our elevated cash levels and we will be relishing any short-term correction – our initial target is below 6100, or 1.5% lower.

Thanks for the questions this morning and happily it’s the week we received the fewest for a while has coincided with a likely very busy day on trading desks across the country, I wonder if the previously quiet market had lulled subscribers into a slumber before Fridays steep falls.

ASX200 Index Chart

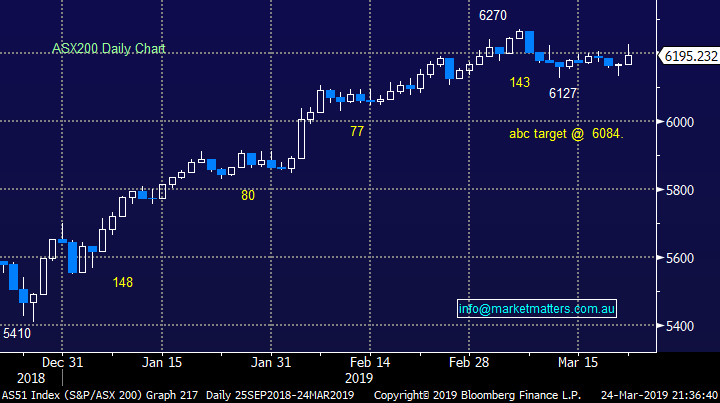

US stocks closed down around 2% on Friday but as the below chart illustrates its hardly a blip on the radar compared to the impressive rally from their Decembers low.

MM’s initial target is another 3% lower but a deeper correction would not surprise.

Hence while we are looking to put some of our large cash holdings to work into weakness there are no plans to be aggressive at this point in time.

US S&P500 Chart

Question 1

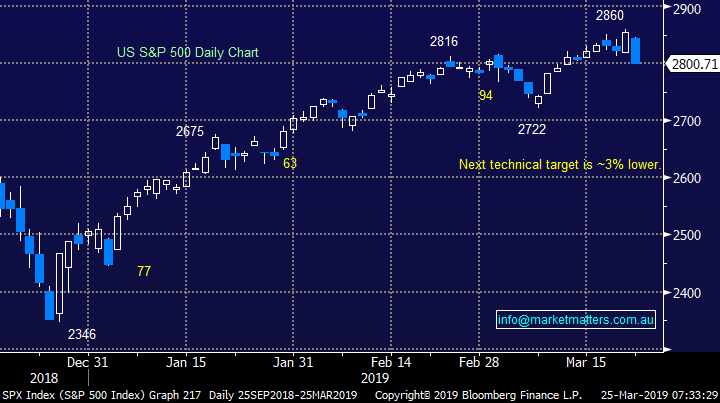

“Would you consider buying a BBOZ or Bear position now, as it seems as if there may be significant downside from here in the near future.” – Regards Sadhana P.

Hi Sadhana,

We are currently holding very elevated cash positions across both of our 2 MM portfolios hence it’s unlikely we will be buying negative facing EFT’s this week – we will focus more on accumulating stocks hopefully into some decent weakness.

However, our preferred scenario is a pullback for the ASX200 below 6100 and potentially deeper, similar to US stocks.

Hence if we were trading the market today we would be in the camp of “sell bounces” until the market has a decent dip under 6100.

Beta Shares Leveraged Bearish ASX200 ETF (BBOZ) Chart

Question 2

“I notice that OVH and PPS have been marked down over the last weeks--joined by HUB recently. Results for all three seemed reasonable. Have I missed something?” - Regards, Christopher J.

Hi Christopher,

Two main reasons hitting the sector is pressure on platform fees and the requirement that retail investors receiving personal advice must now actively opt in each year. We’ve seen the major platform providers reduce their fee structures with AMP the latest to move cutting fees on its MyNorth platforms by 0.1% to 0.2% of account balance. Lower fees and more portability between platforms have been key focus areas for regulators in recent times.

That, plus the valuations of the providers of investment platforms are extremely high; HUB24 (HUB) is trading on an Est P/E of 72.55x for 2019 and Praemium (PPS) is on 48.2x relatively big numbers when compared to say market favourite Appen (APX) which is trading on 51x without the negative regulatory headwinds.

Below is a quick glance at the 3 individual stocks you mentioned:

1 – Onevue Holdings (OVH) 44c – OVH shares were sold off following their half year results, the superannuation & investment solutions provider delivered over 30% growth in revenue but only an 8% lift in EBITDA which clearly disappointed expectant investors. Another 10% lower and OVH will look interesting technically.

2 – Praemium (PPS) 53c – the business is performing strongly in Australia but still getting its footing o/s and in the last half year ending December 31st revenue was up only 7% to just under $23m, not exciting considering the stocks valuation, we would not be surprised to see a test lower towards the 40c area.

3 – HUB24 (HUB) $13.35 – This platform provider has been the clear pick of the bunch and was rewarded by entering the ASX200 this year but director selling has also weighed on HUB this month while short positions have risen steadily, and are now 11% of issued capital. Risk / reward looks far healthier ~$10 considering the stock’s current hefty valuation.

HUB24 Ltd (HUB) Chart

Praemium (PPS) Chart

Question 3

“Hi James, can you comment on ECX and viability for recovery of the share price in the medium term?” - David H.

Hi David,

Eclipx (ECX) has been lighting up all trading screens for the wrong reasons over the last 2-years but no more so than last week when the stock more than halved. The company issued a very sobering profit warning that its net profit after tax was down over 40% for the first 5-months of this financial year plus suitor McMillan Shakespeare (MMS) has understandably walked away from its interest in ECX following the major downgrade.

The novated leasing, car lending and financing business blamed the result on challenging market conditions however they managed to find some positives in its cost-cutting program, theoretically resulting in the reduction of $20 million costs per annum over the next 18-months.

Your question is a tough one David in today’s economic times with car sales likely to get worse before they improve. However you did say medium-term hence my answer is yes but don’t expect any short-term miracles unless MM sees an opportunistic growth opportunity at these lower levels in ECX.

Short-term ECX looks likely to rotate between 50c and $1, potentially one for the trader.

Eclipx (ECX) Chart

Overnight Market Matters Wrap

· The US and Euro region sold off overnight as investors believe that global growth is slowing down following factory output in Europe down the most in six years, while US manufacturing activity fell close to a 2 year low.

· Meanwhile, British PM, May is facing more calls for her resignation as they lurch towards a no-deal Brexit. The US-China trade talks resume in Beijing, where a deal does not seem to be imminent.

· Most metals on the LME fell, with Dr. Copper (an indicator on global growth) was the worst performer.

· BHP along with its major peers are expected to underperform the broader market after ending its US session down an equivalent of -1.91% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 47 points lower, testing the 6150 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.