3 stocks we like even with the ASX200 around 6300 (SGM, ASL, BSL)

The ASX200 tested fresh 2019 highs yesterday before giving back around half of the day’s gains into the close but the market still closed up 25-points well above the psychological 6200 area. The buying continues to rotate between most sectors - on Monday the resources rallying while the Software & Services sector slipped whereas Tuesday was the complete opposite. The standout factor is the index continues to grind higher and we’re already showing gains of over 10% for 2019.

However overall we are seeing clear rotation from the defensive “yield play” stocks into the more “risk on” side of the curve following the strong data releases from China and a collective group of dovish central banks. This is a trend we believe will continue for the remainder of the financial year as investors take some $$ from the safety side of the table following the crash to all-time lows by Australian bond yields – we actually believe the likes of Sydney Airports (SYD) and Transurban (TCL) are sells from a risk / reward perspective hence we are watching our Telstra (TLS) position closely at this point in time.

Last nights budget, which is looking likely to be irrelevant with Labor strong favourites to win in May, had few major surprises just lots of cash being thrown around by the Liberals in an attempt to turn the opinion polls around with around 6-weeks before the Federal election – history tells us that budgets rarely lift a parties popularity although there are times when it has destroyed it. MM’s opinion is this doesn’t appear to be where the Liberals are intending to fight the election with most of the “handouts” being fairly closely aligned to Labors, their problem clearly remains the parties internal stability which voters feel simply over.

We continue to target a 6000 – 6300 less sanguine trading range for this quarter with the upper band already being tested and we’re only 2 days in the quarter!

The ASX200 has now achieved our upside target area switching us back to a neutral / bearish stance short-term.

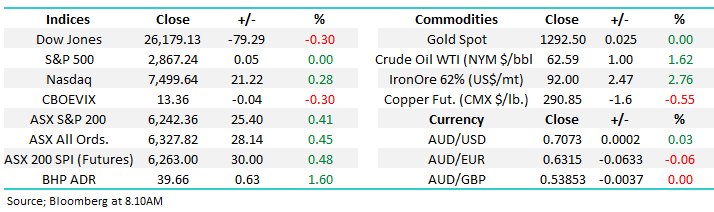

Overnight US markets were quiet with the Dow closing down while the NASDAQ rallied +0.3% however the SPI is calling the ASX200 to pop ~0.5% higher this morning following a strong rally by both oil and BHP in the US.

Today we are looking at 3 stocks we like even after the market has rallied by more than 10% in 2019 – not surprisingly they are in the cyclical end of town. A touch shorter report than usual because we are being cautious on the buy side at current market levels = a short list!

ASX200 Chart

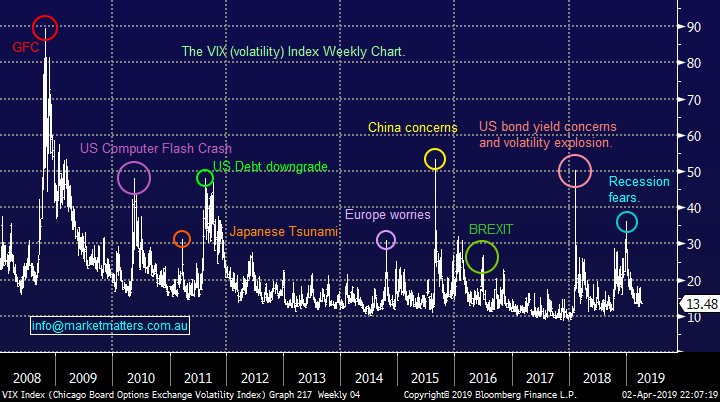

Since the GFC arguably the best trade is to go long every time the Fed makes a dovish statement and its working again, the markets rallied strongly following Jerome Powell in January basically taking any rate hikes off the table in the US for the rest of 2019 – reminds me of the sayings from the last decade i.e. “The Bernanke Put” and “Don’t fight the Fed”.

The VIX (Fear Index) below shows how quickly the markets have calmed since the almost panic recession fears in late 2018 – the concerns were the Fed would hike rates too fast but now Powell has assured markets they won’t.

The chart below also shows stocks are in the area of complacency but note we often stay here for many weeks, or even months.

US VIX (Volatility) Chart

In early 2018 lithium stocks were all the rage as the likes of Toyota took stakes in Orocobre Ltd, literally right at the top with the stock subsequently dropping by over 50%.

A number of subscribers maintain a close eye on the sector as we continually read about electric car penetration e.g. Bill Shorten has said Labor are targeting 50% of all new cars to be electric by 2030.

The trouble is as demand rises in the future so does supply, at this stage MM still finds the lithium sector too hard.

Lithium ETF (LIT US) Chart

MM is now looking at 3 ASX200 stocks that we like at current prices with our attention firmly on the cyclical / growth end of town.

1 Sims Metal (SGM) $11.39.

Scrap metal and recycling business Sims Metal (SGM) has been struggling due to tough trading conditions but we believe the risk / reward has now become compelling with stock trading on an Est. P/E for 2019 pf 14.1x while yielding 4.65% fully franked. Importantly SGM has been damaged by the US – China trade war but we believe that situation is improving almost daily.

We believe SGM is well positioned as a turnaround story for the next financial year and the markets clearly starting to warm to the prospect.

MM is bullish SGM initially targeting a 15-20% rally from current levels.

Sims Metal (SGM) Chart

2 Ausdrill (ASL) $1.70.

Specialist drilling services business Ausdrill (ASL) has continued to land new contracts in 2019 including over $170m worth in January which included contracts with Western Areas (WSA) and Regis Resources (RRL). The recent acquisition of Barminco has made ASL the second largest mining services business on the ASX200 which we feel is a solid position considering the bumper profits being realised by many of our large cap miners.

The shares are currently trading on an Est P/E of 11x while yielding over 4% fully franked.

MM remains bullish ASL targeting an additional 15% upside.

NB MM holds ASL in its Growth Portfolio.

Ausdrill (ASL) Chart

3 BlueScope Steel (BSL) $14.72

MM has been watching BSL for most of 2019 and probably too long in hindsight! The company beat earnings expectations in February and looks set to increase growth when its full-year numbers are released. However now the “risk on” button looks set to be the “order of the day” into the end of this FY we can see BSL significantly outperforming the ASX200. Again the easing of US – China trade tensions is also a handy tailwind moving forward.

The shares are currently trading on a conservative P/E for 2019 of under 8x while essentially yielding nothing at this point in time.

MM likes BlueScope (BSL) with stops below $14.

BlueScope Steel (BSL) Chart

Conclusion

MM is bullish SGM, ASL and BSL into the end of this financial year.

*Watch for alerts.

Global Indices

US stocks closed mixed last night with the small cap Russell 2000 continuing to test its major resistance area ~1560.

With both the S&P500 and tech based NASDAQ reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

US Russell 2000 Chart

No change with European indices even as the BREXIT fiasco rolls on, markets are encountering some selling from our targeted “sell zones”, we remain cautious or even bearish the region at this stage, especially into fresh 2019 highs.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets closed mixed overnight while European markets rallied despite the continued chaos surrounding Brexit with the UK Prime Minister Theresa May pushing for another extension to the exit deadline.

· As the 2019 bull markets continue to roar, Asian markets have been leading the charge with the Chinese market in particular one of the best performers, having rallied 27% year to date - close to a one year high, in anticipation of a trade deal with the US, as the protracted trade negotiations roll on.

· BHP is expected to test the $40.00 mark again today after ending its US session up an equivalent of 1.60% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to extend its recent strength to the 6280 level this morning as traders see last night’s pre-election stimulatory budget as a positive.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.