BREXIT sounds a mess but the exposed stocks appear strong (JHG, CYB, WEB, MQG, APT)

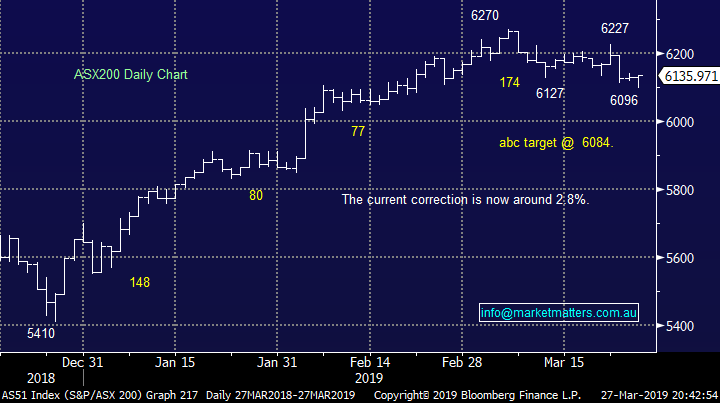

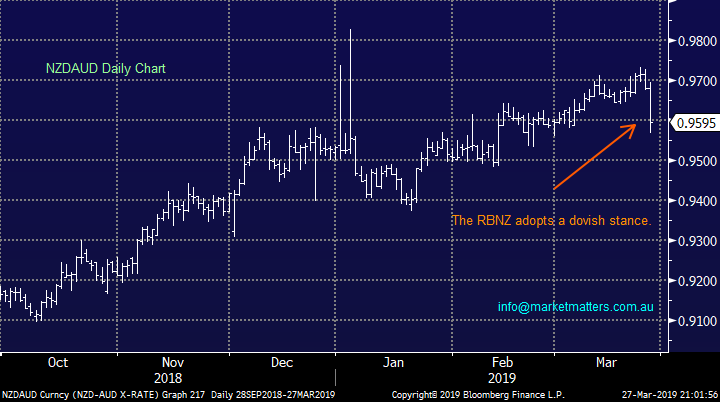

The ASX200 ended Wednesday slightly up on the day after falling -0.5% into lunchtime before enjoying a solid recovery, especially in the last hour of the day. A steady rally in the US futures plus the looming prospect of lower interest rates in NZ may have both played a role in the days reversal. The stock market across the Tasman actually surged +1.3% on the day following the RBNZ switching to a dovish outlook on interest rates, the ANZ Bank in New Zealand are now expecting a rate cut by November, at the latest – the stack of cards (central banks) continue to fall onto the dovish side of the fence.

On the sector level we noticed the resources and IT sectors enjoyed a bid tone throughout most of the day but large cap healthcare stocks CSL Ltd (CSL) and Cochlear (COH) encountered some selling - overall we’re seeing some very choppy action on both the stock and sector level e.g. what’s strong one day gets sold the next. At this stage we feel comfortable holding relatively large cash levels but we do anticipate starting to slowly accumulate a few stocks in the weeks ahead if / when the correct risk versus reward opportunities present themselves.

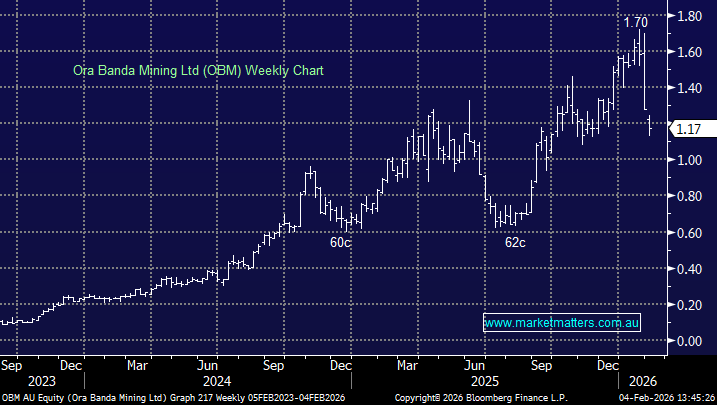

The ASX200 has now basically achieved our initial downside target and we are switching back to a neutral stance short-term.

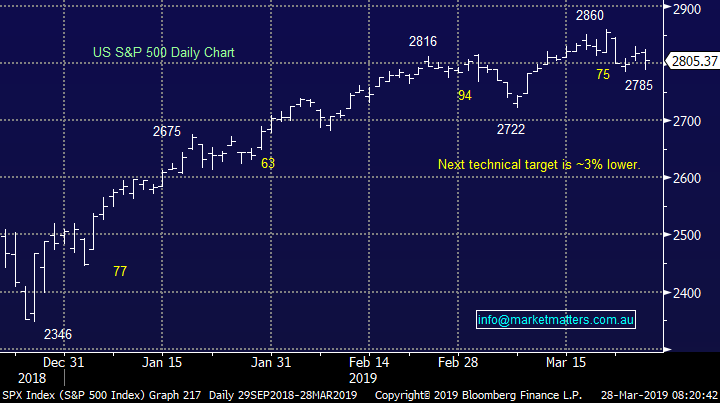

Overnight US markets again slipped lower with the broad based S&P500 declining by -0.5% with the Healthcare sector leading the declines, just as it did locally yesterday. The ASX200 SPI futures have closed flat implying the local index will open largely unchanged morning.

Today we have looked at the BREXIT related stocks as this European farce becomes something William Shakespeare would have been proud of! It now seems after a series of failed votes that the UK is headed for a hard BREXIT, which is whereby the UK leaves not only the EU but the single market and Customs Union, effectively rejecting the whole idea of close alignment.

ASX200 Chart

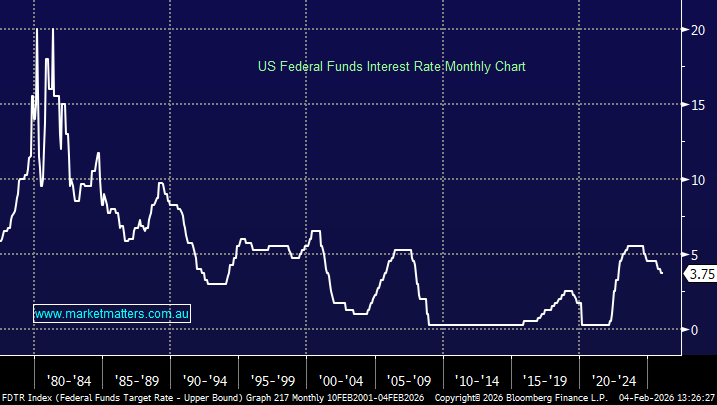

The worlds jumping onboard the dovish / lower interest rate train at an increasing rate but the obvious question is are they too late, or are we set for a “few more glorious years” of ultra-low interest rates and QE. However remember as we said yesterday this may not be all good news as was previously the case following the GFC when central banks dragged global economies back from the brink of an abyss. This time we have a share market that’s not cheap and only 3-months ago investors were actively discussing how fast the Fed would raise rates as the US economy appeared to be booming – things can change very fast in equities land.

At this stage as we watch Australian 10-year bond yields plunge to fresh all-time lows our view is the train appears to have only just left the station and interest rates are now going lower in Australia.

Australian 10-year bond yields Chart

As central banks are turning more dovish the pattern has repeated itself a few times now i.e. initially shares rally, just like NZ yesterday, but then they have struggled as the reasons behind the policy switch appear to have been considered in more detail.

Yesterday the NZ Dollar tumbled, while their stock market rallied to fresh all-time highs, it will be interesting to see if this time the gains can be maintained, or compounded.

New Zealand Dollar v Australian Dollar ($A) Chart

MM has been “stalking” Star Entertainment since we sold the casino / hotel operator back in mid-2017, our target at the time and has remained the $4 to $4.10 area.

However we now question if SGR is a prudent purchase if we believe the local economy is likely to struggle in the next 1-2years – we may be patient just for now.

Star Entertainment (SGR) Chart

BREXIT and all its drama.

The UK has been riding an emotional rollercoaster since the surprise BREXIT vote back in mid-2016 – that’s now approaching 3-years for this messy tale.

This morning we woke to see Prime Minister Theresa May has offered to quit as leader of the Conservative Party, and hence as Prime Minister, if they back her BREXIT deal in what appears to be one last roll of her dice. Her plan is facing opposition from a parliamentary led vote which is choosing an alternative from 8-options currently on the table, you have to question what they have all done for the last 2 ¾ years when such as obvious gap still exists between the policy makers.

"I am prepared to leave this job earlier than I intended in order to do what is right for our country and our party, to leave the European Union with a smooth and orderly Brexit" – Theresa May.

Rather then waste time trying to second guess this bunch of unorganised politicians today we are going to focus on the related markets / stocks and how they have been unfolding. In a nutshell its been an optimistic outlook from markets in 2019 on BREXIT with the FTSE rallying over 10% and the Pound over 6% - in other words looking through the mess fund managers are seeing light at the end of the tunnel and some sort of outcome / resolution before the end of the year.

British Pound vs USD Chart

Today we have quickly looked at 5 local stocks who maybe materially influenced by the BREXIT transition in whatever form it finally takes.

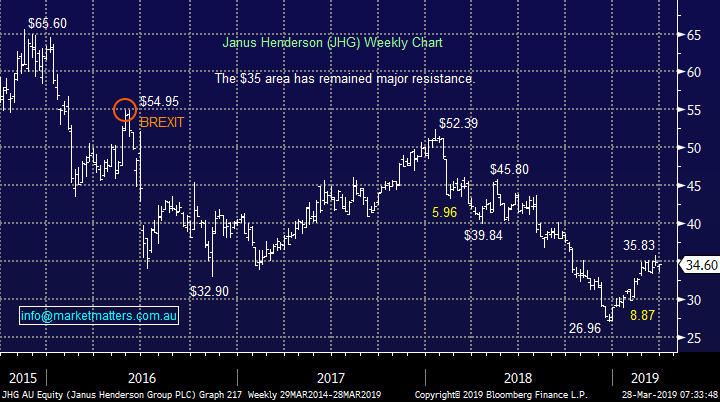

1 Janus Henderson (JHG) $34.60

MM owns JHG in our Growth Portfolio and while it’s been a tough ride of late the recent ~30% rally has certainly improved the picture.

The business is based in London with the company having significant exposure to Europe and its related equity markets.

At this stage we see the potential for a pop higher on future good news around BREXIT but we may consider selling into any euphoric style rally however the shares remain relatively cheap trading on a P/E less than 10x Est 2019 earnings hence at this stage we would be looking for fresh 2019 highs before considering pressing the sell button with JHG.

Janus Henderson (JHG) Chart

2 CYBG Plc (CYB) $3.63

UK based bank CYB which was spun off by National Australia Bank (NAB) has endured an awful 6-months, basically halving in value.

However the problems of CYB are not down to BREXIT but more with their domestic banking sector although the board has of course included European worries as a reason for recent shocking performance.

MM would only consider CYB as a trade into panic below $3.

CYBG Plc (CYB) Chart

3 Webjet (WEB) $14.60

Online travel business Webjet (WEB) has an agreement with UK company Thomas Cook which puts a portion of the Australian companies revenue at the mercy of the UK economy.

Unfortunately Thomas Cook has cited a combination of BREXIT and great UK weather (yes it can happen!) as excuses for poor performance over recent times – their shares have actually crashed 80% since mid-2018.

BREXIT concerns may provide a reasonable risk / reward opportunity in WEB i.e. buy below $14 with stops below $12.50 i.e. just over 10% risk.

Webjet (WEB) Chart

4 Macquarie Group (MQG) $126.58

MQG has significant business exposure in the UK & Europe as you would expect from such a large investment bank – it operatates in many areas across the region and obviously the short-term future revenue path is potentially more uncertain, however we’re probably drawing a long bow to link MQG with BREXIT too closely.

Technically we can see a 5-6% pop higher hence the stock may interest traders a few $$ lower.

MM is neutral MQG at current levels with BREXIT / stock near highs clouding the picture.

Macquarie Group (MQG) Chart

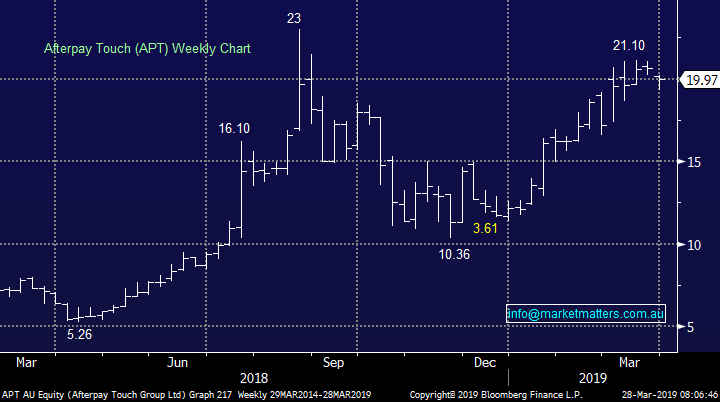

5 Afterpay Touch (APT) $19.97

APT purchased UK payments business ClearPay last August creating a strong footprint in the 3rd largest e-commerce market, one which enjoys over $130bn in online sales per annum.

However while economic troubles in the UK is not good news for APT their main growth strategy moving forward is focussed in the US where they are performing strongly.

MM currently likes APT around the $17.50 area.

Afterpay Touch (APT) Chart

Conclusion

Of the 5 stocks looked at today MM likes APT around $17.50 while also considering selling our JHG position into fresh 2019 highs, ideally into a euphoric rally as BREXIT is finally “put to bed” one way or another.

Global Indices

US stocks closed down around -0.5% last night but they managed to reclaim some early steep losses, our preferred scenario remains for a few more weeks of weakness with an ideal target around the 2700 area.

US S&P500 Chart

No change, European indices are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage.

German DAX Chart

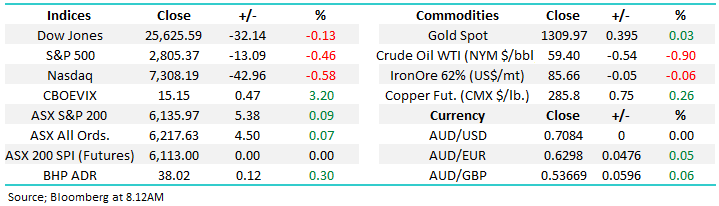

Overnight Market Matters Wrap

· The US eased overnight, with the 3 major indices ending their session in negative territory as investors remain cautious on the US 10-year bond yield, now trading at 2.38% - it’s lowest since 2017.

· On other macroeconomic news, Brexit and the US-China trade wars are weighing on sentiment while official and non-official manufacturing PMI data coming out of China in the next few days will be heavily scrutinised.

· The March SPI Futures is indicating the ASX 200 to open 8 points lower, testing the 6130 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.