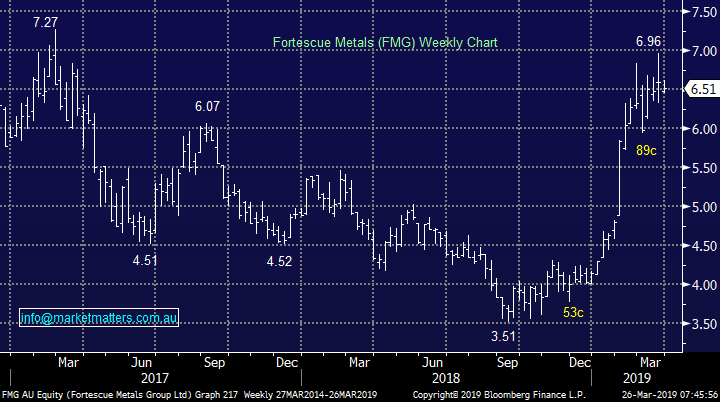

Where would we buy the resources into a correction? (APX, FMG, RIO, OZL, AWC, WSA)

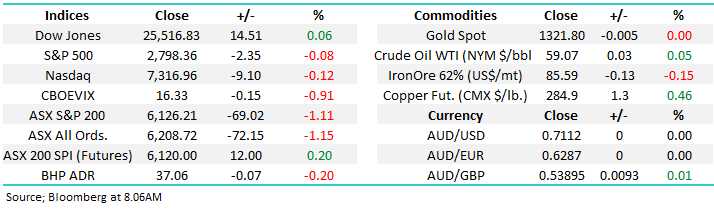

The ASX200 was smacked 1.2% yesterday taking over $20bn from the market with only 17% of the index managing to close in the black, the buying was almost entirely focused in the perceived safety areas of the gold and “yield play” sectors. While the weakness was obviously broad based the Energy and Information Technology sectors wore the brunt of the selling falling -3.4% & -4% respectively illustrating the markets concern of a potential global recession looming on the horizon.

Australia actually fared reasonably well compared to most of Asia where the declines ranged from -2% for the Hang Seng to -3% for the Japanese Nikkei. When markets wobble there’s usually a topic that dominates “desk talk” and yesterday it was focussed on the strong rise in the market despite no meaningful earnings growth, in other words the market has simply become more expensive – in Australia the P/E for the ASX 200 has risen from around 13.5x at the December low to now trade at 15.6x. This P/E expansion has received major tailwinds from dovish central banks (low interest rates) and aggressive local economic stimulus by China but with it comes increased risk - as we said in yesterday’s PM report markets can be fickle hence don’t be surprised if we see further de-risking by investors in the weeks ahead.

Friday nights shocking German manufacturing data which helped invert the US bill / 10-year bond yield was the catalyst which sent stocks tumbling on Friday night. The Feds recent policy reversal to their anticipated rate hikes in 2019 only managed to sustain a rally in global stocks for a few days and even though we are now seeing an anticipated end to rate hikes in the likes of Europe, Japan and of course Australia global stocks are struggling. At MM we now expect at least a few weeks weakness in equities and last nights failure to bounce by US stocks makes us comfortable with this outlook.

MM expects at least another 1% downside in the ASX200 over the next few weeks.

Overnight US markets closed basically unchanged after trading in a choppy session where the last 30-minutes saw the S&P500 recover most of the day’s losses. The SPI futures are calling the ASX200 to bounce slightly on the open while BHP closed marginally lower in the US.

Today we will look at 5 resources stocks because this is one sector which is likely to struggle if the current fixation with a potential global recession continues.

ASX200 Chart

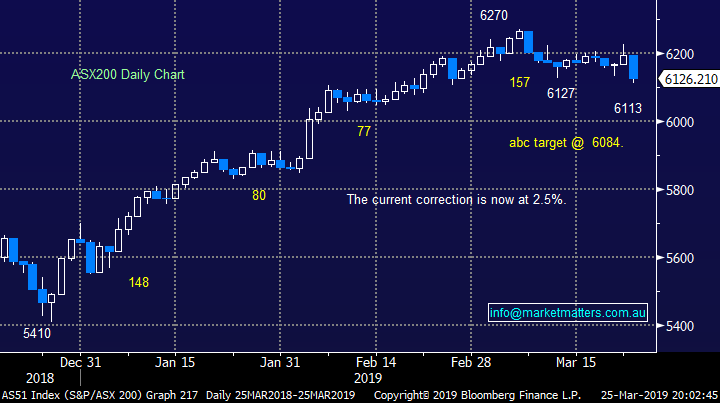

Yesterday we saw Australian 10-year bond yields trade at an all-time low of 1.76% while the shorter dated 3-years closed within a hairs breath of reaching the same milestone.

We still expect the RBA to cut interest rates at least once in 2019 although it feels like our central bank would rather sit on their hands until they fully understand the ramifications of the indebted Australian consumer and of course falling property prices – perhaps the next rate cut if / when it occurs will actually be 0.5% as opposed to the far more common 0.25%.

Australian 3 & 10-year bond yields Chart

Although MM is sitting on a large 28% cash position in our Growth Portfolio we didn’t consider pressing any buy buttons into yesterday’s aggressive weakness – fingers crossed that wasn’t a mistake!

While a number of stocks are slowly slipping into our “buy zones” 2 caught our eye yesterday:

1 – Star Entertainment (SGR) $4.24 – the casino and hotel operator closed at its lowest level since mid-2015, at this stage MM remains a buyer around the $4.10 area, an entry we have been stalking for months which is now only ~3% away.

2 – Appen Ltd (APX) $22.11 – the high flying artificial intelligence (AI) stock was smacked over 5.5% yesterday as the IT sector followed the NASDAQ’s aggressive sell-off on Friday night. MM continues to like the business with our current buying objective around the $20.50 area, now around 6% lower.

Appen (APX) Chart

Looking for opportunities in the Resources sector.

If the markets continue to remain concerned about a looming global recession then we would expect base metals and the related resources sector to come under pressure, especially following their strong gains of recent years.

Today we are going to focus on 5 stocks within the sector paying particular attention to where MM is considering taking a position, with one very focussed eye on risk / reward. The Australian resources stocks are positioned strongly at present with low debt levels (and net cash in many instances) while paying nice yields and returning cash to shareholders via buybacks and special dividends, hence making them attractive investments to many in today’s current low interest rates.

Its important to bear in mind that Australian miners are not looking particularly cheap at the moment and their levels are arguably unstainable without continued tailwinds.

Interestingly copper, often referred to as Dr Copper and used as leading economic indicator, is trading around the same levels as 18-months ago implying traders / investors are uncertain as to what comes next on the economic front.

Copper Chart

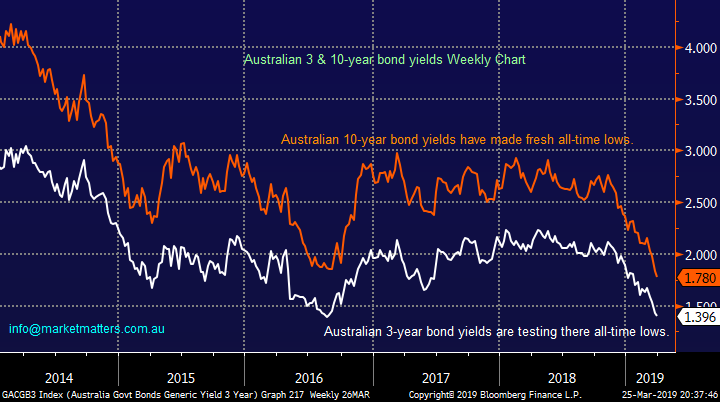

1 Fortescue Metals (FMG) $6.51

Fortescue Metals (FMG) has surged in 2019 primarily due to Vales awful mining disaster in Brazil which sent the price of iron ore soaring. However this short-term shortage of the bulk commodity will eventually abate thus MM has no interest chasing FMG into strength.

We have focused on FMG in the Weekend Report over the last 2 weeks in the “Trade of the Week” section, initially calling it a sell ~$7 and now a buy below $6.

MM remains interested in FMG below $6 i.e. almost 10% lower.

Fortescue Metals (FMG) Chart

2 RIO Tinto (RIO) $93.13

Big (sort of) diversified miner RIO has performed strongly basically on all fronts over the last few years. The stock has actually become one of the new breed of resource “yield plays”, the stock’s paying ~4.5% fully franked before any special dividends – very attractive when bond yields are plunging to all-time lows.

However as we said earlier the sectors not cheap considering lower earnings to come in outer years and it feels a crowded trade at this point in time hence we only have interest into weakness.

MM is interested in RIO around $88 i.e. close to 5% lower.

RIO Tinto (RIO) Chart

3 OZ Minerals (OZL) $10

OZ Minerals (OZL) has mapped out one of the most comprehensive growth paths in the sector giving us confidence in the businesses direction moving forward.

The copper and gold miner, who owns flagship mine Prominent Hill, is obviously at the mercy of the underlying commodities prices and while its run hard, we do like Oz for the years ahead – just for extra spice there’s also an outside possibility that someone may regard OZL as a takeover target, never say never.

MM will become interested in OZL closer to $9, or around 10% lower.

OZ Minerals (OZL) Chart

4 Alumina (AWC) $2.57

Alumina (AWC) is a great example of when things look the best its often time to sell – in October 2018 Norwegian aluminium company Norsk Hydro ASA announced that it was preparing to shut down production from its alumina refinery Alunorte in Brazil sending prices soaring. However in the following year the share price of AWC collapsed over 30%.

We are neutral AWC at current levels but as the chart below shows this can be a volatile beast and if we see another deep correction by the stock we will pay close interest. **We do own AWC in the Income Portfolio sitting on an open profit of around 14%**

MM will become very interested in AWC below $2 for the Growth Portfolio.

Alumina (AWC) Chart

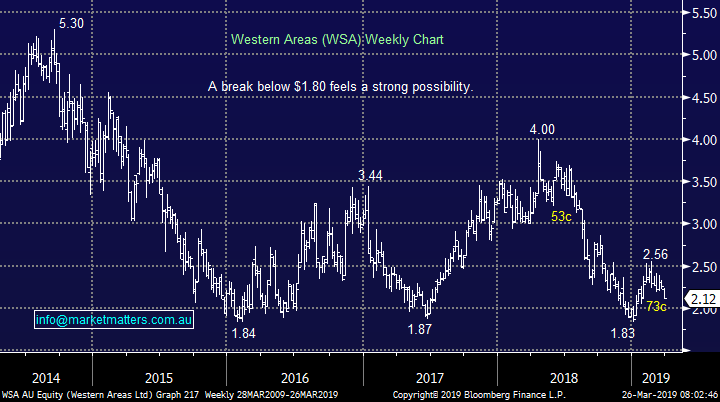

5 Western Areas (WSA) $2.12

Nickel producer Western Areas (WSA) was smacked over 6% yesterday illustrating the volatility in the stock we have discussed previously.

WSA disappointed the market when they reported in February making it relatively easy to imagine a further 15% decline to fresh multi-year lows. Conversely the other nickel miner we watch Independence Group (IGO) remains strong, still up over 25% in 2019, this relative performance elastic band may stretch too far in the weeks ahead.

MM remains interested in WSA below $1.80.

Western Areas (WSA) Chart

Conclusion

MM likes the 5 miners we looked at today but into decent weakness, they are all in our “closely watch” basket.

Global Indices

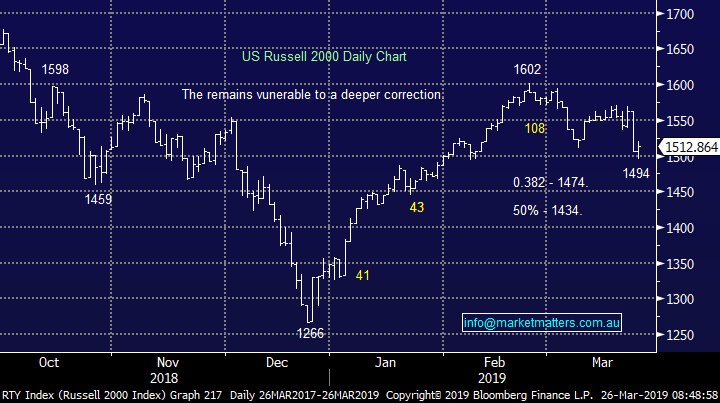

US stocks closed basically unchanged last night and while our preferred scenario remains for a few more weeks of weakness the outperformance last night by the small cap Russell 2000 Index suggests the next few days at least should be ok.

US Russell 2000 Chart

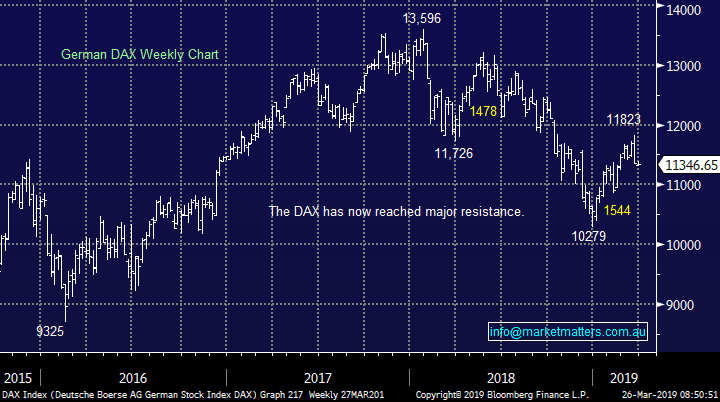

Also no change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

Any significant Increase in our equities exposure moving forward may be accompanied by purchasing a negative facing ETF.

German DAX Chart

Overnight Market Matters Wrap

· The US closed with little change overnight, with more action seen in the treasury market particularly where the US 10 year bond yields falling to 2.4% following concerns of lower world growth.

· Metals on the LME were led lower by aluminium, while oil and gold traded higher. Iron ore fell a touch as the market awaits the release of Vale’s quarterly production report, financial results and an analyst call, all due this week.

· BHP is expected to underperform the broader market yet again, after ending its US session down an equivalent of -0.20% from Australia’s previous close.

· Locally on the Mergers and Acquisitions space, WES announced that it is bidding LYC at $2.25/share – a 45% premium to last close.

· The March SPI Futures is indicating the ASX 200 to open 9 points higher towards the 6135 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.